Bitcoin Leverage Reaches Five-Year High Amid ETF Inflows

- Bitcoin leverage hits a five-year peak.

- Market volatility and liquidation risks are rising.

- Institutional inflows continue in Bitcoin and Ethereum ETFs.

In August 2025, the Bitcoin market is demonstrating late-cycle patterns with futures leverage reaching a five-year high, indicating potential volatility and risk of liquidations.

This situation highlights elevated market risks, balanced by strong institutional inflows into Bitcoin and Ethereum ETFs, suggesting a nearing cyclical peak.

Market Dynamics

The Bitcoin market is experiencing late-cycle patterns in August 2025, with leverage in futures reaching a five-year high. This trend indicates heightened risks of volatility and liquidations, as institutional ETF inflows remain robust.

Axel Adler Jr, Analyst, CryptoQuant, remarked:

“In August 2025, the estimated leverage ratio (ELR) for Bitcoin futures saw a 30-day change that reached the highest level in the past five years, exceeding +0.4. This … could lead to increased market volatility and a heightened risk of severe liquidations.”

Key players such as Bitcoin futures analysts and institutions like BlackRock underscore this trend. They have been pivotal in shifting Bitcoin and Ethereum positions through strategic movements, leading to substantial capital reallocations.

Institutional Influx

The market impact is notably significant, with potential risks affecting multiple sectors. Institutional inflows are combating volatility but further indicate a peak in market cycles. Leveraged positions among investors amplify potential instability.

With financial implications in mind, rising leverage ratios could lead to severe liquidations. Meanwhile, ETF inflows suggest sustained institutional confidence in major cryptocurrencies, despite the cyclical peaks.

Future Outlook

Historical trends reveal similarities with previous euphoric phases, posing questions about future impacts. Whales continue to optimize positions strategically, indicative of market repositioning.

Financial insights highlight potential outcomes, including regulatory responses and technological adaptations. Leveraged trends historically lead to extended volatility, while ETF inflows might continue supporting investment appetite. Market participants are advised to cautiously navigate these developments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

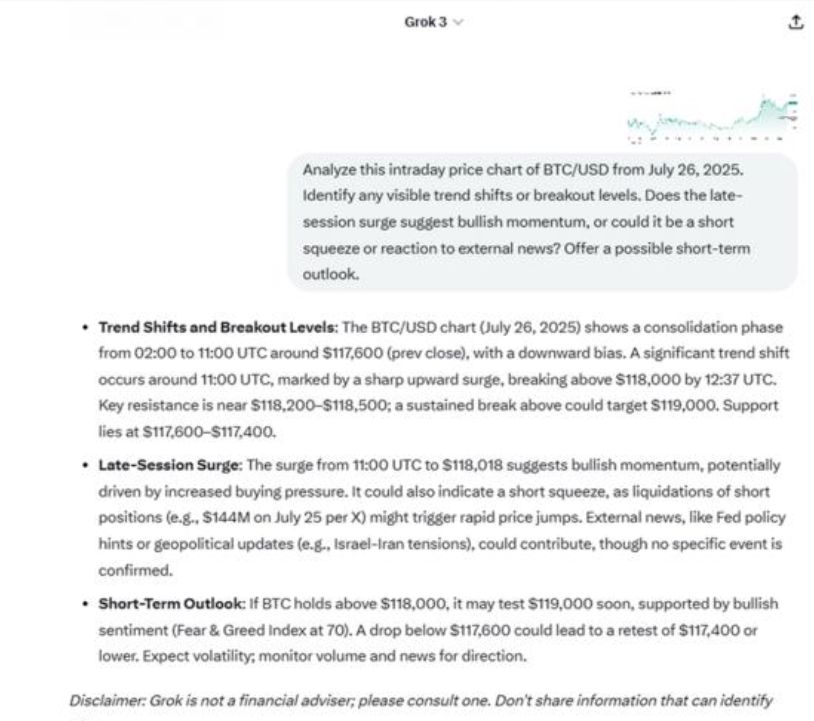

ChatGPT and Grok shift crypto trading to sentiment, now explains “why” behind moves

Share link:In this post: Crypto traders have turned to ChatGPT and Grok for real-time context, sentiment analysis, and narrative framing. In charts, Grok gives a more detailed and information-packed breakdown, pointing out resistance and support levels, liquidation events, and possible outside causes. Experts say that over-reliance on the bots without checking the ideas against standard charts or news causes traders to have false confidence.

Trump’s Fed chair shortlist grows longer than expected

Share link:In this post: President Trump, through Treasury Secretary Scott Bessent, is moving forward with interviews for 11 potential replacements for Fed Chair Jerome Powell, whose term ends in May. The list includes current Fed governors, past officials, and top financial executives. Philip Jefferson, the current vice chair, is also in the running. If selected, he would become the first Black Fed Chair in U.S. history.

Pennsylvania House sees bill to ban public officials from owning Bitcoin and digital assets

Share link:In this post: A new bill (HB1812) introduced in the Pennsylvania House of Representatives could impose jail time on public officials who fail to divest their Bitcoin holdings. Officials who do not comply with the divestment requirement could face civil penalties of up to $50,000, and violations may be classified as felonies. Similar proposals, especially at the federal level, are growing as more officials express discontent with Donald Trump’s relationship with crypto.

Wyoming launches FRNT stablecoin with Visa support across seven blockchains