Bitcoin whale dumps 4,000 BTC and stacks over 837,000 ETH total

Key Takeaways

- A Bitcoin whale sold 4,000 BTC and accumulated 96,859 ETH, boosting its total ETH stash to over 837,000 units.

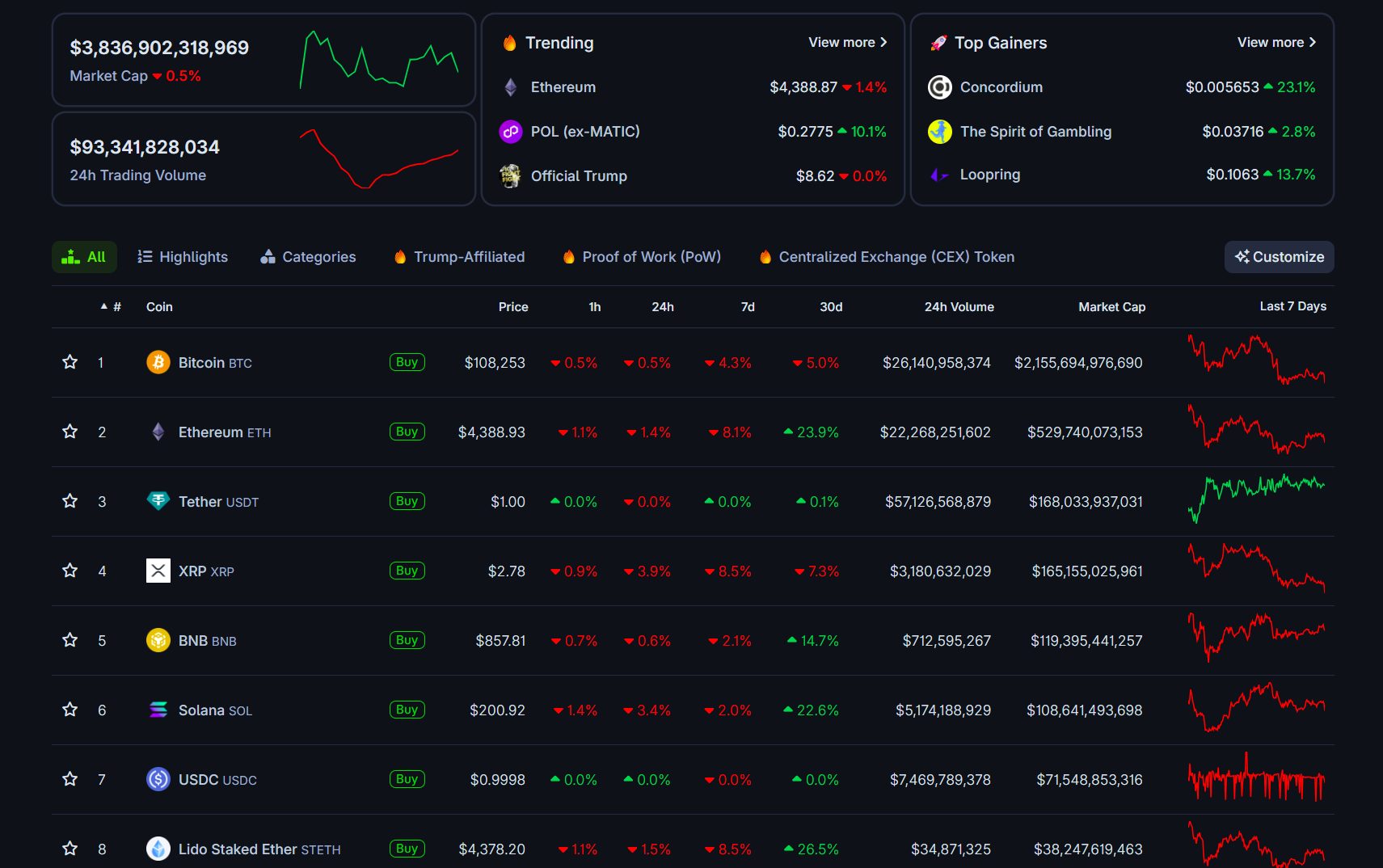

- Ethereum has outperformed Bitcoin in the past month, with a nearly 24% price gain despite market volatility.

A Bitcoin whale that recently made headlines for rotating its BTC stash into Ethereum has now accumulated 837,429 ETH worth roughly $3.7 billion, according to on-chain data from Lookonchain.

On Sunday, the whale, associated with wallets containing $11 billion in Bitcoin that had been dormant for seven years, sold 4,000 BTC for $435 million and acquired 96,859 ETH. The investor’s latest move extends a series of rotations from Bitcoin into Ethereum that began after the dormant wallets were reactivated.

The transaction came amid heightened market volatility. Bitcoin slid to $107,700 on Sunday evening before recovering slightly above $108,000, putting the asset on track for a 5% loss in August, according to CoinGecko data.

Ether, while not immune to crypto market pressures, has outpaced Bitcoin this month. The second-largest crypto is trading near $4,424 at press time, up nearly 24% over the past 30 days.

Lookonchain also flagged activity from another whale, Longling Capital, known for buying low and selling high. The entity resumed its Ethereum accumulation on Saturday, purchasing 7,000 ETH for about $30.6 million.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

ReChange: NFT-driven engine on the TBC public chain, making every transaction flow like a stream

ReChange enables NFTs to "circulate endlessly."

In this bull market, even those who stand still will be eliminated: only "capital rotation" can survive the entire cycle.

Summary of the 7 deadly mistakes in the crypto market: 99% of traders keep repeating them