The 2025 Meme Coin Boom: How Speculative Frenzy and Community Power Are Reshaping Digital Investing

- The 2025 meme coin market hit $74.5B, driven by speculative FOMO and community-driven projects like APC, FARTCOIN, and GIGA. - Projects use deflationary mechanics, influencer ecosystems, and whale incentives (e.g., APC’s 11,263% ROI projection) to amplify scarcity and engagement. - Meme coins increasingly blend humor with utility, such as FARTCOIN’s metaverse plans and MOODENG’s charity-linked NFTs, though long-term viability remains uncertain. - Risks persist via volatility, liquidity traps, and pump-an

The meme coin market in 2025 has evolved into a $74.5 billion juggernaut, driven by a unique blend of speculative fervor and community-driven innovation. As altcoin season intensifies, projects like Arctic Pablo Coin (APC), Fartcoin (FARTCOIN), and Gigachad (GIGA) are leveraging viral narratives, deflationary mechanics, and influencer ecosystems to create value beyond mere humor. This article examines how speculative momentum and grassroots engagement are fueling the next wave of meme coin dominance.

Speculative Momentum: FOMO, Whales, and Gamified Mechanics

The 2025 meme coin surge is underpinned by behavioral psychology and whale-driven accumulation. Platforms like Pump.fun exploit retail FOMO by creating algorithmic pump-and-dump cycles, while projects such as Arctic Pablo Coin (APC) use structured token burns to amplify scarcity. Similarly, Fartcoin (FARTCOIN) has embedded digital fart sounds into transactions and plans a “Dodgeball Metaverse,” with a fixed supply of 100 million tokens and deflationary burns enhancing its speculative appeal.

Whale activity is another critical driver. Coins like MoonBull ($MOBU) and Peanut the Squirrel ($PNUT) incentivize whale participation through exclusive whitelist access and NFT-based governance. These strategies create self-fulfilling price cycles, as large holders lock liquidity and reward long-term stakers.

Community-Driven Value Creation: From Meme to Utility

While humor remains the core of meme coins, 2025 projects are increasingly integrating blockchain utility. Moo Deng (MOODENG), inspired by a viral Thai piglet meme, combines cultural branding with charity initiatives and NFT drops. Its community-driven “Moo Army” funds local food banks, blending emotional resonance with financial incentives. Gigachad (GIGA) takes a different approach, leveraging AI-driven marketing and NFT-based governance to reward “The Chad Army” with staking rewards and exclusive digital assets.

Fartcoin (FARTCOIN) and Pepe Coin (PEPE) further illustrate this trend. FARTCOIN’s “Dodgeball Metaverse” plans to tokenize virtual events, while PEPE has expanded into DeFi staking and governance. These projects demonstrate how meme coins are transitioning from pure speculation to platforms with tangible utility, albeit with uncertain long-term viability.

Risks and Realities

Despite the optimism, meme coins remain inherently volatile. Tokens like LoFi and Trump Coin ($TRUMP) have experienced rapid price swings tied to viral trends or political narratives. Investors must also navigate liquidity traps and pump-and-dump schemes, necessitating tools like Nansen and DEXScreener to track whale movements and tokenomics.

Conclusion

The 2025 meme coin landscape is a testament to the power of community and virality in digital finance. While projects like APC, MOODENG, and GIGA offer high-risk, high-reward opportunities, their success hinges on sustained engagement and utility integration. For investors, the key lies in balancing FOMO-driven speculation with rigorous on-chain analysis.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

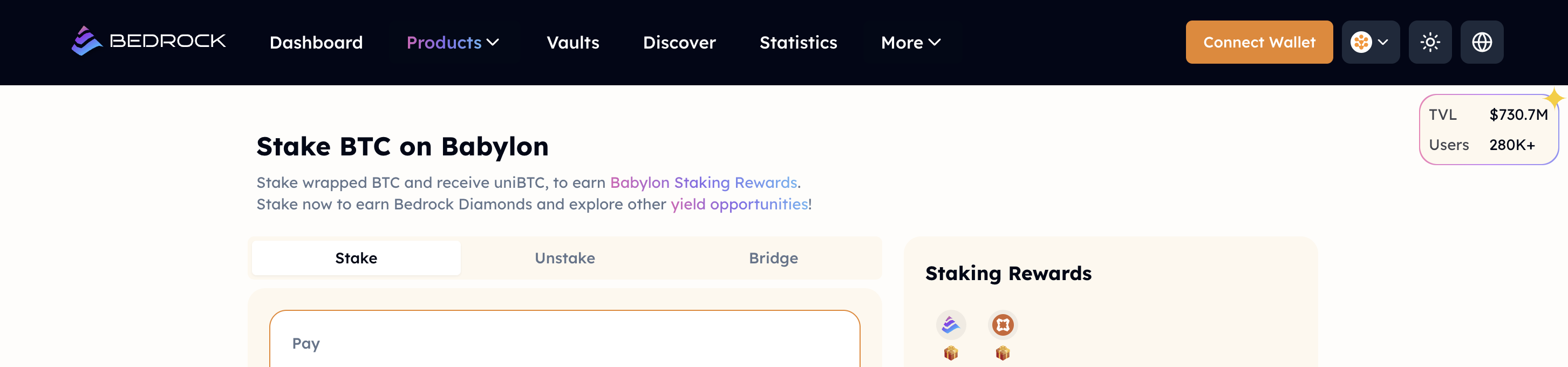

uniBTC Is Now Live on Rootstock: Unlock New BTC Yield and DeFi Opportunities

The New Order of AI Generative Development: Deconstructing the Vibe Coding Ecosystem

Vibe Coding is an early-stage project with clear structural growth, strong potential for platform moat, and diverse, scalable application scenarios.

Solo: Building a Web3 Trusted Anonymous Identity Layer Based on zkHE Authentication Protocol

Solo is building a "trusted and anonymous" on-chain identity system based on its original zkHE architecture, which is expected to break through the long-standing challenges...