US Judge Unfreezes $57 Million in USDC Linked to Libra Case

- Court Releases $57 Million in Frozen USDC

- Libra Token Scandal Involved Global Investor Losses

- Davis and Chow are not seen as a risk of concealment

A U.S. federal court has authorized the release of $57,6 million in USDC that had been frozen since May amid the lawsuit over the collapse of the Libra token. The decision was made by Judge Jennifer L. Rochon of the Southern District of New York, who determined that defendants Hayden Davis and Ben Chow posed no risk of transferring or concealing the assets.

The funds were held in two digital wallets linked to Davis, the promoter of the Libra memecoin, and Chow, the former CEO of the Meteora exchange. They had been frozen as part of a class action lawsuit seeking more than $100 million in damages for losses suffered by investors in the project's collapse.

According to the judge , Davis and Chow respected all the rules imposed during the process and did not attempt to manipulate or move the blocked resources.

“It is clear that there would be monetary compensation to compensate the class”

Rochon wrote, highlighting that the plaintiffs were unable to prove “irreparable damage” that would justify maintaining the freeze.

The judge also emphasized that the defendants did not act as "evasive actors," a decisive factor in the release of the funds. However, she noted that the case is still in its early stages and expressed skepticism about the class action's chances of success, without ruling out the possibility of future dismissal.

Chow's attorney, Samson Enzer, called the allegations against his client "untested and without merit," indicating that the defense may seek to have the case dismissed.

The Libra token, initially promoted by Davis's Kelsier Labs with Meteora infrastructure, reached a market value of over $4,56 billion in February of this year. Enthusiasm grew after Argentine President Javier Milei expressed support for the asset on social media, pushing the coin's price above $4 at launch.

However, in less than 24 hours, the token lost nearly 97% of its value, triggering one of the biggest recent scandals in the cryptocurrency sector. The episode caused global losses and led to ethics investigations into Milei, in addition to damaging Davis's reputation and forcing Chow's resignation from Meteora.

The court's decision to release the USDC gives the defendants some leeway while investors await answers about possible compensation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Wall Street’s Calculation: What Does $500 Million Buy in Ripple?

Ripple's story has turned into a classic financial tale: about assets, valuation, and liquidity management.

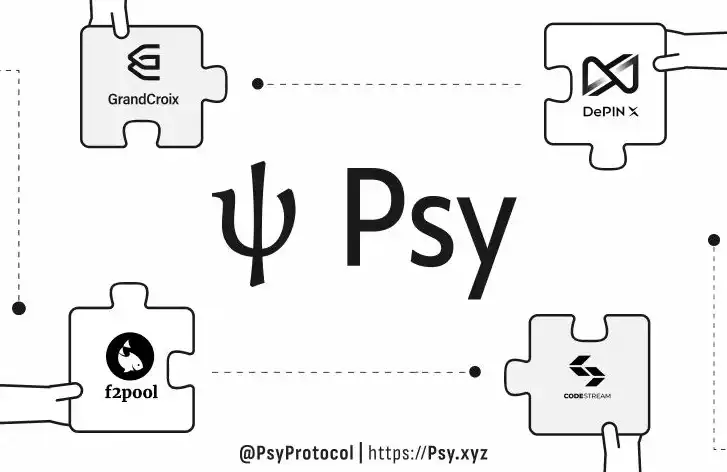

Leading mining pools and hash power ecosystems join Psy Protocol testnet to jointly build a new generation PoW smart contract platform

Leading mining pools and computing power ecosystems such as F2Pool and DePIN X Capital have joined a PoW platform designed for the agent economy, which is capable of processing over one million transactions per second.

Polkadot 2025 Q2 Treasury Report: $27.6 million spent, $106 million remaining!

What happened? Polkadot gaming chain Mythos ranks among the top three globally in transaction fees!