Bitcoin Not ‘Out of the Danger Yet’ As BTC Flashes Signs of Topping Out, According to Analytics Firm – Here’s the Outlook

Analytics platform Swissblock is warning that a key metric is flashing a bearish signal for Bitcoin ( BTC ).

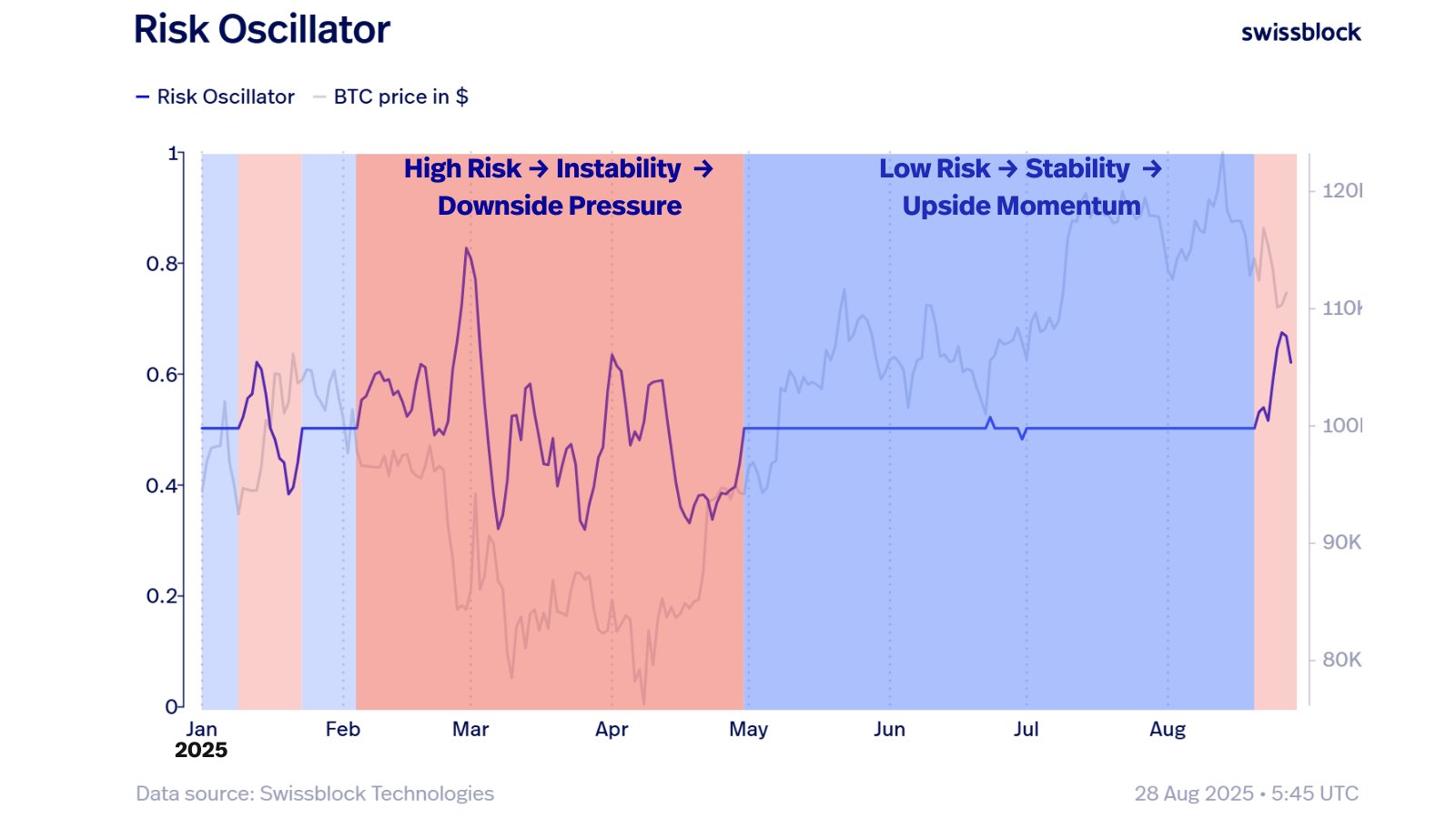

Swissblock says that its proprietary Risk Oscillator metric, which signals the direction of market sentiment using on-chain data, price behavior and other criteria, suggests Bitcoin may have already reached a cycle peak.

However, the analytics firm says that if Bitcoin can convincingly reclaim the $113,500 level as support, the risk of further downside will fade.

“Risk is showing signs of topping, price is recovering, but we’re not out of danger yet. The first step to ease pressure is price action confirming:

- Reclaiming $112,000 equals initial relief signal.

- Breaking $113,500 with strength equals true easing of risk.

Without these confirmations, the system remains fragile – upside capped, rallies short-lived and downside volatility still in play. If confirmed, this would be the foundation for broader recovery momentum.”

Source: Swissblock/X

Source: Swissblock/X

According to the chart, the Swissblock Risk Oscillator suggests a higher risk market when prices may decline.

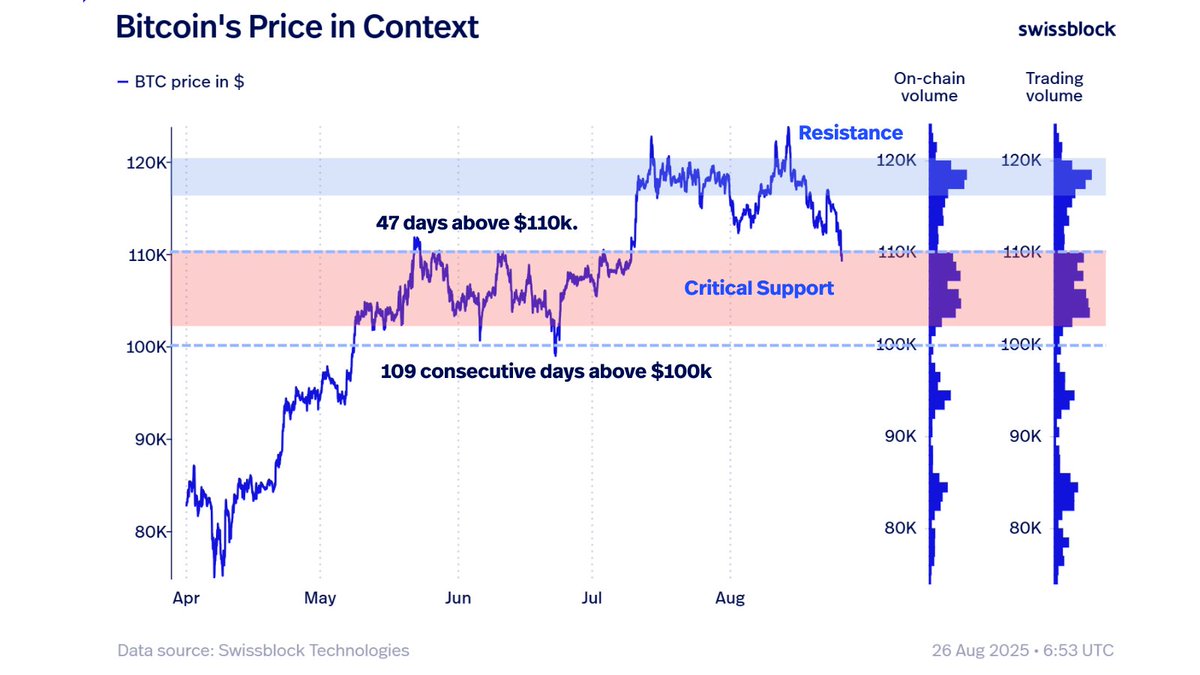

The analytics firm also says that Bitcoin needs to hold $110,000 as support to remain in a bullish trend.

“BTC is at a make-or-break level:

- $110,000 equals lifeline support.

- $121,000 equals ceiling to break.

In short: BTC has proven resilience above $100,000, but survival above $110,000 will decide if the trend continues bullish or tips into structural weakness.”

Source: Swissblock/X

Source: Swissblock/X

Bitcoin is trading for $112,435 at time of writing, up marginally on the day.

Generated Image: DALLE-3

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto: The Fear Index Drops to 10, But Analysts See a Reversal

Uniswap Labs Faces Pushback as Aave Founder Highlights DAO Centralization Concerns

Ethereum Interop Roadmap: How to Unlock the “Last Mile” for Mass Adoption

From cross-chain to "interoperability," many of Ethereum's fundamental infrastructures are accelerating towards system integration for large-scale adoption.

A $170 million buyback and AI features still fail to hide the decline; Pump.fun is trapped in the Meme cycle

Facing a complex market environment and internal challenges, can this Meme flagship really make a comeback?