Avalon Labs Launches on Bitcoin Layer 2 Rootstock

Bitcoin lending market Avalon Labs is now live on Rootstock, the fourth largest Bitcoin sidechain by total value locked (TVL), according to a press release viewed by The Defiant.

The integration will see Avalon expand to Rootstock, and compete to be the chain’s largest lending market by providing access to Bitcoin-collateralized lending for digital assets such as Rootstock’s RBTC and RIF, as well as stablecoins like USDC.E and Tether’s cross-chain stablecoin protocol USDT0.

Avalon is the latest major integration for Rootstock, which already boasts support for USDT0, LayerZero, and Solv Protocol. These additions to Rootstock are meant to boost the chain’s capabilities as a leader in Bitcoin DeFi, also known as BTCFi, and are intended to help the network continue to scale to new highs.

Jason Twu, Avalon’s head of ecosystem, commented on the announcement, telling The Defiant: “This is a partnership between two BTCFi powerhouses and signals a leap forward for scaling all sorts of useful applications that use Bitcoin.”

Avalon’s current TVL sits at $752 million, a 113% increase over the last year. However, TVL in the lending market is still down 62% from its all-time high of $2 billion in January 2025.

“We’re both laser-focused on this shared vision of providing industry-leading financial products not just for retail users but also the growing number of institutional-size actors that desire to do more with their Bitcoin.” Twu concluded, referring to the partnership.

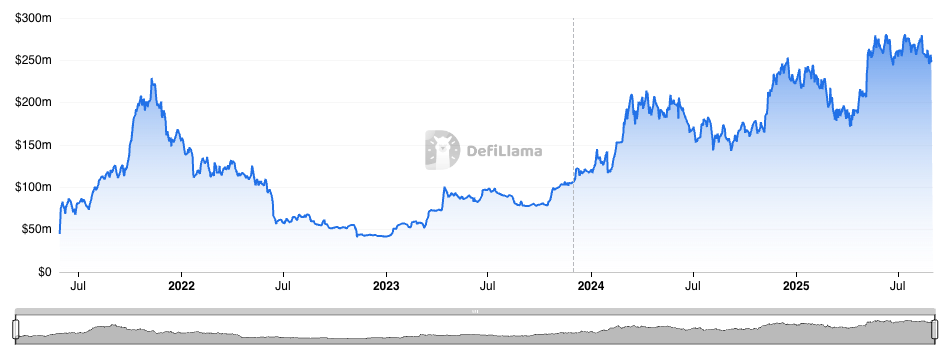

The Rootstock integration may help Avalon reclaim its strong growth trajectory from Q4 2024, as Rootstock has been steadily growing over the last two years, and commands a $255 million TVL today, compared to just $42 million at the beginning of 2023.

While the Rootstock network has been consistently growing in the past two years, the chain’s RIF token has yet to catch up with the network’s performance. RIF is down almost 25% over the last year, and changes hands at a $56 million market capitalization, an 82% decrease from its all-time high of $313 million in 2021.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Latest Speech by US SEC Chairman: Farewell to a Decade of Chaos, Crypto Regulation Enters an Era of Clarity

The US SEC Chairman further elaborated on the "Project Crypto" initiative, outlining new boundaries for token classification and regulation.

Circle Q3 report released: Is there a bigger game ahead?

What are the highlights of Circle's Q3 financial report, the first listed stablecoin company?

Exodus' Q3 net profit increased more than 20 times, with Bitcoin revenue accounting for over 60%.