Investors Shift Focus as Altcoins Redefine Blockchain's Future

- BlockDAG leads altcoin growth with scalable blockchain architecture addressing traditional limitations, attracting investor attention. - ONDO, VET, and ATOM gain traction through DeFi integration, supply chain solutions, and cross-chain interoperability, boosting trading volumes. - Rising altcoin adoption coincides with potential ETF expansion, as regulatory frameworks evolve to accommodate diversified crypto investments. - Cautious optimism persists amid reduced volatility, though long-term success depe

BlockDAG has emerged as one of the top-performing altcoins in the cryptocurrency market, capturing significant attention from investors and analysts alike. While Bitcoin and Ethereum continue to dominate the broader market, alternative cryptocurrencies such as BlockDAG, ONDO, VET, and ATOM have shown promising gains, reflecting growing confidence in the evolving altcoin space. BlockDAG’s rising prominence is attributed to its unique blockchain architecture and scalability solutions, which aim to address some of the core limitations faced by traditional blockchain technologies [1].

Market data from multiple sources indicate that altcoins are gaining traction as investors diversify their portfolios beyond the leading cryptocurrencies. ONDO, for example, has seen a steady increase in trading volume, driven by strategic partnerships and a growing number of use cases across the DeFi sector. The token’s performance has been positively influenced by increased adoption of its decentralized financial applications and a favorable regulatory environment in key markets [1]. Similarly, VET (VeChainThor) has demonstrated strong momentum, buoyed by its integration in supply chain management solutions and enhanced enterprise adoption. The token’s 7-day price trend highlights a growing interest in blockchain-based solutions for logistics and data verification [1].

Another altcoin showing robust performance is ATOM (Cosmos), which continues to attract attention due to its interoperability framework. The Cosmos network is facilitating cross-chain communication and enabling developers to build modular blockchains that can interact seamlessly with other ecosystems. This technological advantage has translated into a surge in market capitalization and trading volume, reinforcing ATOM’s position among the top altcoins [1]. The rise of these altcoins is indicative of a broader shift toward blockchain technologies that offer scalability, interoperability, and enterprise use cases.

The growing altcoin momentum is also reflected in the increasing number of altcoin-based ETFs and investment products entering the market. Following the approval of Bitcoin ETFs in the U.S. in early 2024, there has been heightened speculation around the potential for similar structures to be introduced for altcoins like BlockDAG, ONDO, VET, and ATOM. While no official announcements have been made, industry analysts have suggested that the regulatory landscape may evolve to accommodate a wider array of digital assets [1]. This potential expansion could further catalyze investment flows into the altcoin sector.

Investor sentiment remains cautiously optimistic, supported by a mix of technical indicators and fundamental developments. The Fear and Greed Index, a widely referenced tool for gauging market sentiment, has shown a moderate increase in investor confidence. This is largely attributed to the sustained performance of altcoins, which has helped reduce the volatility typically associated with the sector [1]. However, analysts caution that while short-term gains are evident, the long-term sustainability of altcoin adoption will depend on continued innovation and real-world application development. As the cryptocurrency market matures, the role of altcoins like BlockDAG, ONDO, VET, and ATOM is likely to become more prominent.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

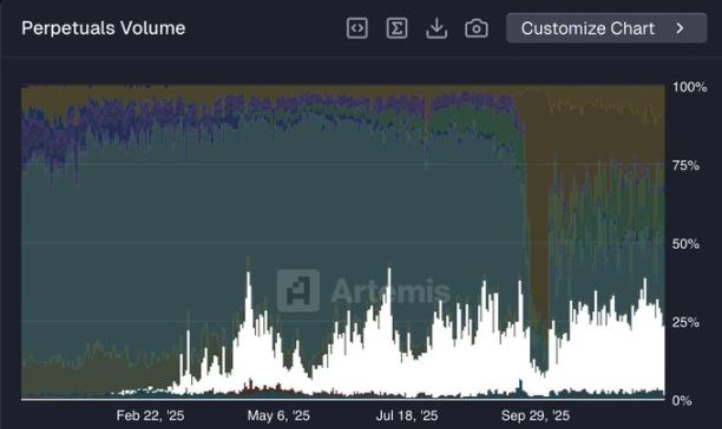

With its market share plummeting by 60%, can Hyperliquid make a comeback?

Russia Rules Out Bitcoin Payments "Under Any Circumstances"