Bitcoin Declines Sharply, YZY Token Faces Volatility

- Bitcoin sees sharp decline, YZY token faces volatility.

- MicroStrategy’s buying reduced, affecting momentum.

- Community speculation influences YZY trading movements.

Bitcoin encountered substantial bearish trends after reaching a record high above $124,000, while Ye’s YZY token exhibited volatile trading on decentralized exchanges, reflecting intense speculative activity.

These events highlight heightened market volatility and changing sentiment among investors, prompting wider implications for cryptocurrency valuations and trading strategies in the current financial climate.

The cryptocurrency market experienced significant shifts as Bitcoin’s sharp decline followed an all-time high above $124,000. Speculative trading activity has also impacted tokens like Ye’s YZY, which saw rapid movements in decentralized exchanges.

Key players in the Bitcoin market, including Michael Saylor’s MicroStrategy, have seen changes in their buying patterns, affecting overall momentum. Meanwhile, the YZY token’s price movements were primarily influenced by community and influencer activities.

The decline in Bitcoin price led to increased market volatility and bearish sentiment. On-chain data reveals that most BTC holders remain in profit, which may limit panic selling. Crypto markets are observing institutional risk-off behaviors.

Financial shifts include diminishing institutional flows, with reports of net-negative flows into exchange-traded products. YZY’s speculative nature is evident with the token’s high trading volumes on major decentralized exchanges.

“August may be remembered as a major trap for Bitcoin,”—citing the fading impact of MicroStrategy’s purchases and structural market weakness emerging since early July. — Miles Deutscher, Market Commentator

Previous Bitcoin volatility episodes highlight its susceptibility to sentiment shifts. The emergence of spot ETFs has not visibly reduced volatility, demonstrating that psychological and macroeconomic factors remain significant.

Historical trends suggest crypto markets are often impacted by interest rate changes and regulatory expectations. Current data indicates potential future market adjustments as investors remain cautious with modest institutional engagement in altcoins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ether gains 10% after Fed's Jackson Hole, ETF holdings top 6.4M ETH

ETH ‘god candle’ emerges amid Fed rate cut hopes: Is $6K Ether next?

ETH data and return of investor risk appetite pave path to $5K Ether price

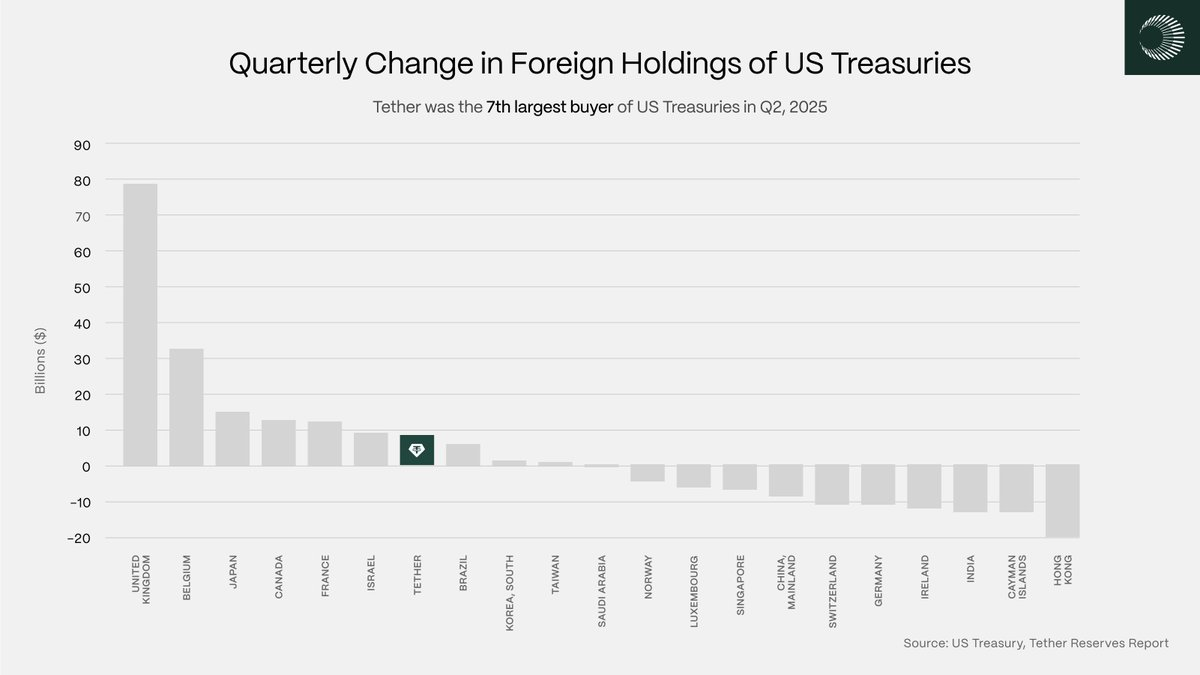

Tether: Quasi-sovereign allocator

Tether’s ascent as a top-10 foreign buyer of Treasurys signals stablecoin issuers are no longer just liquidity users