Avail's Acquisition of Arcana: A Strategic Leap Toward Web3's Unified Future

- Avail's acquisition of Arcana combines modular blockchain with chain abstraction to enhance Web3 interoperability and user experience. - The integration enables gasless cross-chain transactions, unified asset management, and scalable infrastructure for developers and users. - A 4:1 XAR-AVAIL token swap with 6-36 month vesting aligns incentives, positioning Avail as a leader in modular blockchain consolidation. - Strategic partnerships with major chains and Q4 2025 mainnet launch timelines highlight Avail

The acquisition of Arcana by Avail marks a pivotal moment in the evolution of Web3 infrastructure. By merging Avail's modular blockchain framework with Arcana's chain abstraction technology, the combined entity is poised to redefine how users and developers interact with decentralized systems. This move not only accelerates multichain interoperability but also positions Avail as a dominant infrastructure player in the next phase of blockchain growth. For investors, the implications are clear: a project that addresses the most pressing pain points of the current Web3 landscape is now better equipped to capture market share and drive long-term value.

Strategic Rationale: Modular Architecture Meets Chain Abstraction

Avail's modular design focuses on optimizing data availability and execution layers, while Arcana's chain abstraction protocol simplifies cross-chain interactions by abstracting complexity from users. Together, they create a unified infrastructure that enables seamless, gasless transactions, unified balance management, and intent-based execution across multiple chains. This synergy is critical in an ecosystem where liquidity fragmentation and user friction have historically hindered mass adoption.

For example, Arcana's embedded wallet SDK allows users to spend assets across chains without manually bridging tokens or managing gas fees. Avail's modular infrastructure complements this by providing scalable, interoperable execution environments. The result is a system where developers can build multi-chain dApps with ease, and users experience a Web3 environment as intuitive as the traditional internet.

Token Economics and Long-Term Incentives

The XAR-to-AVAIL token swap (4:1 ratio) is a strategic move to align Arcana's community with Avail's vision. With vesting schedules spanning six to twelve months for general holders and three years for the Arcana team, the transition ensures sustained commitment and reduces short-term volatility. This structured approach also mitigates the risk of token dumping, preserving value for long-term stakeholders.

For investors, the token swap represents a vote of confidence in Avail's roadmap. The integration of Arcana's tools into Avail's infrastructure is expected to drive demand for AVAIL tokens, particularly as the project accelerates its mainnet launch in Q4 2025. Early adopters who secured AVAIL tokens during the swap are likely to benefit from increased utility and adoption as the platform scales.

Market Implications: Consolidation and Competitive Advantage

The acquisition reflects a broader industry trend: the consolidation of modular infrastructure projects to address interoperability challenges. Avail's move to acquire Arcana—backed by Founders Fund and a team of over 55 members—positions it as a leader in this space. By integrating Arcana's chain abstraction tools, Avail gains access to partnerships with major chains like Avalanche , BNB Chain, and Polygon, expanding its reach into EVM, ZK, and sovereign chain ecosystems.

This strategic expansion is critical for capturing the next wave of Web3 growth. As the number of blockchains continues to rise, the demand for solutions that unify liquidity and simplify user experiences will only increase. Avail's ability to offer a scalable, interoperable infrastructure gives it a first-mover advantage over competitors, making it a compelling investment for those seeking exposure to the modular blockchain boom.

Investment Thesis: A Long-Term Play on Web3's Infrastructure Layer

For investors, Avail's acquisition of Arcana presents a unique opportunity. The combined project addresses two of the most significant barriers to Web3 adoption: fragmentation and complexity. By solving these issues, Avail is not only enhancing user experience but also empowering developers to build applications that can scale across ecosystems.

Key metrics to watch include Avail's mainnet launch timeline, the rate of developer adoption for its chain abstraction tools, and the growth of its ecosystem partnerships. Additionally, the performance of the AVAIL token post-vesting will provide insights into market sentiment.

Investment Advice:

1. Long-Term Holders: Consider accumulating AVAIL tokens as the project executes its roadmap, particularly during the vesting period when liquidity is controlled.

2. Diversified Portfolios: Allocate a portion of crypto exposure to modular infrastructure projects like Avail, which are foundational to the next phase of Web3 growth.

3. Risk Management: Monitor regulatory developments in the blockchain space, as interoperability solutions may face scrutiny in jurisdictions with strict compliance frameworks.

Conclusion: A New Era for Web3 Infrastructure

Avail's acquisition of Arcana is more than a strategic merger—it's a bold step toward a unified, user-friendly Web3. By combining modular blockchain architecture with chain abstraction, Avail is addressing the core challenges of the current ecosystem while positioning itself as a leader in the next phase of innovation. For investors, this represents a rare opportunity to back a project that is not only solving today's problems but also laying the groundwork for tomorrow's decentralized future.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

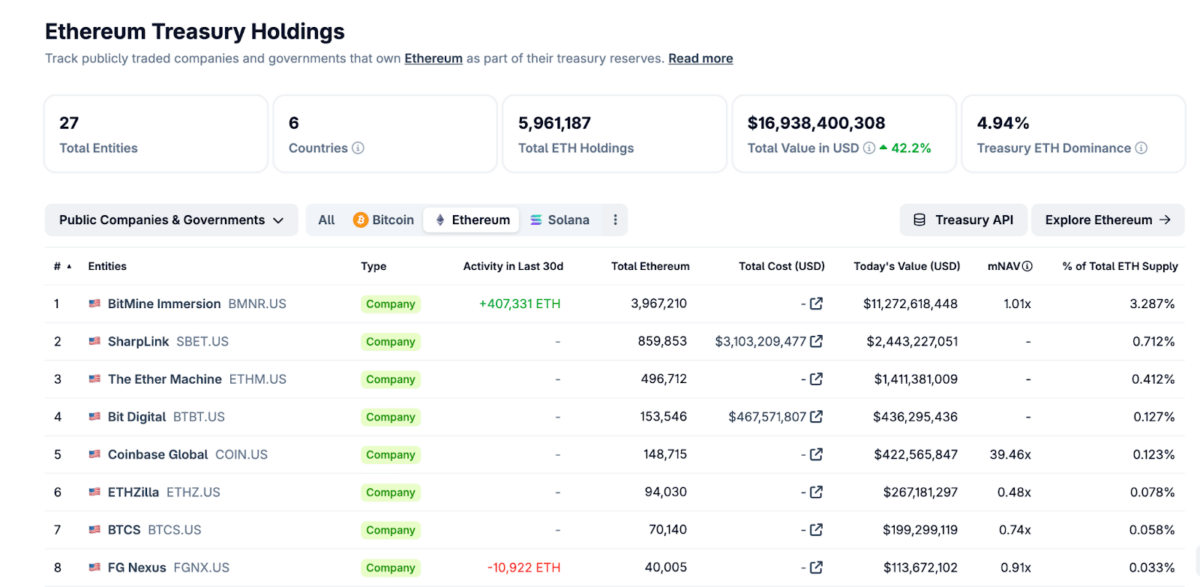

SharpLink Gaming Appoints New CEO as Ethereum Treasury Surpasses 863K ETH

Critical Challenge for Bitcoin Miners in 2026: The AI Temptation

Bhutan says 10,000 bitcoins will be used to build its new administrative city

Analyst to XRP Holders: Hold On to Your Hats. We Wait for a Decision