Stellar (XLM), a notable player in the cryptocurrency market, experienced significant gains earlier this year; however, it has witnessed marked declines over the past months. In the last month alone, XLM’s price dropped by 16.1%, and in the past week, this decline reached 8.2%. A reduction of 1.7% has been recorded over the past 12 hours as well. Despite a pleasing yearly increase of around 300% for investors, current technical indicators hint at an escalation in selling pressure.

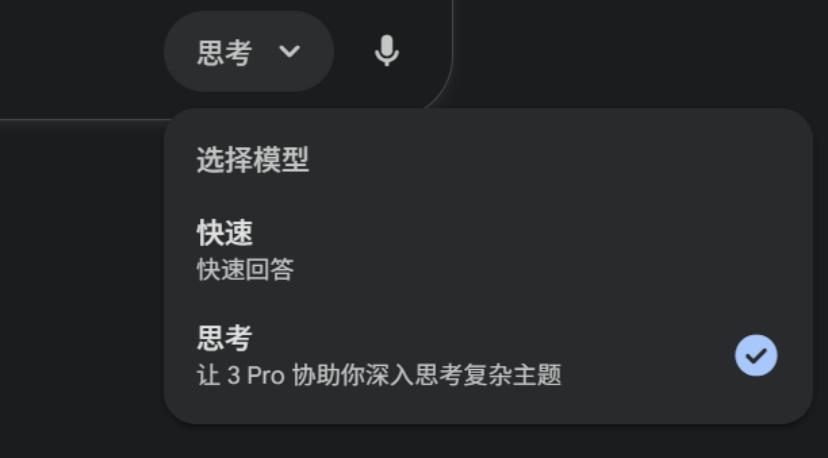

Decline in Futures Trading Enhances Selling Pressure

Initially, the weakening futures market accompanied the negative signals for Stellar. The high volume of open positions can accelerate price fluctuations and lead to sudden spikes. However, the open interest amount, which peaked at 588.53 million dollars on July 18, has dropped by nearly 50% to 306.22 million dollars. This decline suggests a weakened potential for new bullish waves in the market.

The reduction in futures trading volume may cause instant buying and selling to have a more substantial impact on the price. This situation is considered one of the developments that could increase selling pressure in the spot market.

Technical Indicators Support Sellers

Exponential Moving Average (EMA) indicators prominent in technical analysis also pointed to negative signals in the short and medium term. On the 12-hour price chart, the descent of the 20 EMA below the 50 EMA gave sellers an advantage in the short term. Similarly, the potential descent of the 50 EMA below the 200 EMA on the 4-hour chart recalls previous declines and is seen as a factor increasing selling pressure.

The EMA indicator responds more quickly to price movements by increasing the weight given to current prices. The descent of the short-term EMA below the long-term EMA generally indicates that selling pressure is continuing and that the downtrend may persist.

Descending Triangle Formation Poses Risk

On the daily charts, XLM price is moving within a formation known as a descending triangle, generally accepted as a bearish continuation pattern. It is noted that the price is hovering around $0.39, just above the support levels of $0.38 and $0.36.

If these support levels break downward, technical indicators suggest that the price could retreat to the $0.23 level. From current prices, this scenario brings an additional decline risk of approximately 40% into play.

The negative outlook for Stellar can be summarized in three key points: the decline in futures volume, downward crossovers in EMA indicators, and the development of the descending triangle pattern on the daily chart. It is stated that investors need to surpass peak levels again, and prices need to rise above $0.43 to prevent the continuation of selling pressure.

Stellar’s price analysis warns, “If a closing is achieved above $0.43, the upward breakout of the triangle formation may cancel the bearish scenario and initiate a recovery in prices.”