$1 Billion Bitcoin Accumulated In 24 Hours, Even As Profits Drop To 2-Month Low

$1 billion BTC accumulated in 24 hours as profits hit 2-month low; Bitcoin at $112,425 clings to $112,500 support amid investor accumulation.

Bitcoin is facing turbulent market conditions as its price struggles to recover from $112,500. At the time of writing, BTC is trading at $112,425, hovering just above key support.

Despite ongoing volatility, investor sentiment remains surprisingly positive. What’s fueling this optimism is not price growth, but behavior.

Bitcoin Profits Dip

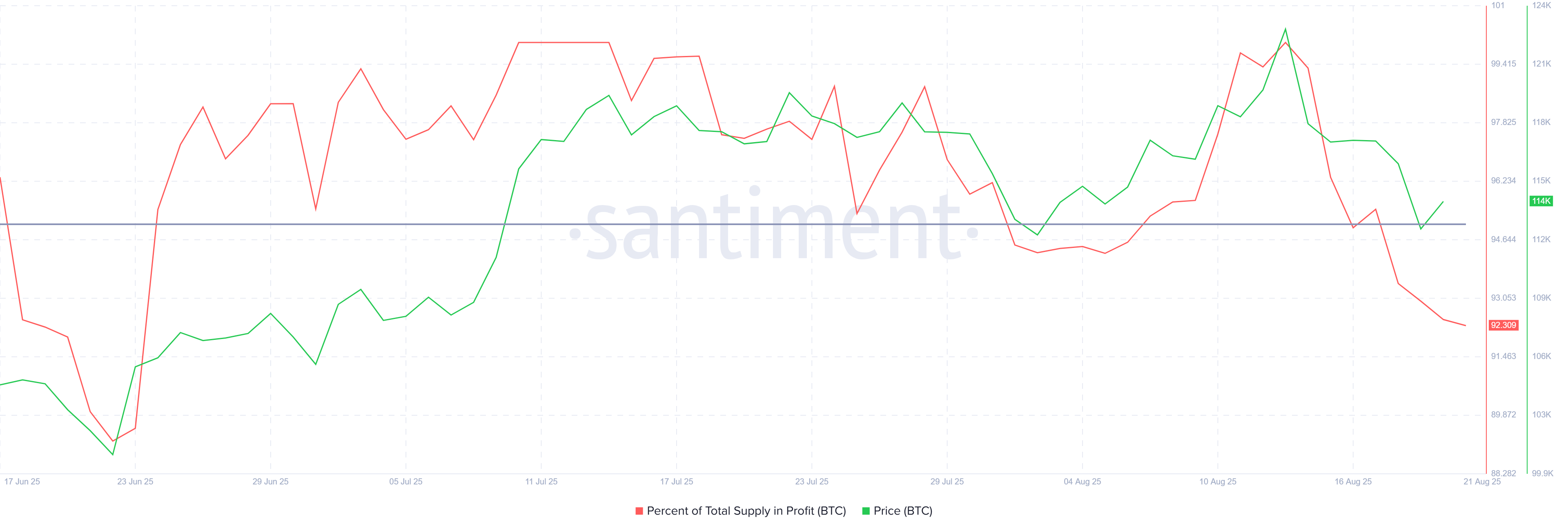

In the span of one week, Bitcoin profits have declined sharply, hitting a two-month low. The price drop has pushed several addresses out of profit, reducing overall realized gains. Such drawdowns often follow overheated conditions, which may have marked a recent market top.

Historically, when 95% of the supply is in profit, a market top is formed, making a reversal likely. Investors tend to take profits at these levels, leading to short-term corrections. This behavior, though predictable, still challenges those expecting continued price surges.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

Bitcoin Supply In Profit. Source:

Bitcoin Supply In Profit. Source:

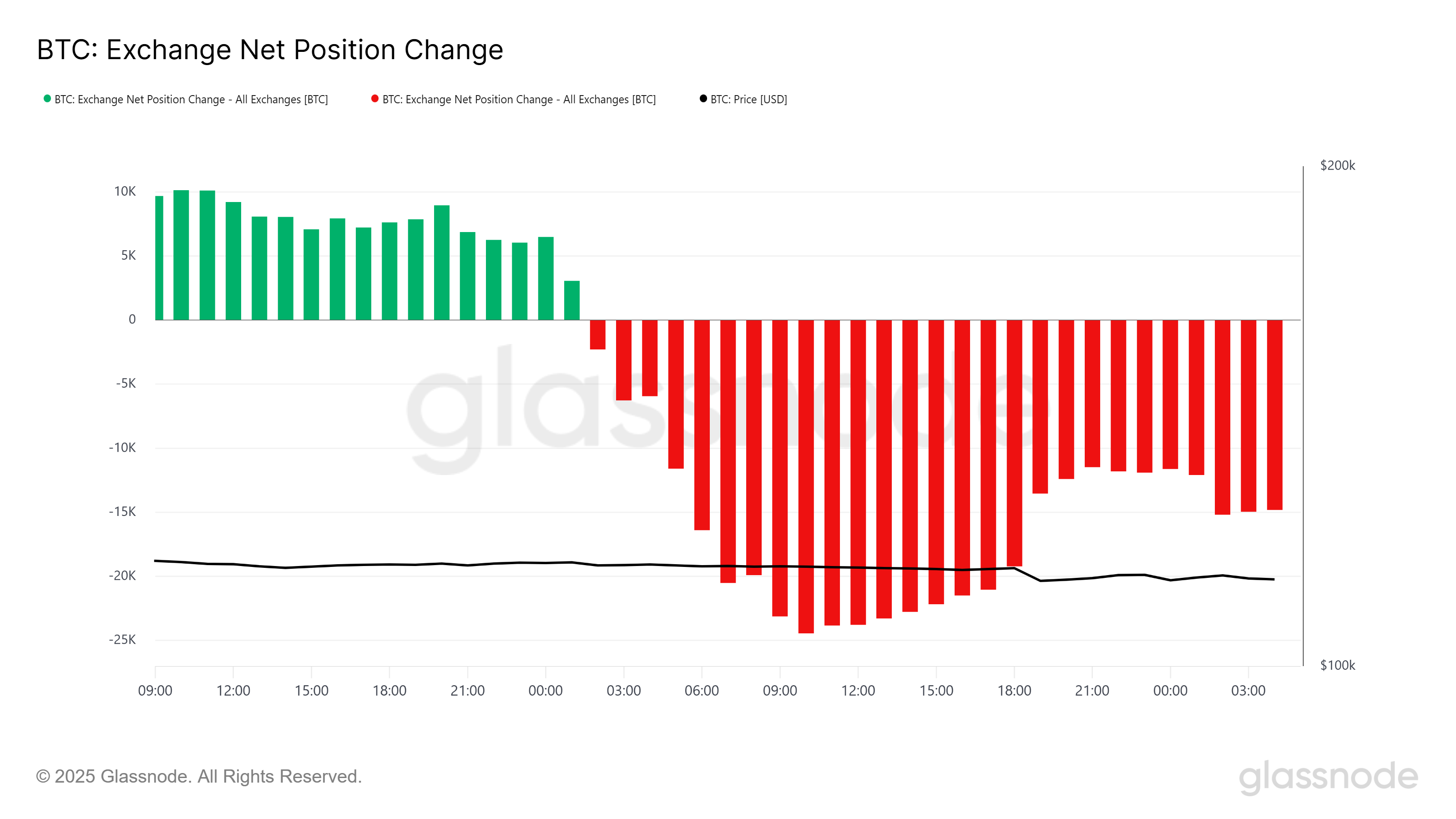

Despite the fall in profitability, investor behavior shows resilience. According to on-chain data, over the last 24 hours, more than 11,890 BTC were withdrawn from exchanges. This trend signals accumulation, with holders anticipating a rebound.

The exchange net position change shows consistent outflows, even as prices drop. Previously active sellers are now returning as buyers, indicating a shift in strategy. These movements suggest confidence in Bitcoin’s long-term value, despite short-term setbacks in profitability.

Bitcoin Exchange Net Position Data. Source:

Bitcoin Exchange Net Position Data. Source:

BTC Price Maintains Support

Bitcoin’s current price is $112,425, clinging to the $112,500 support level. This zone has held strong since early August, offering a key buffer against deeper losses. For now, price action shows consolidation rather than collapse.

Given the current sentiment and net accumulation, Bitcoin could see a bounce to $115,000. If buying pressure increases and macro support builds, BTC might stabilize above this resistance. Alternatively, it may continue to trade sideways between $112,500 and $115,000 until clarity returns.

Bitcoin Price Analysis. Source:

Bitcoin Price Analysis. Source:

However, if accumulation slows and selling resumes, Bitcoin may drop to $110,000. A move this low would mark a near two-month bottom and could expose BTC to increased downside risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC returns to $93,000 after a brief dip to $83,000—what exactly happened?

Economic Truth: AI Drives Growth Alone, Cryptocurrency Becomes a Political Asset

The article analyzes the current economic situation, pointing out that AI is the main driver of GDP growth, while other sectors such as the labor market and household finances are in decline. Market dynamics have become detached from fundamentals, with AI capital expenditure being key to avoiding a recession. The widening wealth gap and energy supply are becoming bottlenecks for AI development. In the future, AI and cryptocurrencies may become the focus of policy adjustments. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still in the process of iterative improvement.

AI unicorn Anthropic accelerates IPO push, taking on OpenAI head-to-head?

Anthropic is accelerating its expansion into the capital markets, initiating collaboration with top law firms, which is seen as an important signal toward going public. The company's valuation is approaching 300 billions USD, and investors are betting it could go public before OpenAI.

Did top universities also get burned? Harvard invested $500 million heavily in bitcoin right before the major plunge

Harvard University's endowment fund significantly increased its holdings in bitcoin ETFs to nearly 500 million USD in the previous quarter. However, in the current quarter, the price of bitcoin subsequently dropped by more than 20%, exposing the fund to significant timing risk.