To Claim Airdrop, Do You Need to First "Buy Coins"? Camp Network Sparks Outcry Across the Web

The total number of wallets participating in the testnet interaction has reached 6 million, but only 40,000 addresses are eligible for the airdrop, with almost everyone missing out.

原文标题:《「被反撸」新高度,Camp Network 空投为何引全网骂声?》

原文作者:Asher,Odaily 星球日报

Camp Network 算是近期「撸毛」项目中被反撸、社区骂声最多的项目了。

昨晚,融资高达 3000 万美元、主打解决 AI 版权乱象的 L1 项目 Camp Network 正式上线主网,同时开放代币交易与空投领取。

原本,不少「撸毛党」抱着「苦测几个月,至少能换顿猪脚饭」的心态,勤勤恳恳在测试网交互各个生态合作项目来「积攒火柴」。但结果,却迎来剧情反转——几乎全员被反撸。

下面,Odaily 星球日报带大家梳理为何从空投查询开启那一刻起,Camp Network 就成了「撸毛」社区口中的众矢之的。

无空投资格者居多,有资格者需花 10 美元进行空投注册

抱怨点一:大批早期用户无空投资格

8 月 22 日,Camp Network 宣布上线空投查询。根据社区反馈,除非此前铸造了 NFT 或者邀请好友人数足够多,绝大多数早期用户辛苦交互 Camp Network 测试网海量任务却没有空投资格。

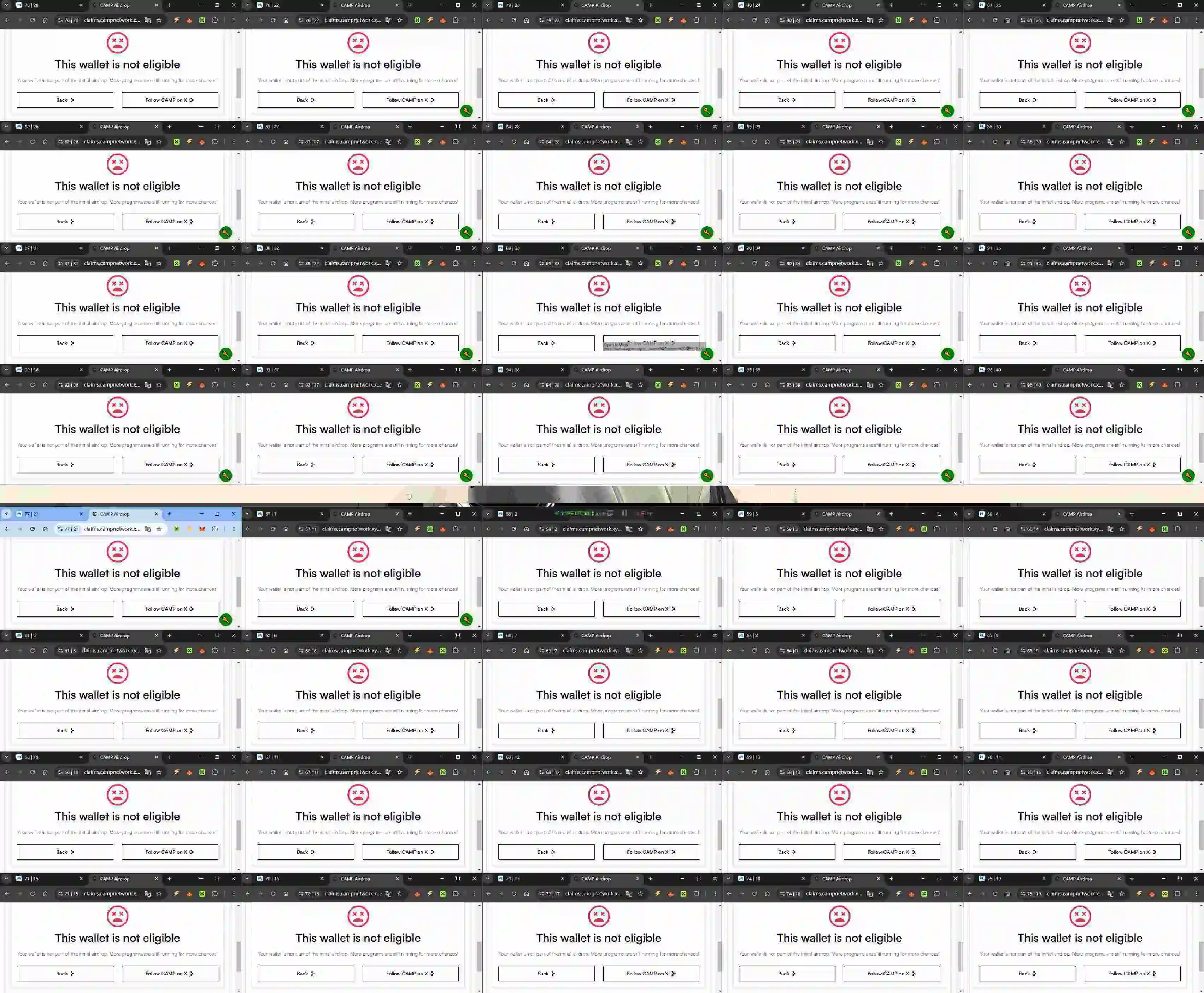

某「撸毛党」交互 Camp Network 测试网多号均无空投资格

根据社区统计数据,参与 Camp Network 测试网交互的总钱包数高达 600 万个,其中 Summit Series 活跃钱包约为 28 万个,但符合空投资格地址仅有 4 万个。

社区对 Camp Network 测试网地址统计数据

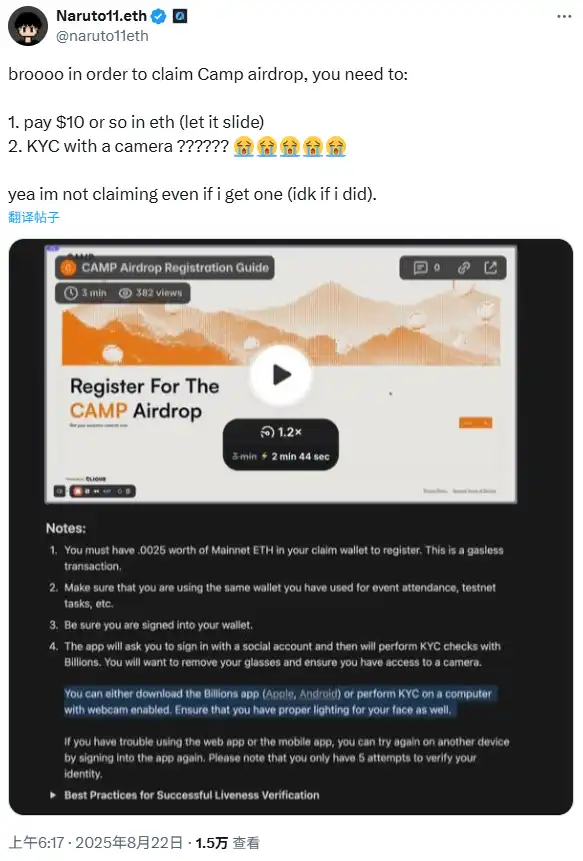

抱怨点二:有空投资格用户需花费 10 美元进行账户注册

大批「撸毛党」因被「反撸」而心生不满,本已让社区怨气冲天。没想到,就连少数拿到空投资格的用户,项目方也要求额外付费——必须支付 0.0025 ETH(约 10 美元)作为注册费用,才能最终确认领取。这也让 Camp Network 成为首个要求用户付费才能参与的主流 L 1 空投项目。

然而,随着社区负面情绪迅速发酵,Camp Network 在当天下午紧急宣布取消空投注册费,并承诺对已支付 0.0025 ETH 的用户全额退款。

迫于社区压力,官方取消空投注册费

抱怨点三:严苛的 KYC 要求

即便侥幸获得空投资格也会因无法完成严苛的 KYC 认证而无法顺利完成空投领取。根据获得空投资格用户反馈,相较于支付 10 美元注册费,更让人吐槽的是严苛的 KYC 身份认证,该认证需要通过摄像头,同时 KYC 提供商屏蔽了 VPN 和某些国家,导致大量国际用户被排除在外。

社区成员对严苛 KYC 认证的吐槽

TGE 仅解锁 20%,领取竟需先去交易所买币支付 Gas 费

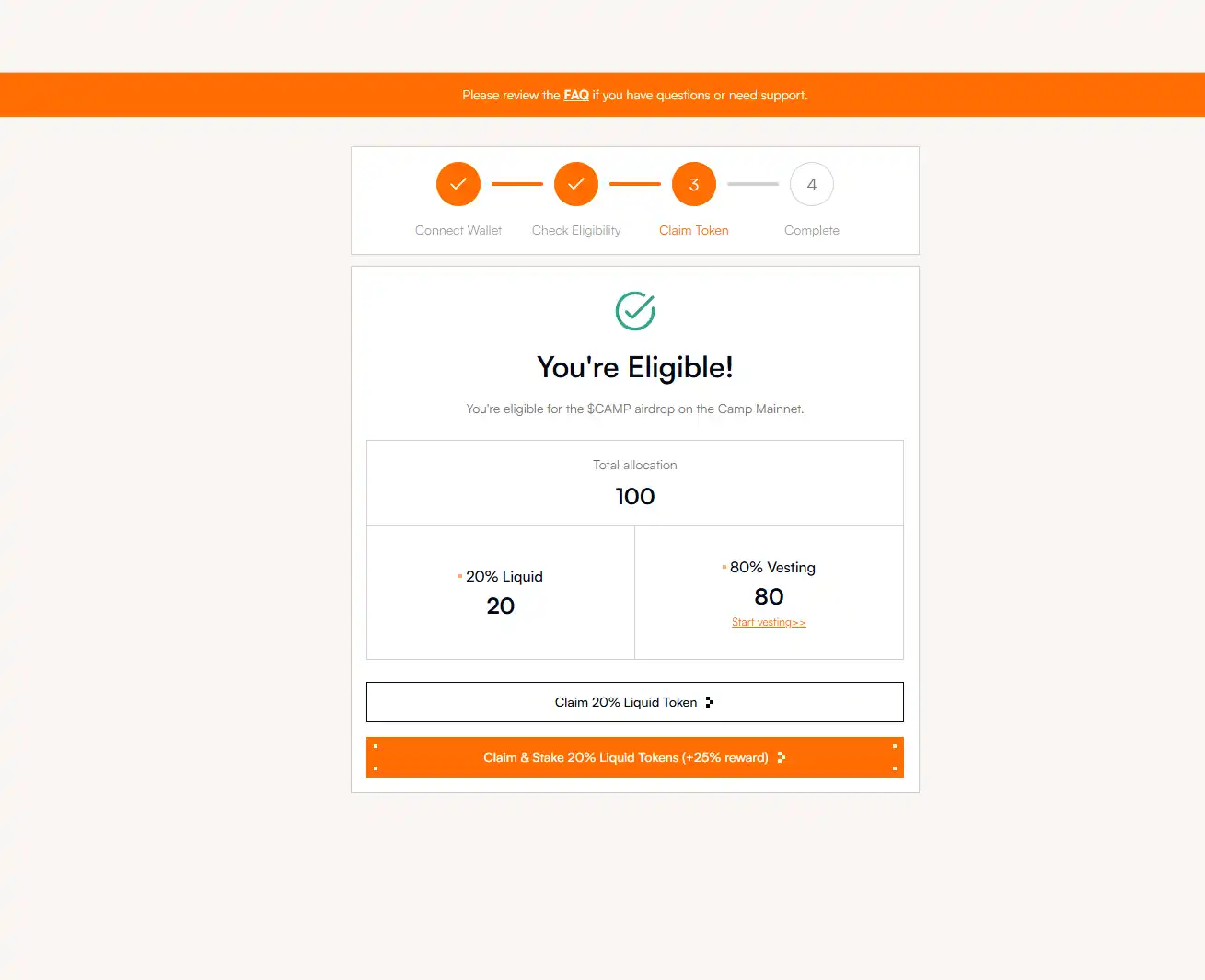

相比大批早期用户被排除在外,更令社区不满的是,TGE 期间要先掏钱上交易所买币,才能支付 Gas 领取空投。如下图,该名早期用户获得 100 枚 CAMP 代币,但开盘仅能解锁 20%,即 20 枚 CAMP,目前单价 0.09 美元,价值不足 2 美元。

领取 CAMP 代币空投界面

领取代币需先去交易所买币来支付空投 Gas 费,但交易所还无法提币

更离谱的是,领取空投需先去交易所买 CAMP 代币来支付 Camp Network 主网 Gas 费,但上线 CAMP 的部分交易所竟然到现在仍无法提币(下图所示为 Bitget 交易所)。

Bitget 交易平台目前仍无法提取 CAMP

可以看出,Camp Network 项目方在空投设计上层层设限,让绝大多数早期用户无法顺利领取代币。如此高控盘的代币机制,本身就意味着巨大的不确定性和风险,无论是选择做多还是做空,大家都需要三思而后行,切勿因为一时的情绪或短期行情而盲目冲动。

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

a16z Annual Report: The 17 Most Exciting Web3 Ideas for 2026

Stablecoins will become the infrastructure of Internet finance, AI agents will gain on-chain identity and payment capabilities, and the advancement of privacy technologies, verifiable computation, and compliance frameworks will drive the crypto industry from pure trading speculation towards building decentralized networks with lasting value.

Morning Brief | a16z Crypto releases annual report; crypto startup LI.FI completes $29 million financing; Trump says the rate cut is too small

A summary of important market events on December 11.

Trend Research: The "Blockchain Revolution" is Underway, Remain Bullish on Ethereum

The integration trend in the crypto market and Ethereum's value capture.

Interest Rate Cuts Implemented, Why Are Assets Acting "Rebellious" Collectively?