A Look into the Crypto Power Play of Trump’s World Liberty

A new wave of liquidity is surging on the Solana chain, with World Liberty providing TWAP services, possibly led by the Trump family, sparking concerns about centralization and regulation. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still being iteratively improved.

Good news: Another wave of hype is about to hit the Solana chain!

We have finally ushered in the long-awaited large-scale liquidity, and this time, it's the bankers who are injecting funds into our "memes."

If you need a brief summary: @worldlibertyfi is providing TWAP (Time-Weighted Average Price) services for the ETH and SOL ecosystems. This alone is enough to foreshadow what’s coming next.

At first glance: a "money laundering" scheme?

When I first heard about World Liberty, to be honest, I thought it was just a well-orchestrated "money laundering business" by the Trump family.

The logic seemed to make sense in theory:

- Print billions in profits through the $TRUMP memecoin;

- Launch a platform that provides liquidity services for traditional finance (TradFi) funds;

- Transfer profits tax-free through this scheme;

- No regulation, no touch, perfectly accomplished.

But at the time, I overlooked a key point—something I finally understand today—World Liberty is much bigger than that!

HUUUUUGE

The Liquidity Machine of Crypto

World Liberty is positioning itself as a major liquidity provider in the on-chain ecosystem. Whether you like it or not: Trump may be about to save us "decentralization fanatics."

We have always craved liquidity, and now it’s finally here. Sounds great, right?

However, here’s the problem: those who control the inflow and outflow of funds also control the entire rules of the game.

In the last cycle, centralized exchanges (CEX) played this role. They were the bridge between banks (the real liquidity providers, the source of fiat) and traders.

But now, CEXs have basically become irrelevant. CZ and Brian saw this coming long ago, which is why they started building their own on-chain layers.

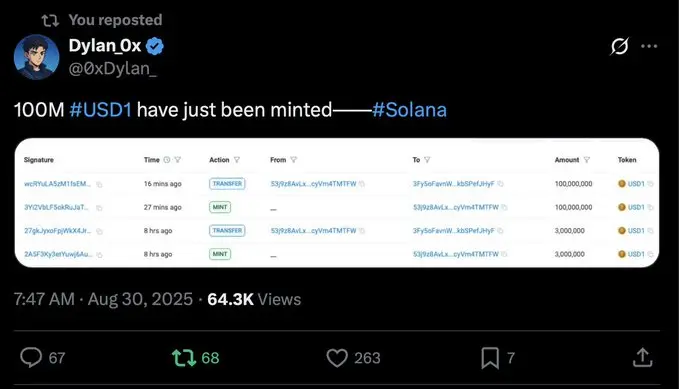

Meanwhile, as you read this article, World Liberty has already minted hundreds of millions of USD1 stablecoins.

"USD1 Wallet" Account Manager

The Problem with USD1

So far, how these funds will actually be deployed remains a mystery.

Who can get access to these funds?

What are the standards?

Is it enough to be close to the Trump family? Or do you need to give them 10% of your company’s shares in exchange for funds?

No one can know the exact answer. But the key is: they control the flow of liquidity across the entire crypto space.

From now on, every emerging trend is directly tied to Trump’s influence.

Don’t like Meme Meta? They’ll switch to funding ICM (On-Chain Capital Market) projects.

Don’t like ICM this month? Next month it might be AI.

They can steer the direction of the entire cycle.

Married... with Kids 2.0

The Hidden Dangers of Centralization

In the short term, we win: attention, hype, liquidity. Decentralization fanatics will revel in this feast.

But in the long run, who are the real winners?

Is it the crypto natives, or the Wall Street bankers backing this game?

Ask yourself: how many people still hold the bitcoin you once accumulated? Or have you already gambled it all away in the memecoin frenzy?

Don’t tell me you bet all our money on those memecoins, Donnie! (Note: Donnie is a nickname for Trump.)

All my bitcoin is gone.

Transparency, Control, and Punishment

We are no longer the "Wild West."

We traded freedom for liquidity, fun for privacy. Now, every transaction you make on Solana is permanently visible.

Right now, most people might think: "I don’t care, they can’t touch me."

But the truth is, they can touch you, and they just might. Groypers. (Note: Refers to groups supporting extreme conservatism.)

At some point, you might be punished for assets you traded in 2025, tokens you held, or even things you said. This is the bitter consequence of this game:

We are priced out of the assets we once built;

We lose ownership of the ecosystems we love;

Worst of all, we give up freedom in the very space we depend on to survive.

We need Degenspartan back!

Here are my preliminary suggestions

While the window is still open, make as much money as you can.

But never forget: there’s no such thing as a free lunch. Liquidity isn’t free, and Trump’s "support" isn’t free either.

We’re swimming in a shark tank, and those sharks don’t want the "little guys" to win.

What about the future?

Which coins should you buy? The truth is, unless you can get direct inside information from the Trump circle, it’s all speculation. They control the market now. Just like Rothschild once said: "Whoever controls the money controls the world."

My best guess is: as World Liberty starts bringing TWAP (Time-Weighted Average Price) into the ecosystem, other foundations will follow.

Expect Chinese players and other forces to bring in more aggressive yields (higher APY, more leverage).

By the end of 2025 or early 2026, regulation may step in to lock all this down—not to weaken World Liberty’s power, but to solidify it.

By then, real-world startups and tech projects will begin deploying on-chain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?