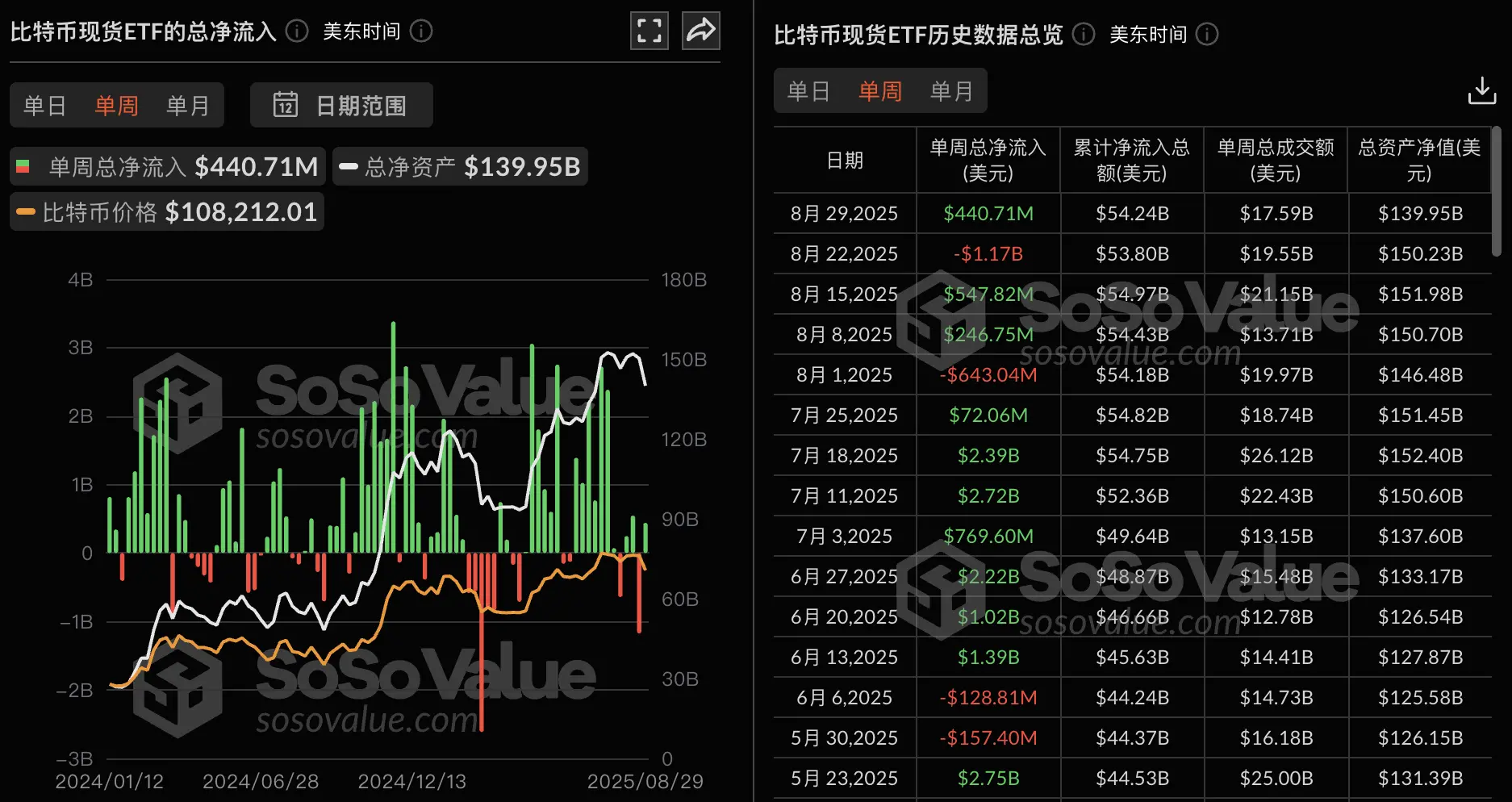

Data: Bitcoin spot ETFs saw a net inflow of $441 million last week, with BlackRock IBIT leading at a net inflow of $248 million.

According to ChainCatcher, citing SoSoValue data, the net inflow of Bitcoin spot ETFs during last week's trading days reached $441 million.

The Bitcoin spot ETF with the highest net inflow last week was BlackRock's Bitcoin ETF IBIT, with a weekly net inflow of $248 million. The historical total net inflow for IBIT has reached $58.31 billion. The second highest was Ark Invest and 21Shares' ETF ARKB, with a weekly net inflow of $78.59 million, and ARKB's historical total net inflow has reached $2.09 billion.

The Bitcoin spot ETF with the highest net outflow last week was Grayscale's ETF GBTC, with a weekly net outflow of $15.3 million. The historical total net outflow for GBTC has reached $23.94 billion.

As of press time, the total net asset value of Bitcoin spot ETFs stands at $139.95 billion, with the ETF net asset ratio (market value as a percentage of Bitcoin's total market value) reaching 6.52%. The historical cumulative net inflow has reached $54.24 billion.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

SOL treasury companies and ETFs hold over 24.2 million SOL, worth approximately $3.44 billion.

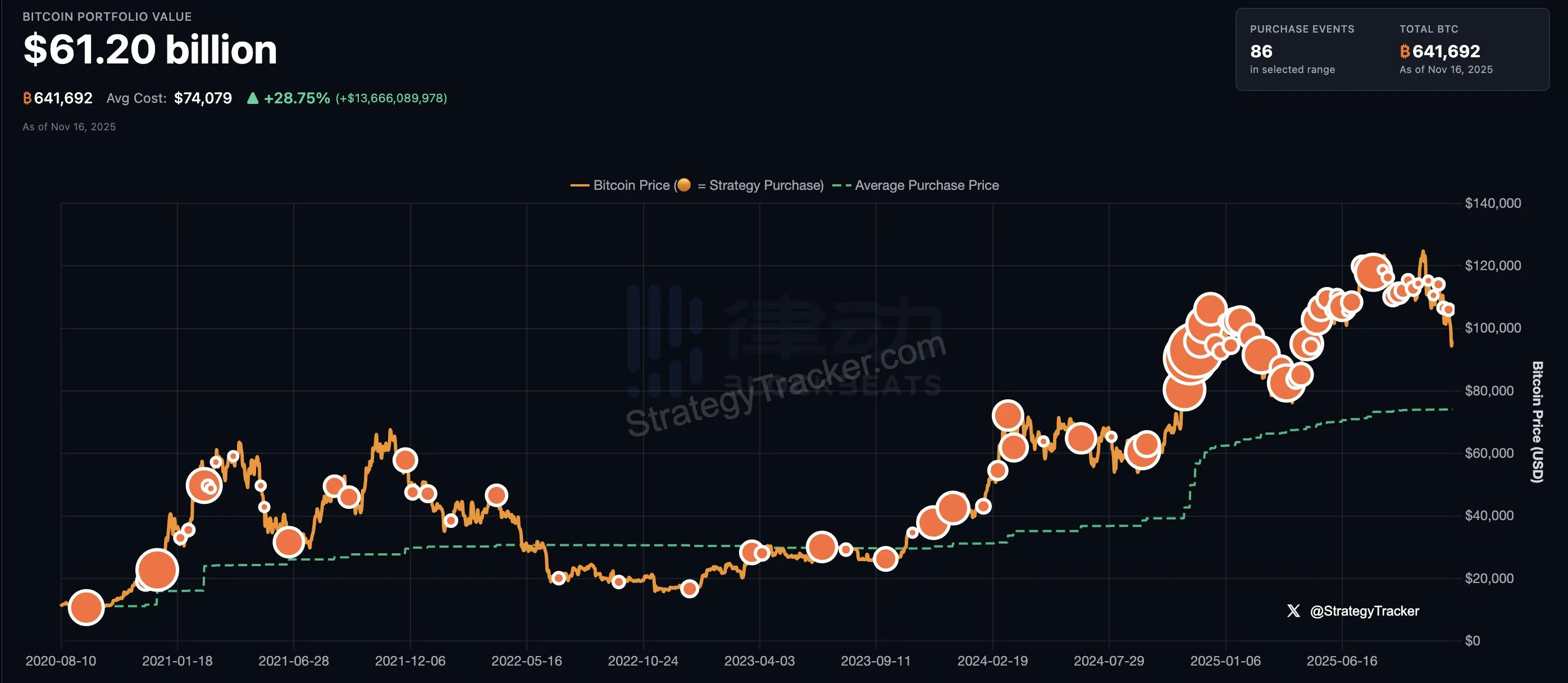

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchase

Michael Saylor releases Bitcoin Tracker information again, possibly hinting at another BTC purchase