Nearly $15 Billion in Bitcoin and Ethereum Options Expire Today: What Traders Should Expect

Bitcoin and Ethereum face $14.6 billion in expiring options today, with prices expected to test max pain levels amid Nvidia-driven uncertainty.

Crypto markets brace for volatility this Friday, with the August options due for expiry today. Notably, today’s expiring options are for the month, making them significantly higher than in the past several weeks.

The expiry highlights clustered open interest (OI) around critical levels, with analysts noting traders’ split over whether Nvidia’s blockbuster earnings on Wednesday, August 27, will ripple into crypto volatility.

Bitcoin, Ethereum Options Expiry Looms With $14.6 Billion at Stake

According to Deribit data, Bitcoin and Ethereum options worth $14.6 billion will expire today, comprising contracts for August.

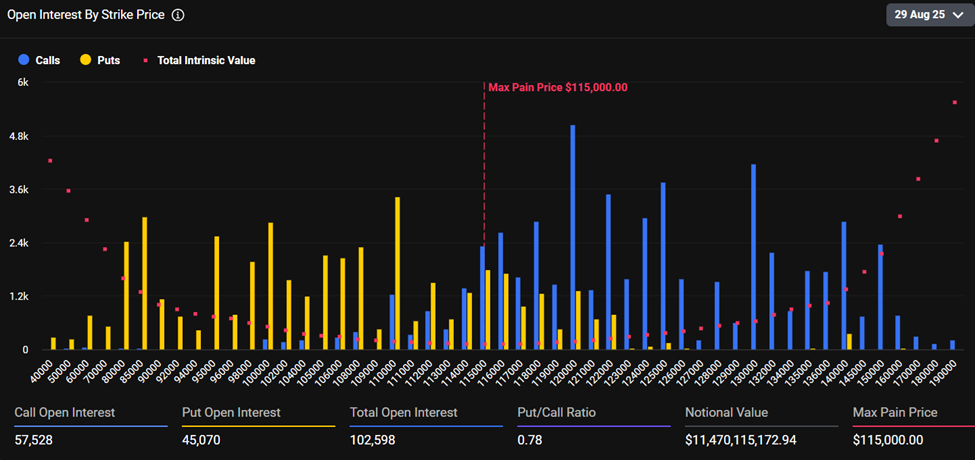

Out of these, Bitcoin contracts comprise the majority of expiring options, registering a notional value of $11.47 billion. More closely,

These expiring Bitcoin options have a total open interest of 102,598, the sum of all open Put (Sales) and Call (Purchase) option contracts.

Meanwhile, these options contracts have a Put-to-Call ratio (PCR) of 0.78, suggesting a cautious but optimistic outlook in the market, as purchase orders exceed sale orders.

Bitcoin Expiring Options. Source:

Deribit

Bitcoin Expiring Options. Source:

Deribit

As the chart above indicates, the maximum pain (Max Pain) level for today’s Bitcoin expiring options is $115,000. Here, most Bitcoin options holders will feel the most financial pain.

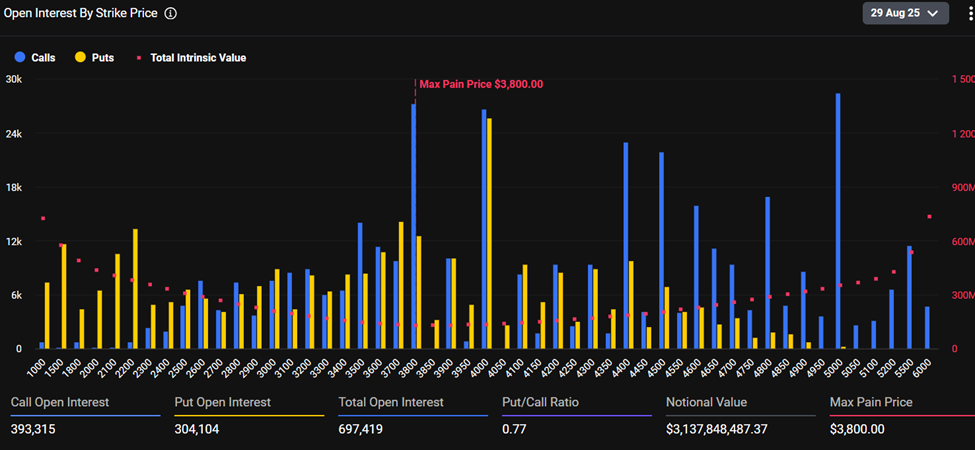

Meanwhile, Ethereum options with a notional value of $3.137 billion will expire today. It constitutes a total open interest of 697,419, where call (purchase) options dominate.

The Deribit data shows the PCR at 0.77, accentuating the dominance of purchase orders over sale orders, and suggesting that options traders are leaning bullish.

The Maximum pain or strike price for today’s Ethereum expiring options is $3,800, at which point most holders will experience the most financial loss.

Expiring Ethereum Options. Source:

Deribit

Expiring Ethereum Options. Source:

Deribit

This week’s expiring options are significantly less than the $5 billion witnessed last week. The difference comes as the $14.6 billion is for the month. This is because today is the last Friday of August.

Deribit’s analysis showed that ETH options activity leans toward cautious optimism, yet analysts flagged signs of weakness compared to Bitcoin.

“ETH shows balanced flows with upside at $3,800 and $5,000,” the exchange noted.

However, they questioned whether expiry will deliver the breakout traders have positioned for, or a reversal that flips sentiment.

Nvidia Earnings Cast a Shadow Over Bitcoin’s Volatility Outlook

Analysts at Greeks.live noted that traders’ sentiment is mixed. Some welcomed the survival of $112,000 put positions, while others voiced concern over Ethereum’s relative weakness compared to Bitcoin.

The discussion, however, was dominated by the looming impact of Nvidia’s earnings, which have historically spilled into broader markets.

“Debate centered around BTC implied volatility being too low ahead of NVDA earnings,” Greeks. live reported.

They point to Nvidia’s implied volatility (IV) at 100% and an expected 7% move. The divide stems from whether Bitcoin will track equities, as it did after Nvidia’s February 2024 earnings, or whether crypto has decoupled enough to remain resilient.

Against this backdrop, the outcome of today’s expiring options could prove pivotal. Amidst the caution, seen with put-to-call ratios nearing 1, the general sentiment appears to be investors showing optimism.

Notwithstanding, as today’s options near expiration, volatility is expected, with both Bitcoin and Ethereum prices likely to pull toward their respective max pain levels.

As of this writing, Bitcoin and Ethereum were trading for $111,428 and $4,468, respectively, which suggests imminent correction for Ether and possible gains for BTC as these options near expiration.

However, the market tends to stabilize after options expire at 8:00 UTC on Deribit, with traders adjusting to new trading environments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Zcash Faces Vitalik Buterin’s Challenge: What Lies Ahead?

In Brief Vitalik Buterin warns Zcash against token-based governance. Zcash community is divided over future governance approach. ZEC Coin struggles with market negativity and volatile price movements.

70M$ inflows this week: Bitcoin ETFs rise again

BlackRock Downplays IBIT Outflows as Bitcoin ETF Market Shows Signs of Recovery