US Equities Could Dip in September but Investors Should ‘Stay the Course,’ Says Citi’s Quant Macro Researcher

US equities could dip in September, but that doesn’t mean investors should shed their portfolios, according to Alex Saunders, Citi’s head of quant macro research.

Saunders says in a new interview on CNBC that the market is caught between opposing forces: on one side, cyclical fears and a fragile labor market, which could be bad for equities, and on the other side, artificial intelligence (AI) and “the potential for a productivity-induced growth period,” which could be a boon for stocks.

The Citi analyst says the equities market could go on a run after a bumpy September, barring any new big tariff announcements from the White House.

“For now, we would say, ‘Stay the course.’ Keep hold of equities, we remain overweight equities, neutral on fixed income – if you do want to hedge, if you do want the seatbelt for that potential turbulent period, then credit is the place to be at.”

Saunders lists high-quality corporate bonds and the credit default swap index (CDX) as potential hedging options, though he cautions that corporate credit is not as exposed to AI, so it wouldn’t benefit as much if there is a growth environment.

In terms of equities, the Citi analyst notes that he favors communication services, tech, financials and utilities.

Generated Image: MIdjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC price bull market lost? 5 things to know in Bitcoin this week

1inch launches Aqua: the first shared liquidity protocol, now open to developers

The developer version of Aqua is now online, offering the Aqua SDK, libraries, and documentation, allowing developers to integrate the new strategy models ahead of time.

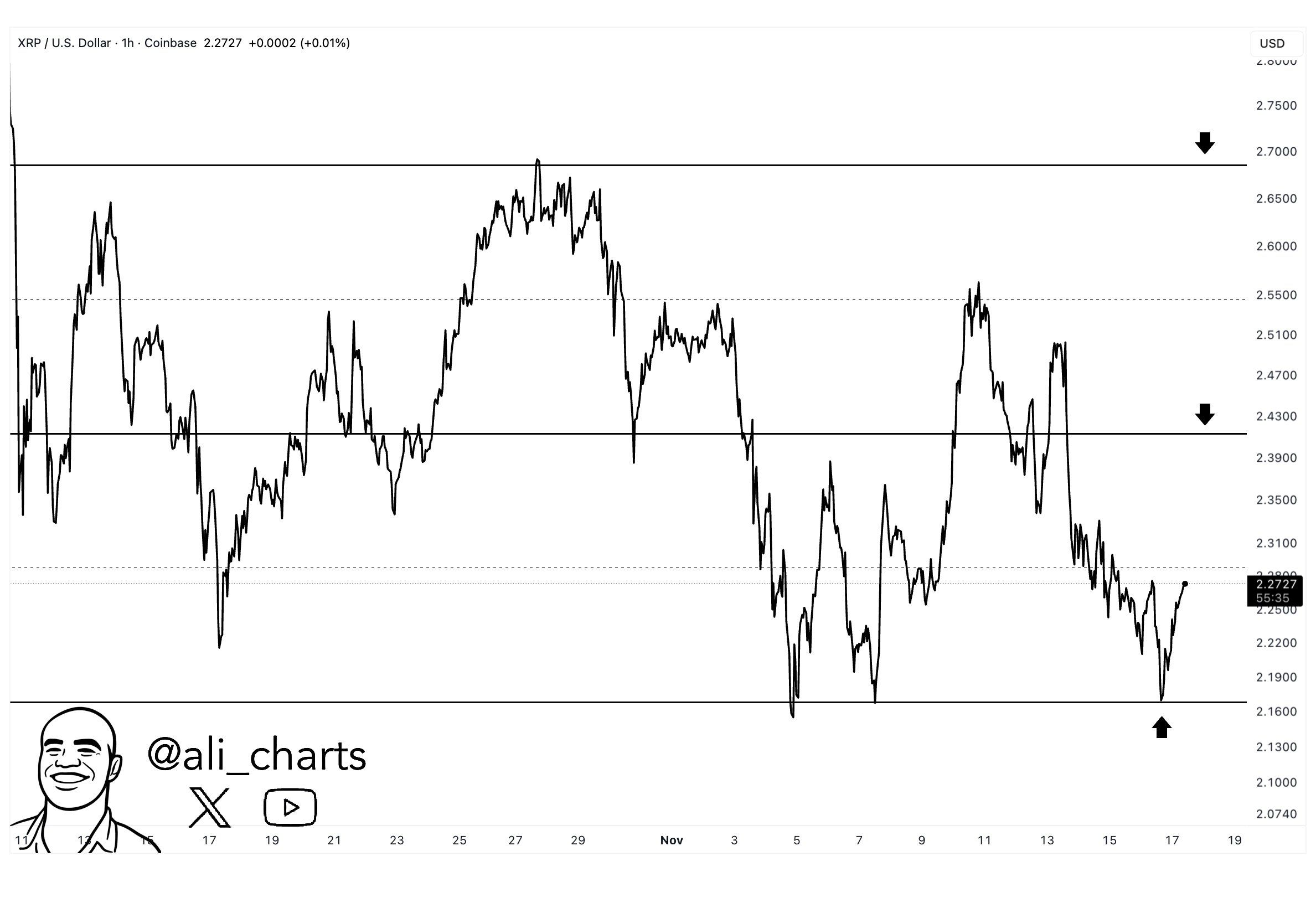

Franklin XRP ETF Debut Meets XRP’s $2.15 Line in the Sand