SharpLink’s Ether treasury now totals 797,704 ETH (about $3.7B) after a $252 million ETH buy and $360.9 million raised via ATM equity; the board also approved a $1.5 billion stock buyback while retaining $200 million cash for additional ETH purchases.

-

Nearly 800,000 ETH: SharpLink holds 797,704 ETH after last week’s $252M purchase.

-

Board approved a $1.5B stock buyback while continuing ETH accumulation and staking activity.

-

New “ETH Concentration” metric exceeds 4.0 ETH per 1,000 diluted shares; staking rewards total 1,799 ETH.

SharpLink Ether treasury now 797,704 ETH (~$3.7B); company approved $1.5B buyback and keeps $200M cash for more ETH purchases — read latest updates.

SharpLink expanded its Ether treasury to 797,704 ETH following a $252 million purchase and approved a $1.5 billion stock buyback, while keeping $200 million cash for further Ethereum purchases.

What is SharpLink’s current Ether treasury position?

SharpLink Ether treasury currently stands at 797,704 ETH, valued at roughly $3.7 billion after a $252 million ETH purchase last week. The company also reported $360.9 million raised via its ATM equity program and retains $200 million in cash earmarked for additional buys.

How did SharpLink expand its ETH holdings last week?

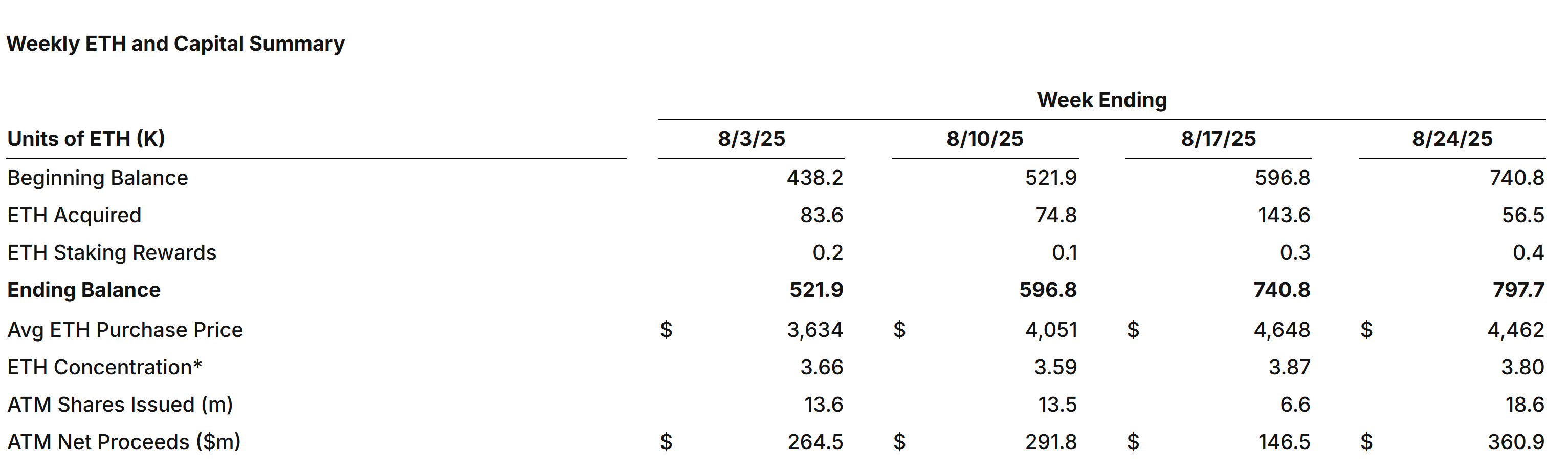

SharpLink Gaming acquired 56,533 ETH at an average price of $4,462 per token in the latest purchase. That buy followed weeks of disciplined accumulation that grew the treasury from about 438,000 ETH to nearly 800,000 ETH since June.

SharpLink’s weekly ETH moves. Source: SharpLink

SharpLink’s weekly ETH moves. Source: SharpLink

Why did SharpLink approve a $1.5 billion stock buyback?

SharpLink’s board approved the $1.5 billion program to enhance shareholder value while maintaining capital deployment into its crypto strategy. Management positions the buyback as complementary to the ETH treasury build-out and broader corporate capital allocation.

What is “ETH Concentration” and why does it matter?

The company’s new metric, ETH Concentration, measures ETH holdings per 1,000 assumed diluted shares outstanding. It now exceeds 4.0, more than doubling since June, and signals how aggressively SharpLink is allocating balance-sheet resources to Ethereum relative to equity dilution.

How much cash and staking rewards does SharpLink report?

SharpLink reports approximately $200 million in cash available for further ETH purchases. Since launching its ETH treasury strategy in June, the firm has earned 1,799 ETH in staking rewards, reflecting active participation in Ethereum staking economics.

Frequently Asked Questions

How did SharpLink fund its latest ETH purchase?

SharpLink raised $360.9 million through an at-the-market (ATM) equity program and used part of those proceeds to acquire 56,533 ETH at an average price of $4,462 per token.

Will SharpLink’s buyback affect its ETH strategy?

Management states the $1.5B buyback complements its ETH treasury approach and aims to balance shareholder returns with continued crypto asset accumulation.

Key Takeaways

- Scale of holdings: SharpLink now controls 797,704 ETH, positioning it among large corporate Ethereum holders.

- Capital allocation: The company raised capital via ATM equity and approved a $1.5B buyback while holding $200M cash for additional ETH purchases.

- Ongoing returns: Staking rewards total 1,799 ETH since the ETH treasury strategy began, contributing to long-term treasury yields.

Conclusion

SharpLink’s Ether treasury build — now 797,704 ETH — and the simultaneous $1.5 billion stock buyback illustrate a dual focus on crypto accumulation and shareholder returns. The company’s new ETH Concentration metric and ongoing staking rewards underscore a deliberate corporate crypto strategy. Watch for further balance-sheet deployment as market opportunities arise.