Metaplanet tops 20,000 Bitcoin ahead of key capital-raising vote

Key Takeaways

- Metaplanet now holds 20,000 Bitcoin valued at over $2 billion, making it the seventh-largest public holder globally.

- Proceeds from an upcoming capital-raising vote are planned to further increase Metaplanet's Bitcoin holdings.

Metaplanet acquired 1,009 Bitcoin, bringing its total holdings to 20,000 Bitcoin valued at over $2 billion at current market prices, the Japanese Bitcoin treasury firm announced Monday.

The company will hold a key shareholder vote today on its capital raising plan, with Eric Trump expected to attend, Bloomberg reported earlier this month.

The proposal seeks approval to issue up to 550 million new shares overseas, targeting proceeds of more than 130 billion yen, or about $884 million. The bulk of the proceeds would be used to purchase more Bitcoin.

The company, formerly known as Red Planet Japan, has transformed from a hotel operator into Japan’s leading Bitcoin treasury company. It is now the seventh-largest corporate holder of Bitcoin, according to BitcoinTreasuries.net.

The company recently joined the FTSE Japan Index in the index provider’s September review, moving up from small-cap to mid-cap. President Simon Gerovich called the upgrade a major step in establishing the firm as Japan’s top Bitcoin treasury player.

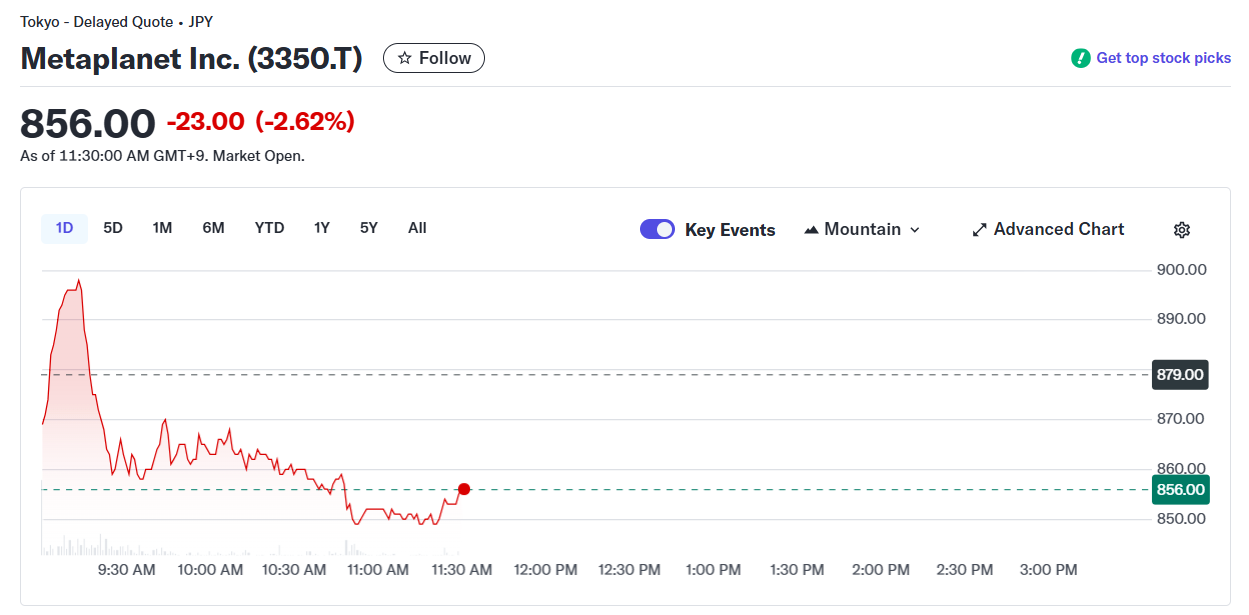

Metaplanet’s shares slipped about 2.6% intraday in Japan. The stock is still up nearly 146% year-to-date.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin, altcoins sell-off as Fed chair switch-up, AI bubble fears spook markets

From yen rate hikes to mining farms shutting down, why is bitcoin still falling?

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The Economist: The Real Threat of Cryptocurrency to Traditional Banks

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

Grayscale's Top 10 Crypto Predictions: Key Trends for 2026 You Can't Miss

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.