Bitcoin Price About To CRASH as Fed Pushes Back on September Rate Cut

Fed Pushes Back on September Rate Cut

A senior U.S. Federal Reserve official made it clear: “With current data, there’s no case for a September rate cut.” Inflation remains sticky, and the labor market is still resilient, giving the Fed little reason to ease up.

For crypto , that’s bad news. A delayed cut means tight liquidity stays longer, restricting the flow of cheap capital into risk assets. Historically, crypto thrives when monetary policy loosens. Instead, traders now face months of higher-for-longer rates, which could weigh on Bitcoin and altcoins alike.

Bitcoin Price Signals Upcoming CRASH – A Warning Sign

The below chart shows two eerily similar Bitcoin topping formations. The first one in late 2024 ended with a sharp multi-month correction. Now in mid-2025, $ BTC price is showing the same pattern again: repeated rejections at the highs, followed by choppy downward action.

BTC/USD 1-day chart - TradingView

At current prices around $112K–113K, $Bitcoin risks breaking down further. If this fractal repeats, another correction could be on the way—potentially wiping out a big chunk of recent gains.

What It Means for Crypto Investors

The mix of a hawkish Fed and bearish technicals makes for a dangerous setup. Without a rate cut to inject new liquidity, crypto markets could continue to struggle, and Bitcoin may be on the verge of a steep retracement.

Key levels to watch:

- $110K – crucial near-term support. A break below could trigger acceleration lower.

- $125K – the resistance bulls need to reclaim to escape the topping pattern.

Unless the macro picture softens, Bitcoin looks set for more downside pressure in the coming weeks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

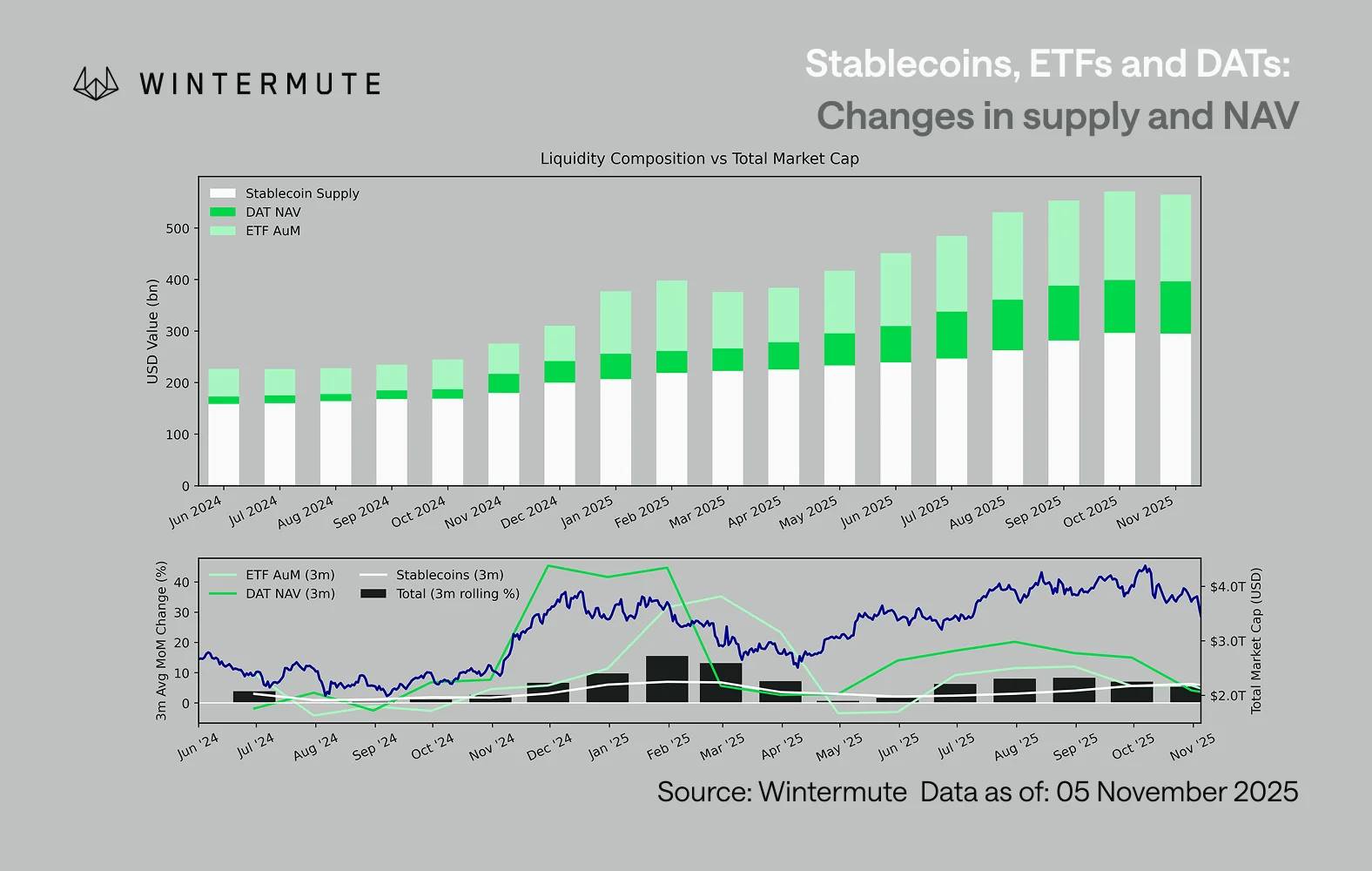

Wintermute: Liquidity, the Lifeline of the Crypto Industry, Is in Crisis

Liquidity determines every cryptocurrency cycle.

Ray Dalio's latest post: This time is different, the Federal Reserve is fueling a bubble

Because the fiscal side of government policy is now highly stimulative, quantitative easing will effectively monetize government debt, rather than simply reinjecting liquidity into the private system.

Famous Bitcoin bull "Cathie Wood" lowers target price due to the "replacement" by stablecoins

Cathie Wood has lowered her 2030 bitcoin bull market target price by about $300,000, after previously predicting it could reach $1.5 million.

Crypto: Balancer publishes a preliminary report on the hack that targeted it