Michael Saylor Signals Fresh Bitcoin Purchase as MicroStrategy Secures Legal Relief

Michael Saylor hinted at more Bitcoin purchases for Strategy, financing its purchases this year through $5.6 billion in IPO proceeds.

MicroStrategy (now Strategy) CEO Michael Saylor has once again pointed toward additional Bitcoin purchases, reinforcing the company’s aggressive treasury strategy.

On August 31, Saylor posted a chart from the independent “Saylor Tracker” platform, which maps Strategy’s Bitcoin holdings over time.

Saylor Hints at New Bitcoin Purchase

The image showed clusters of orange dots representing the firm’s buying history, accompanied by his comment, “Bitcoin is still on sale.”

Bitcoin is still on Sale.

This type of post has historically preceded purchase announcements in the past.

Observers note that the company has filed new Bitcoin purchase disclosures every Monday for the past three weeks, suggesting the pattern could continue into September.

Just last week, Strategy revealed it had added 3,081 BTC at a cost of $356.87 million, paying an average of $115,829 per coin. That purchase lifted its total stash to 632,457 BTC, worth an estimated $68.6 billion.

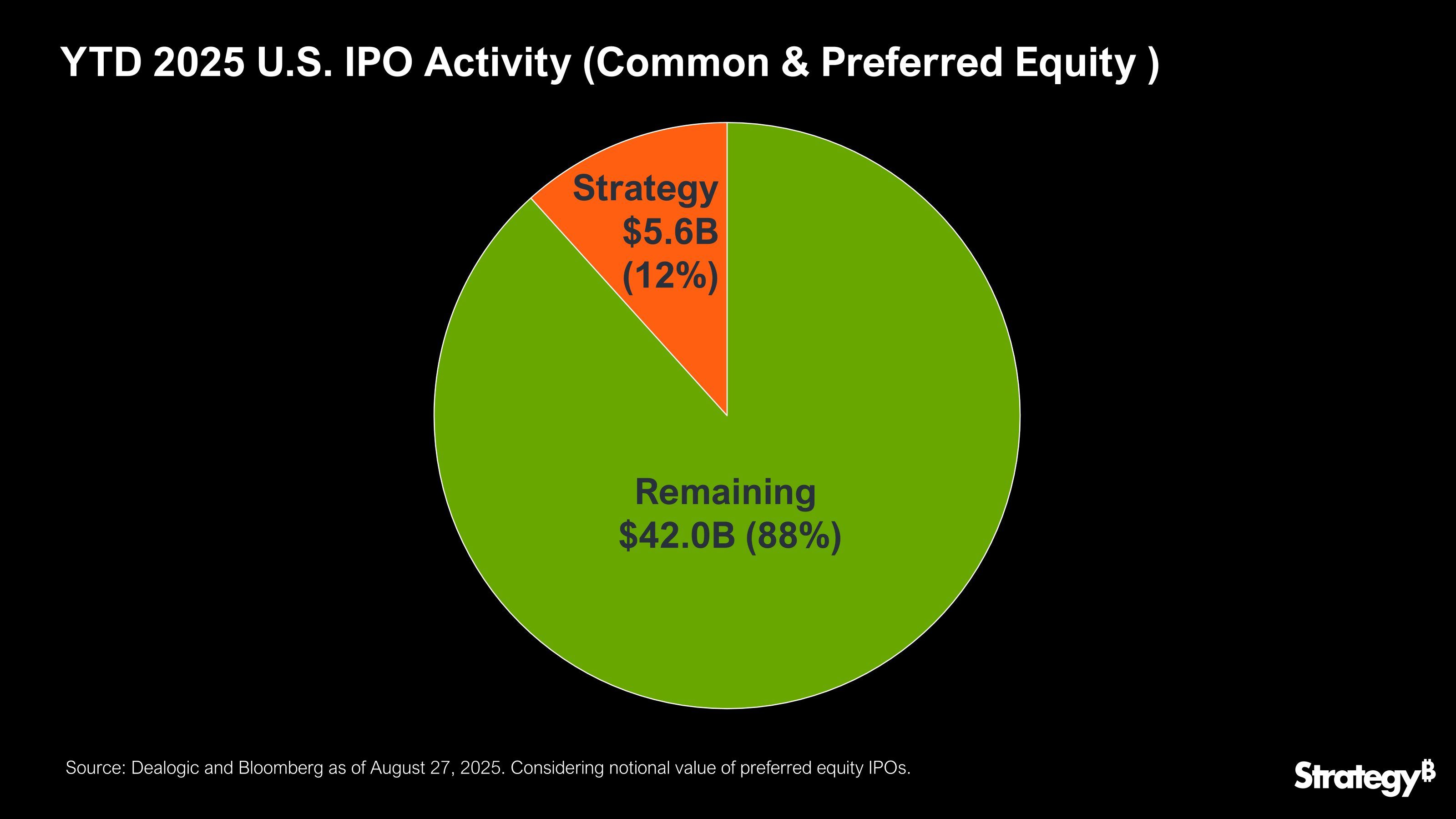

Strategy has relied heavily on equity markets to finance its buying. So far in 2025, the firm has raised $5.6 billion in IPOs, representing about 12% of all US listings.

Strategy’s IPO Activity in 2025. Source:

Strategy

Strategy’s IPO Activity in 2025. Source:

Strategy

Meanwhile, this aggressive fundraising has not significantly impacted the firm’s stock performance.

According to Strategy, its MSTR shares have consistently outperformed the so-called Magnificent Seven technology stocks year-over-year.

Legal Case Dropped

Saylor’s remark coincided with the withdrawal of a class action lawsuit that had been pending since May.

Investors had alleged that Strategy misled shareholders by overstating the benefits of adopting fair-value accounting, which allows digital asset holdings to be marked at market prices each quarter.

Bloomberg reported that the plaintiffs dismissed the case “with prejudice,” which prevents them from raising the same claims again.

That decision removes a significant overhang for the firm and may set a useful precedent for other companies holding Bitcoin as a balance-sheet reserve.

By securing legal relief while signaling further Bitcoin accumulation, Strategy reinforced its dual approach of leveraging capital markets and doubling down on its Bitcoin-as-treasury model.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin 2022 bear market correlation hits 98% as ETFs add $220M

Fed rate-cut bets surge: Can Bitcoin finally break $91K to go higher?

Crypto: Fundraising Explodes by +150% in One Year