UK Banks Impose New Crypto Restrictions, Impacting Investors

- UK banks restrict crypto transactions, impacting investors.

- Banking restrictions lead to investment shifts.

- Regulatory tension affects UK crypto market.

UK crypto investors are encountering increased banking restrictions from institutions like Chase UK and NatWest, amid regulatory ambiguity escalating between major banks and the Financial Conduct Authority.

These limitations raise concerns about market competitiveness and consumer access, impacting crypto transaction flows and prompting industry calls for clear stablecoin policies.

UK crypto investors encounter banking hurdles as major banks place new restrictions on crypto transactions. This action follows ongoing regulatory challenges and contributes to a widespread transaction block , hindering access to crypto exchanges.

Chase UK and NatWest have implemented these restrictions, influenced by increasing regulatory scrutiny. The Financial Conduct Authority (FCA) is stepping up its oversight, compelling many crypto firms to seek policy reforms for better access.

40% of UK crypto investors face transaction delays or blocks, prompting some to switch banks or file formal complaints. This situation has led to an uptick in peer-to-peer trading as users explore less restrictive options.

The banking restrictions may result in capital outflows and hinder innovation. Stability concerns loom as GBP stablecoin adoption falters amid unclear regulatory guidelines, impacting both retail and institutional stakeholders.

“We’re in a damaging position where millions of people are effectively being locked out of crypto just because of who they bank with. This kind of behavior is at best anti-consumer, at worst anti-competitive—and it’s not backed by the public.” – Michael Healy, Managing Director, IG Group

Persistent challenges in UK crypto banking could deter investor confidence and stifle market growth. Industry leaders stress the need for a comprehensive stablecoin strategy to ensure competitiveness and address regulatory uncertainties.

New banking actions reflect historical precedents during 2021-2024, where similar restrictions prompted offshore trading and shadow banking channels. Ensuring a balanced regulatory approach could stabilize long-term market dynamics.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

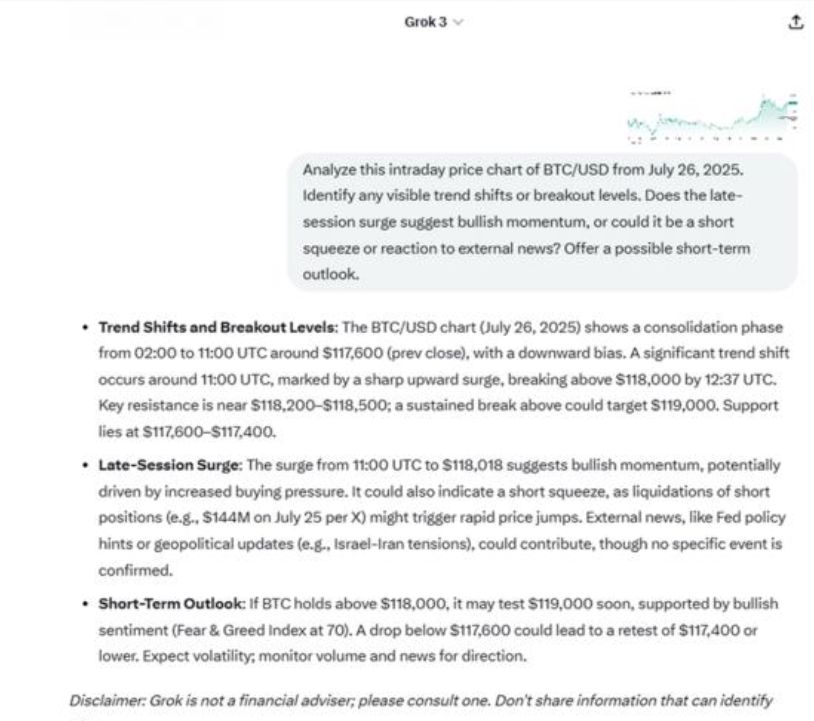

ChatGPT and Grok shift crypto trading to sentiment, now explains “why” behind moves

Share link:In this post: Crypto traders have turned to ChatGPT and Grok for real-time context, sentiment analysis, and narrative framing. In charts, Grok gives a more detailed and information-packed breakdown, pointing out resistance and support levels, liquidation events, and possible outside causes. Experts say that over-reliance on the bots without checking the ideas against standard charts or news causes traders to have false confidence.

Trump’s Fed chair shortlist grows longer than expected

Share link:In this post: President Trump, through Treasury Secretary Scott Bessent, is moving forward with interviews for 11 potential replacements for Fed Chair Jerome Powell, whose term ends in May. The list includes current Fed governors, past officials, and top financial executives. Philip Jefferson, the current vice chair, is also in the running. If selected, he would become the first Black Fed Chair in U.S. history.

Pennsylvania House sees bill to ban public officials from owning Bitcoin and digital assets

Share link:In this post: A new bill (HB1812) introduced in the Pennsylvania House of Representatives could impose jail time on public officials who fail to divest their Bitcoin holdings. Officials who do not comply with the divestment requirement could face civil penalties of up to $50,000, and violations may be classified as felonies. Similar proposals, especially at the federal level, are growing as more officials express discontent with Donald Trump’s relationship with crypto.

Wyoming launches FRNT stablecoin with Visa support across seven blockchains