PENGU, the native token of Pudgy Penguins, fell roughly 4% on Friday and has dropped over 20% in the past 30 days as NFT markets retraced alongside Ether. The decline follows strong user engagement from the Pudgy Party mobile launch despite broader NFT sell-offs.

-

PENGU down >20% in 30 days

-

Mobile game Pudgy Party exceeded 50,000 Google Play downloads and reached Apple top-10 downloads.

-

NFT market cap slipped from $9.3B to $7.4B in August, tracking ETH price movement.

PENGU token decline reflects NFT market pullback; learn why prices fell and what to watch next — read the analysis and expert context.

The official crypto token of Pudgy Penguins had a tough month, consistent with a broader decline in NFT markets and digital collectibles.

Pudgy Penguins’ native token slipped on Friday despite the project’s new title ranking among Apple’s top downloads.

The PENGU (PENGU) token fell by nearly 4% on Friday, following the launch of Pudgy Party, a battle royale game released on Android and iOS, regardless the game recording over 50,000 downloads on the Google Play store and landing in the top 10 most downloaded games on Apple’s App Store.

Pudgy Penguins is a popular non-fungible token (NFT) project in the crypto space. The project supplements its on-chain digital presence with trading cards, plushy penguin-themed toys, video games and other physical merchandise.

According to CoinMarketCap (plain text reference), the token declined by over 20% over the past 30 days.

PENGU token declines by over 20% in August. Source: CoinMarketCap (plain text)

Despite price fluctuations, Pudgy Penguins continues to be a cultural phenomenon and shows mass appeal to non-crypto users through its focus on physical merchandise, drawing both adults and children to the franchise.

Past month context: NFT market cap and blue-chip collections retraced after Ether’s early-August strength, affecting most collectible tokens and project-native assets.

What caused PENGU token to drop despite strong downloads for Pudgy Party?

The PENGU token decline was driven by a broader NFT market downturn and Ether’s price pullback. Short-term on-chain activity from game downloads did not offset macro selling pressure and portfolio rebalancing by holders. Market sentiment and liquidity contraction front-loaded the sell-off.

How severe was the 30-day decline and which data sources report it?

Price tracking (CoinMarketCap, plain text) shows PENGU fell over 20% in the last 30 days. NFT market-cap estimates from industry trackers (NFTPriceFloor, plain text) report the broader NFT category fell from about $9.3 billion to $7.4 billion in August, indicating cross-market correlation with ETH performance.

NFT markets suffer as Ethereum retraces recent gains

The Ethereum network hosts the most NFT trading activity of any blockchain ecosystem, and, following Ether’s (ETH) recent decline from an all-time high near $4,957, the NFT market took a hit.

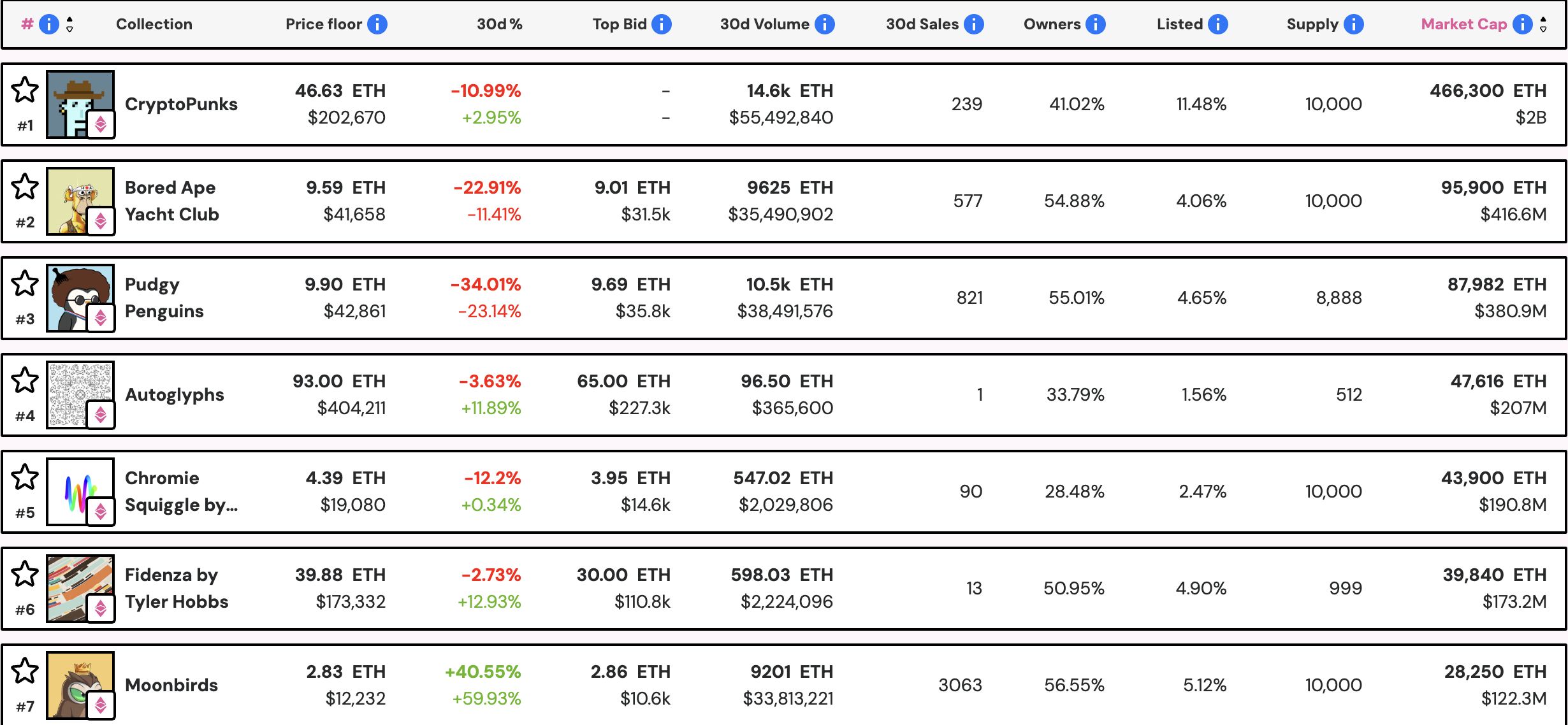

CryptoPunks, a blue-chip NFT collection of pixelated characters often used as profile pictures by industry executives and investors, showed resilience and rose nearly 3% in August, per NFT market trackers (plain text reference).

NFT projects take a hit during August. Source: NFTPriceFloor (plain text)

Bored Ape Yacht Club recorded losses of over 11% in August, while Pudgy Penguins (PENGU) declined by over 20% in US dollar terms. The pattern shows selective resilience but overall downward pressure across many collections.

The NFT market cap hit roughly $9.3 billion at the beginning of August during Ethereum’s historic rally. That figure has since fallen to about $7.4 billion at the time of reporting, underscoring correlation between NFT liquidity and ETH price movements.

Why did game downloads not prevent the price decline?

Downloads signal user interest but do not immediately translate to native-token demand. Many downloads produce engagement without token purchases. Additionally, macro liquidity shifts and speculative profit-taking can outweigh product adoption on short timelines.

How should traders and collectors respond to PENGU and NFT volatility?

Measured responses reduce risk. Evaluate on-chain activity, secondary market floor prices, and Ether-driven liquidity. Distinguish between durable adoption signals and transient hype from marketing or a game launch.

Frequently Asked Questions

Is PENGU a long-term store of value?

PENGU is a project token tied to Pudgy Penguins’ ecosystem and community. Long-term value depends on sustained utility, secondary-market demand for NFTs, and broader ETH market health. Assess roadmap milestones and on-chain activity before assuming long-term value.

How does Ether price movement affect NFT tokens like PENGU?

Ether is the settlement and liquidity backbone for most NFTs. When ETH drops, collectors and traders often reduce exposure, lowering NFT market caps and native token demand. Correlation is high during market-wide sentiment shifts.

What should I watch next for signs of recovery?

Monitor: 1) daily trade volume and floor prices on secondary markets; 2) on-chain active wallet counts; 3) ETH price stabilization. A sustained uptick in these metrics typically precedes price recovery.

Key Takeaways

- PENGU decline: The native token fell ~4% on Friday and over 20% in 30 days amid NFT market weakness.

- Downloads vs. demand: Pudgy Party downloads show product interest but not immediate convertible token demand.

- Watch metrics: Monitor ETH price, on-chain activity, and secondary-market floor prices for recovery signals.

Conclusion

Market data shows the PENGU token has lagged despite strong user engagement from a new mobile release. Short-term price action reflects broader NFT and Ether dynamics rather than a failure of the Pudgy Penguins brand. Observers should track on-chain metrics and ETH liquidity to evaluate recovery prospects.