Chinese developer Xincheng Group plans to raise funds through tokenized debt financing

According to Jinse Finance, Bloomberg reported that Chinese developer Seazen Group Limited plans to issue tokenized private bonds by the end of the year, marking its entry into Hong Kong's digital asset sector. The company announced its strategy to explore such assets on Friday. Seazen expects to establish a digital asset management division by the end of the year and launch non-fungible token products related to its Wuyue Plaza investment properties.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitunix Analyst: Whale Sell-Off Accelerates, Not Panic Yet but Liquidity Gap Poses Risk

Public Chain Activity Ranking for the Past 7 Days: Solana Remains Firmly at the Top

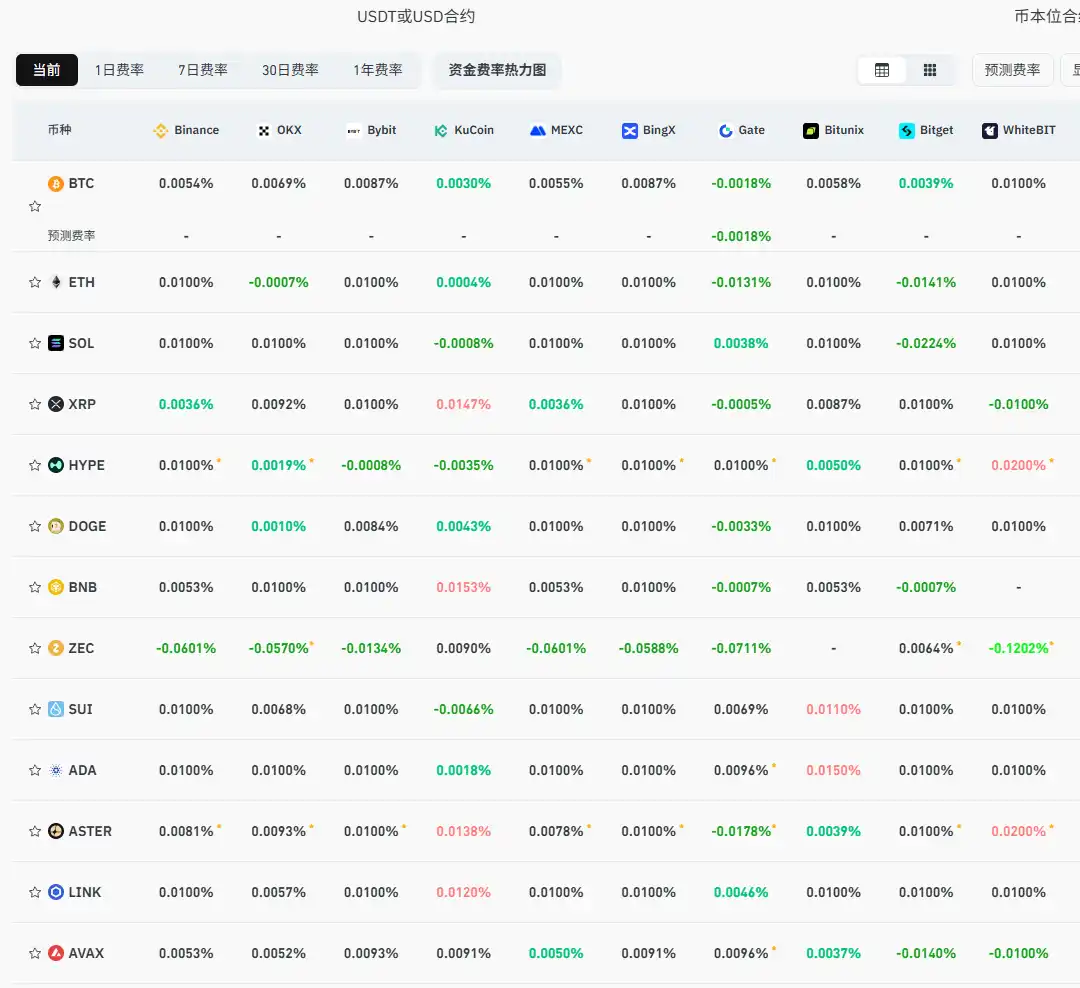

Current mainstream CEX and DEX funding rates indicate that bearish sentiment in the market has weakened.

CoinMarketCap: Launched the decentralized finance index token CMC20