The total market cap of major smart contract platforms relies on more than just price metrics. Vital elements for sustained price increases include the total value locked (TVL) in the network and the number of active users. We examine the on-chain metrics of Ethereum (ETH) $4,738 , Solana $204 ( SOL ), and Avalanche ( AVAX ) to determine their current standing in this regard.

Ethereum (ETH)

Following recent developments, ETH reached new all-time highs, although the exchange-traded fund (ETF) flows remained tepid over the weekend. Despite breaking new ground in spot prices, the TVL has not yet returned to its peak at $105 billion, currently standing at $97.6 billion. The recovery is promising, yet sustained growth in the network is crucial. Even so, surpassing the TVL from its previous ATH period is a positive sign.

The network’s fee revenue stands at $1.27 million with net inflows exceeding $200 million in 24 hours. DEX trading volume has weakened compared to Friday, falling to just below $4.5 billion. Leading protocols by TVL within the network include Lido, AAVE, and EigenLayer.

Active addresses exceed 530,000, although the peak of 575,000 from August 6 has not been revisited. Ethereum showcases positive transaction activity with approximately 1.6 million transactions, normalizing figures previously seen as ATH. Thus, the price increase appears supported by on-chain data, suggesting the rally is likely to continue.

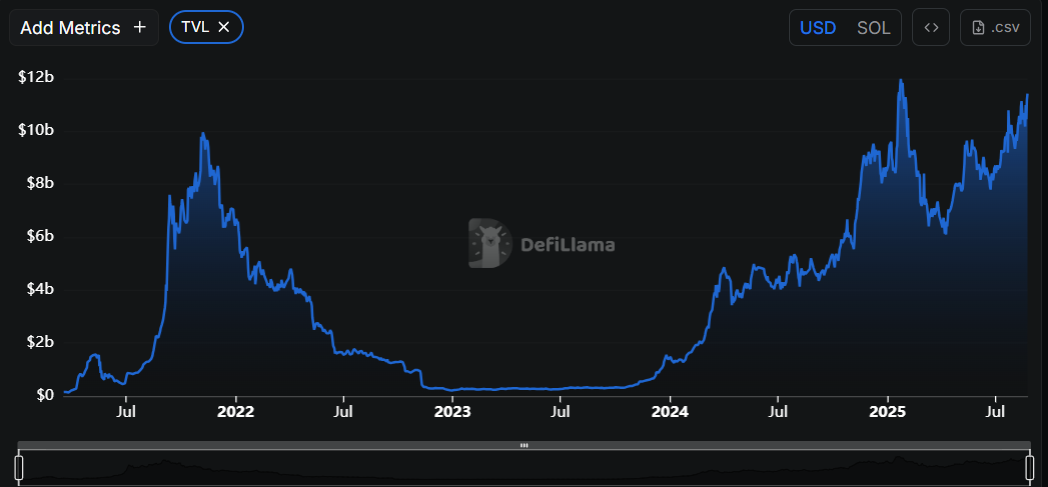

Solana (SOL)

The TVL of Solana had dwindled to $268 million, almost meeting its demise after the FTX collapse but has since rebounded. With a current price exceeding $208, Solana aims for the $300 mark again. Although the TVL has surpassed $11.4 billion, it has not yet reached the January record.

The Solana network has shed the TVL froth from previous meme coin crazes. Its fee revenue nears that of Ethereum, while DEX volume rests at $4 billion, with potential for demand revival on the horizon. Active users exceed 2.3 million, surpassing Ethereum’s due to its cost-efficiency and speed.

Although the number of active addresses has declined since the January hype, Solana’s TVL is bolstered by primary contributors such as Kamino, Jito, Jupiter, Sanctum, and Raydium. Ample room remains for potential future hype, provided Bitcoin $114,658 remains calm.

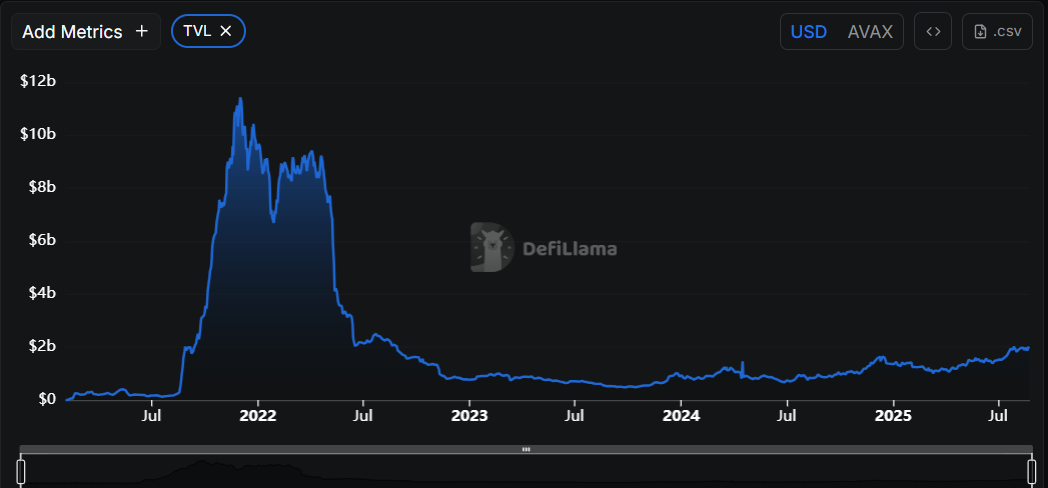

Avalanche (AVAX)

Why is AVAX not experiencing price growth? Avalanche’s TVL still mirrors bear market patterns, resembling only $2 billion compared to over $10 billion at the end of 2021. The network fails to innovate outstanding products within its ecosystem.

With fee revenue at a mere $29,000, transaction costs remain low, yet there exists a distinct gulf between a few thousand dollars and millions. Active addresses are merely around 40,000, and net inflows are capped at $6 million.

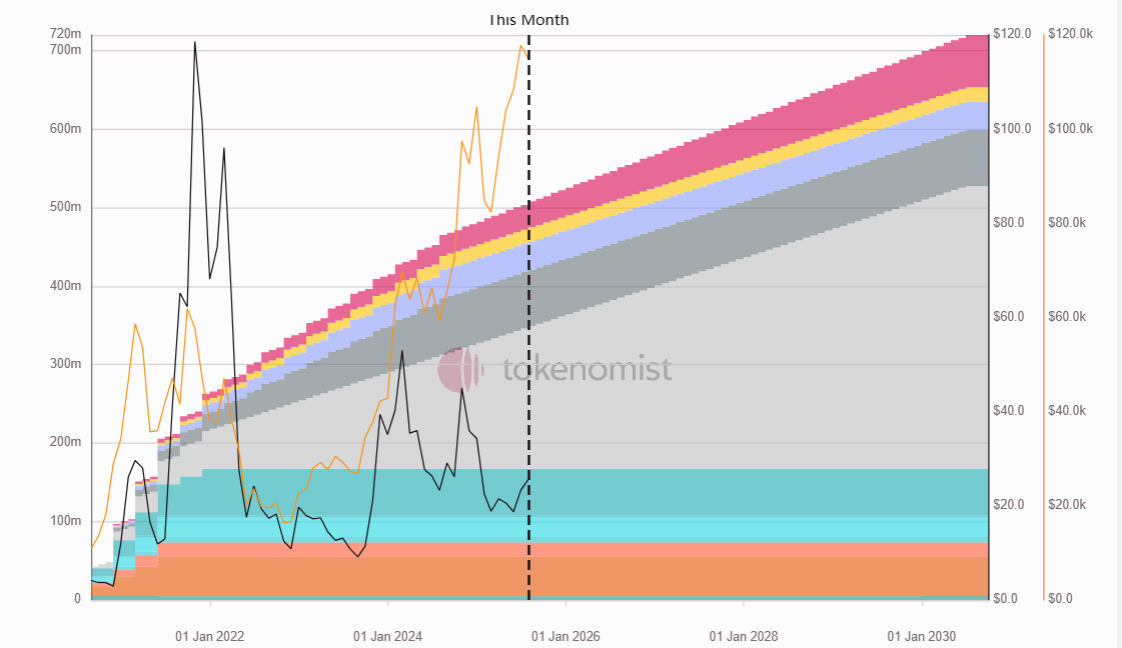

Avalanche’s protocol diversity draws support to inflate TVL figures, but for how much longer remains to be seen. Since 2022, attention has been drawn to the rise in circulating supply, now almost double that of 2021, contributing to fewer interests post-FTX collapse.