Official GDP Data Enters the On-Chain Era: 9 Major Blockchains to Store U.S. Economic Data

Author: Frank, PANews

Original Title: A Historic Step: Official US GDP Data to Be Stored on Bitcoin, Ethereum, and 9 Major Public Blockchains

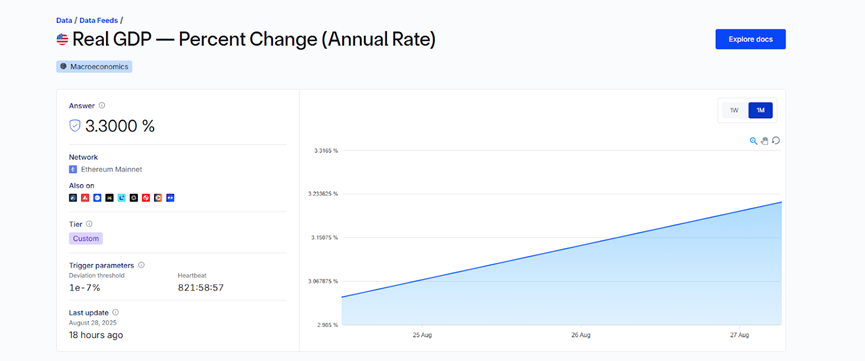

On August 28, the US Department of Commerce announced that starting from July 2025, actual Gross Domestic Product (GDP) data will be published on the blockchain. The first batch of data types includes six related categories, such as actual GDP, the Personal Consumption Expenditures (PCE) price index, and the real final sales to domestic private purchasers.

This data on-chain initiative involves 9 public blockchains and 2 oracle networks. For the crypto industry, this marks a shift as the core data of the world’s most important economy moves from traditional centralized institutions to being natively available on-chain. On one hand, this government-led data on-chain move brings new endorsement to the crypto world. On the other hand, it is also another symbolic step by the Trump administration in advancing the “crypto capital.”

Dual Architecture of “Proof of Existence” and “Application”

First, from a technical perspective, PANews has outlined the process of this data on-chain initiative.

According to the official statement from the US Department of Commerce, the core operation is to embed the cryptographic hash of the official GDP report PDF file—essentially the file’s unique “digital fingerprint”—into transactions on these nine blockchains. The initial blockchains adopted are Bitcoin, Ethereum, Solana, TRON, Stellar, Avalanche, Arbitrum One, Polygon PoS, and Optimism.

Through this operation, anyone can verify whether the report has been tampered with by comparing the on-chain hash value with the official report’s hash value.

In addition, this data on-chain initiative has also selected two leading oracle platforms, Chainlink and Pyth. As middleware services between blockchains and the real world, oracles primarily serve to securely and reliably “feed” off-chain real-world data to blockchain networks.

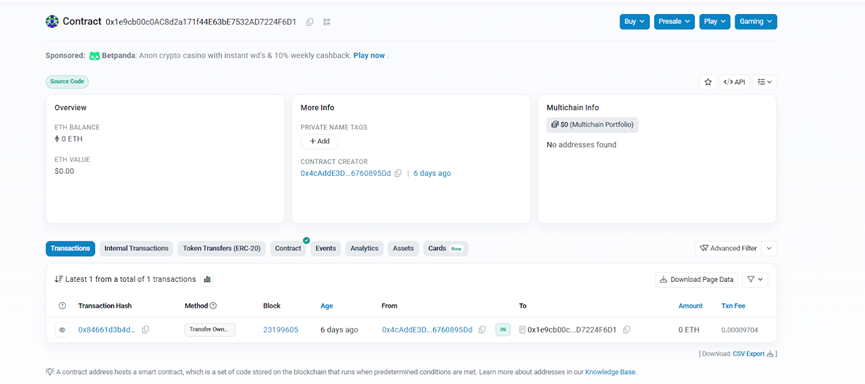

GDP data contract on Ethereum

Therefore, choosing Chainlink and Pyth can better distribute this already on-chain data to applications and ecosystems that need to use it. Chainlink’s official website has already launched a dashboard feature for these six data types.

However, unlike the nine public blockchains announced by the US Department of Commerce, Chainlink’s documentation shows that it currently supports ten public blockchain networks: Arbitrum, Avalanche, Base, Botanix, Ethereum, Linea, Mantle, Optimism, Sonic, and ZKsync.

There appears to be some conflict here, but in reality, it is not due to information synchronization errors. Rather, the blockchain lists mentioned by the two parties play different roles in this process. Simply put, the nine public blockchains announced by the US Department of Commerce are the original data verification networks for proof of existence. The ten blockchain networks announced by Chainlink are the first batch of networks supported by its data feed service. The common feature of these chains is that they are all active smart contract platforms (mainly Ethereum and its Layer 2 scaling networks).

Political “Showmanship”? But Beneficial for On-Chain Products

What actual pain points does this data on-chain initiative address? The real reasons behind it may come from two aspects.

From the perspective of the crypto industry, this data on-chain initiative—especially with the integration of leading oracles like Chainlink and Pyth—can provide the crypto industry with more direct and authoritative sources of GDP and other core US economic data, which is beneficial for the stability of products linked to this official data, such as stablecoins, RWA, and prediction markets.

From another angle, this move to put data on-chain is deeply and complexly related to President Trump and his administration’s history of questioning the reliability of official data.

During his tenure, Trump repeatedly publicly accused economic data unfavorable to him (such as GDP growth or employment data) of being “manipulated” or “biased.” In August, he fired Bureau of Labor Statistics Director Erika McEntarfer over an unsatisfactory employment report and accused her of releasing “false” data.

From the perspective of the US Department of Commerce, writing GDP and other data onto the blockchain seems more like a proactive response to Trump’s doubts about the authenticity of the data. However, many US media outlets believe that such manipulation cannot completely solve the problem of data falsification. After all, putting data on-chain only solves the issue of proof of existence, but cannot guarantee the objectivity and authenticity of the core data source.

PYTH Surges, While Public Chain Tokens Remain Unmoved

Regardless of the ultimate goal and actual effect, this data on-chain initiative led by the US government can ultimately be summarized as further recognition of blockchain technology.

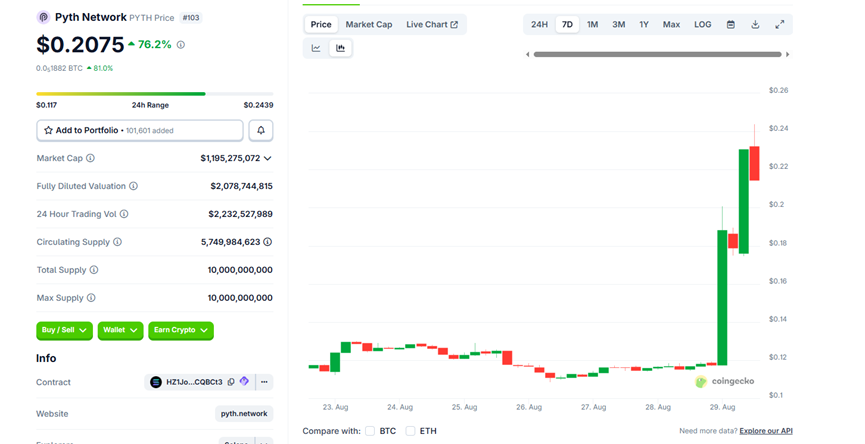

However, judging from the list of public blockchains announced by the US Department of Commerce, the governance tokens of these public chains do not seem to have been stimulated by this news to rise in price. The Chainlink token LINK, which established the partnership, did experience a rapid surge on the evening of the 28th, but its price subsequently fell again along with the broader market.

The only token that was truly and significantly stimulated by this news was Pyth, whose price quickly surged from around $0.11 before the news was released to a high of $0.25, with a daily increase of up to 110%, and a market cap growth of over $600 millions.

This divergence suggests that the sharp rise in the PYTH token may have been actively driven by capital, and the actual support from the news may not be strong.

However, this may be just the beginning. Secretary of Commerce Lutnick clearly stated during the announcement that after the Department of Commerce “finalizes all the details,” it plans to promote this blockchain-based data infrastructure to all federal agencies. This means that in the future, all types of public data from the US government may be published in a similar manner.

Overall, although the short-term market stimulus effect of this US data on-chain initiative is not strong, its long-term impact on the entire crypto industry may be much greater. This marks the opening of a new door for mainstream public blockchains to serve as the core layer for data storage in the future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP profit-taking signals ‘weakness’: Will it delay recovery to $3?

Zcash may see ‘violent end’ as ZEC price rallies 1500% in just two months

Bitcoin, ETH ETFs see $1.7B outflow but whale buying softens the price impact

Bitcoin’s next move could shock traders if BTC price breaks above $112K