Why Caliber's Chainlink Treasury Strategy Could Signal a New Era in Hybrid Real Estate and Blockchain Asset Management

- Caliber, a Nasdaq-listed real estate firm, launched a Digital Asset Treasury (DAT) strategy using Chainlink’s LINK tokens to diversify reserves and generate yield via staking. - The hybrid model combines real estate with blockchain, leveraging Chainlink’s oracles for automated compliance, asset valuation, and cross-chain interoperability to enhance liquidity and efficiency. - Caliber’s stock surged 80% post-announcement, but risks include digital asset volatility and regulatory uncertainty, mitigated by

The integration of blockchain into traditional asset management is no longer a speculative experiment—it’s a strategic imperative. Caliber, a Nasdaq-listed real estate asset manager, has taken a bold step by establishing a Digital Asset Treasury (DAT) strategy centered on acquiring and staking Chainlink’s native token, LINK. This move not only diversifies Caliber’s balance sheet but also positions it at the forefront of a hybrid financial model where real estate and blockchain converge. By leveraging Chainlink’s institutional-grade infrastructure, Caliber is redefining treasury management for the digital age, signaling a paradigm shift in how asset managers approach risk, liquidity, and innovation.

Strategic Diversification: From Real Estate to Digital Reserves

Caliber’s DAT strategy allocates a portion of its treasury funds to LINK tokens, funded through a mix of existing credit facilities, cash reserves, and equity-based securities [1]. This approach mirrors traditional diversification tactics but introduces a novel asset class: staked digital assets. By holding LINK, Caliber gains exposure to a high-liquidity token with deflationary mechanics tied to enterprise revenue growth, while generating yield through staking [2]. This dual benefit—capital appreciation and passive income—addresses a critical challenge in real estate: balancing long-term asset value with short-term liquidity needs.

The strategy’s hybrid nature is further underscored by its funding model. Unlike speculative crypto bets, Caliber’s approach is disciplined, with a dedicated Crypto Advisory Board (CCAB) overseeing governance, custody, and risk management [1]. This structured framework aligns with institutional-grade standards, mitigating volatility risks while retaining the upside potential of blockchain adoption.

Institutional Adoption: Chainlink as the Bridge to Traditional Finance

Chainlink’s role in this strategy is pivotal. As a decentralized oracle network, Chainlink connects smart contracts with real-world data, enabling Caliber to automate asset valuation and fund administration [1]. This integration is not theoretical: by 2025, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) had already enabled institutions like J.P. Morgan and SBI Group to tokenize real-world assets (RWAs), reducing settlement times from days to minutes [2]. Similarly, Chainlink’s Automated Compliance Engine (ACE) and Onchain Compliance Protocol (OCP) embed KYC/AML policies directly into smart contracts, allowing institutions like Goldman Sachs and the European Investment Bank (EIB) to execute atomic settlements in under 60 seconds [2].

These advancements position Chainlink as more than a blockchain infrastructure provider—it is a critical enabler of institutional trust in digital assets. For Caliber, this means operational efficiency gains and enhanced transparency, two cornerstones of real estate management. By adopting Chainlink’s oracle technology, the firm is not merely tokenizing assets but reimagining how real estate data is validated and managed in a decentralized ecosystem.

Market Impact and Risks: A High-Stakes Experiment

Caliber’s DAT strategy has already generated significant investor enthusiasm. Following the announcement, its stock price surged 80%, reflecting market confidence in its blockchain-driven innovation [3]. However, the strategy is not without risks. Digital assets remain volatile, and regulatory uncertainty looms over tokenized treasuries. Caliber’s CCAB and DAT Policy aim to mitigate these risks through rigorous governance, but the long-term success of the strategy will depend on Chainlink’s ability to maintain institutional partnerships and adapt to evolving compliance frameworks [1].

A New Era of Hybrid Asset Management

Caliber’s Chainlink Treasury Strategy exemplifies a broader trend: the convergence of real estate and blockchain. By treating digital assets as core reserves, the firm is challenging the traditional dichotomy between physical and digital capital. This hybrid model offers several advantages:

1. Liquidity: Staked LINK generates yield, providing a buffer against real estate market downturns.

2. Efficiency: Chainlink’s oracles streamline asset valuation and fund administration, reducing operational costs.

3. Institutional Credibility: Chainlink’s partnerships with SWIFT, Mastercard , and BlackRock validate its role in bridging traditional and decentralized finance [2].

For institutional investors, this strategy highlights the potential of blockchain to enhance diversification and operational resilience. As more firms adopt similar approaches, the line between real estate and digital asset management will blur, creating a new asset class that leverages the strengths of both worlds.

Conclusion

Caliber’s DAT strategy is more than a financial experiment—it is a blueprint for the future of asset management. By integrating Chainlink’s infrastructure, the firm is demonstrating how blockchain can address real-world challenges in real estate, from liquidity to compliance. While risks remain, the strategic diversification and institutional adoption metrics underscore a compelling case for hybrid asset management. As the market evolves, Caliber’s initiative may well become a benchmark for how traditional industries harness blockchain to innovate, compete, and thrive.

Source:

[1] Caliber Establishes LINK Token Digital Asset Treasury

[2] Chainlink's Strategic Expansion in Institutional Blockchain

[3] Caliber's Chainlink Treasury: A High-Risk, High-Reward Play in Digital Asset-Driven Real Estate

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

RootData Crypto Calendar Fully Upgraded: Say Goodbye to Information Delays and Build Your 24/7 Trading Alert System

Only with information transparency can wrongdoers be exposed and builders receive their deserved rewards. The RootData calendar section has evolved into a more comprehensive, accurate, and seamless all-weather information alert system, aiming to help crypto investors penetrate market uncertainties and identify key events.

Major Overhaul in US Crypto Regulation: CFTC May Fully Take Over the Spot Market

The hearing on November 19 will determine the final direction of this long-standing dispute.

As economic fissures deepen, Bitcoin may become the next "pressure relief valve" for liquidity

Cryptocurrencies are among the few areas where value can be held and transferred without relying on banks or governments.

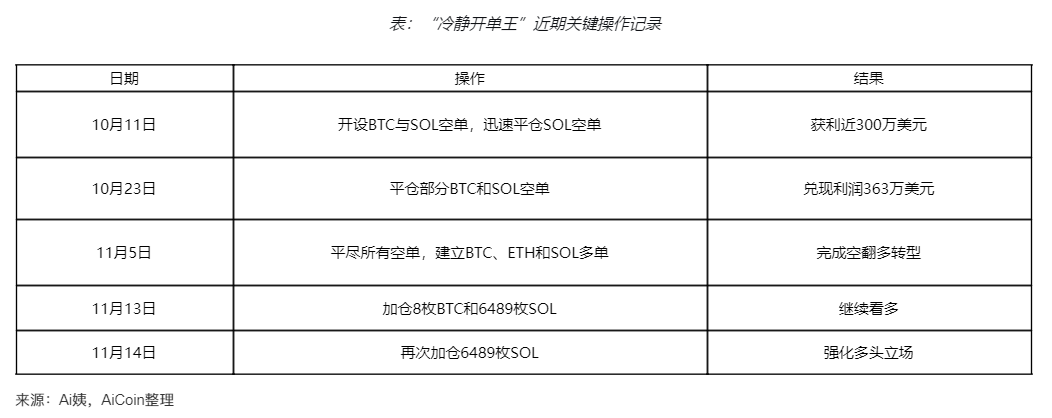

"The Calm Order King" increases positions against the trend, strengthening the bulls!