Spot Ethereum ETF trading is booming, with inflows over the past five trading days more than ten times those of Bitcoin.

The U.S. spot Ethereum ETF has recently attracted significantly more capital than Bitcoin, with inflows over the past five days exceeding those of Bitcoin by more than ten times. Market momentum is shifting due to Ethereum's advantages in stablecoins and asset tokenization, drawing the attention of major institutional investors such as Goldman Sachs.

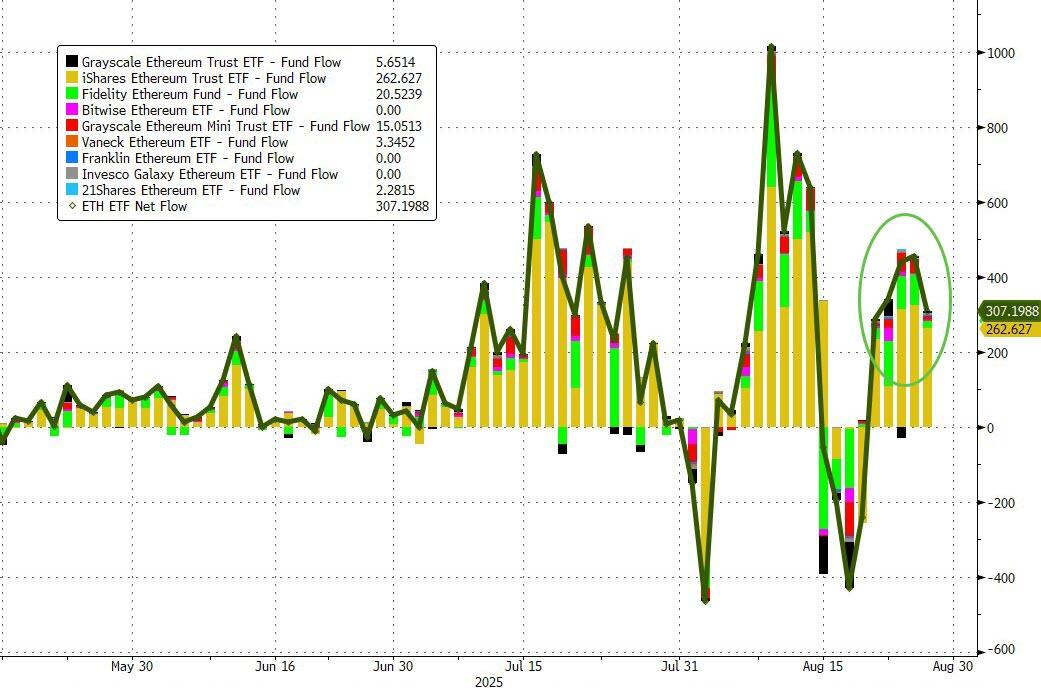

Spot Ethereum ETFs are trading briskly in the United States, with capital inflows over the past five trading days exceeding those of spot Bitcoin ETFs by more than tenfold. According to CoinGlass data, since August 21, spot Ethereum ETFs have recorded inflows as high as $1.83 billion, while Bitcoin ETFs have seen only $171 million in the same period, less than one-tenth of Ethereum's figure.

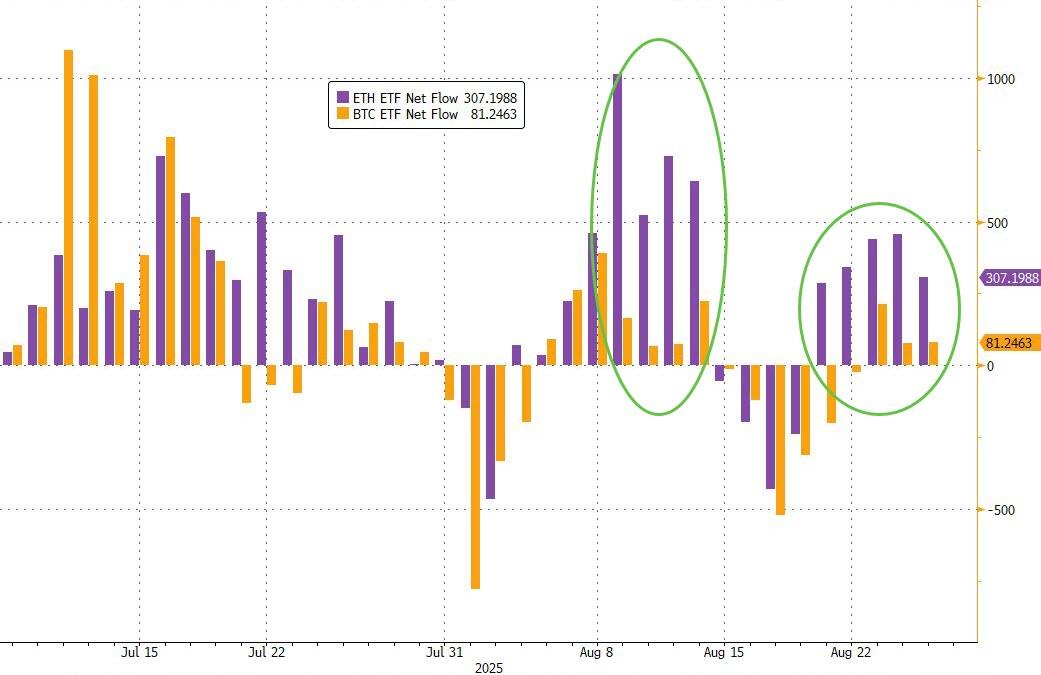

This trend continued on Wednesday: nine Ethereum ETFs saw inflows of $310.3 million, while eleven spot Bitcoin ETFs recorded only $81.1 million.

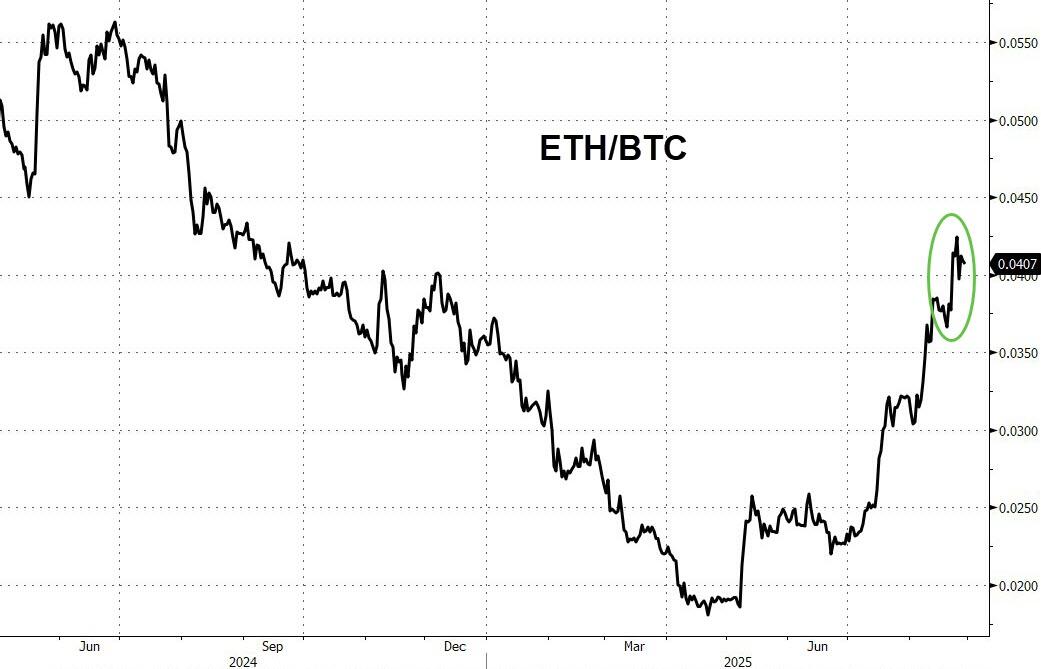

Since the start of this week, Ethereum's price rebound has also outpaced that of Bitcoin.

This large-scale shift of capital toward Ethereum has drawn the attention of industry observers. Insiders describe this change as extremely intense. Since early July, capital inflows into spot Ethereum ETFs have approached $10 billion.

Spot Ethereum ETFs have been trading for 13 months, with cumulative inflows reaching $13.6 billion, most of which has come in the past few months. In comparison, spot Bitcoin ETFs have been listed for a longer period, trading for 20 months, with total assets under management (AUM) of $54 billion.

Since the passage of the GENIUS Stablecoin Act in July, market momentum appears to be shifting toward Ethereum. The reason is that the Ethereum network holds the largest share of the stablecoin and real-world asset tokenization market. VanEck CEO Jan van Eck stated this week, "This fits perfectly with what I call Wall Street tokens."

According to a report by Bloomberg ETF analyst James Seyffart, investment advisors are the largest holders of Ethereum ETFs, with holdings reaching $1.3 billion. According to SEC filings, Goldman Sachs is among the top holders, with holdings of $712 million.

The scale of digital currency ETFs is growing rapidly. Looking only at the largest Bitcoin ETF, IBIT, its AUM is quickly approaching that of the world's largest gold ETF, GLD.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: Fundraising Explodes by +150% in One Year

Bitcoin Drops $8B In Open Interest : Capitulation Phase ?

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025