Date: Sun, Aug 24, 2025 | 06:56 AM GMT

The cryptocurrency market is taking a breather today after a strong rally sparked by Jerome Powell’s comments at the Jackson Hole event, where he hinted at possible rate cuts in September. Ethereum (ETH) surged to a fresh all-time high of $4,878 following the remarks, sparking momentum across the major altcoins , including Jasmycoin (JASMY).

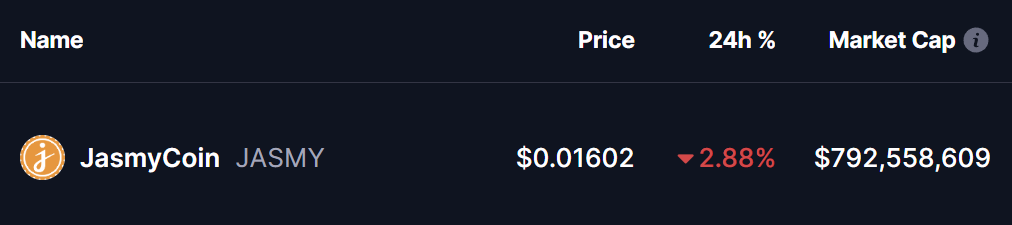

After its initial rally, JASMY is trading slightly in the red today. But beneath the surface, its chart structure suggests that a bullish continuation could be setting up.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Potential Upside

On the daily chart, JASMY is forming a Bearish Butterfly harmonic pattern. Despite its name, this setup often signals an extended bullish leg as the pattern progresses into the CD move toward its completion.

The formation began at point X near $0.02056, dropped to point A, rebounded to B, and then corrected again to point C near $0.01454. Since touching that level, JASMY has begun a recovery and is now trading around $0.01603, showing signs of regaining strength.

Jasmycoin (JASMY) Daily Chart/Coinsprobe (Source: Tradingview)

Jasmycoin (JASMY) Daily Chart/Coinsprobe (Source: Tradingview)

Crucially, JASMY is holding above its 200-day moving average ($0.01577), a key zone that could now act as strong support. If maintained, this level could provide the base for further upside momentum.

What’s Next for JASMY?

If buyers successfully defend the 200-day MA, JASMY could extend higher into the Potential Reversal Zone (PRZ) between $0.02235 (1.272 Fibonacci extension) and $0.02464 (1.618 extension). A move into this zone would mark the likely completion of the Butterfly pattern and deliver an upside of up to 53% from current levels.