Kanye West YZY memecoin hits $3B, but falls after insider concerns

Rapper Kanye West’s newly launched YZY token on Solana rocketed up to $3 billion in value just 40 minutes after its launch, but concerns over insider sales dented a large portion of the gains.

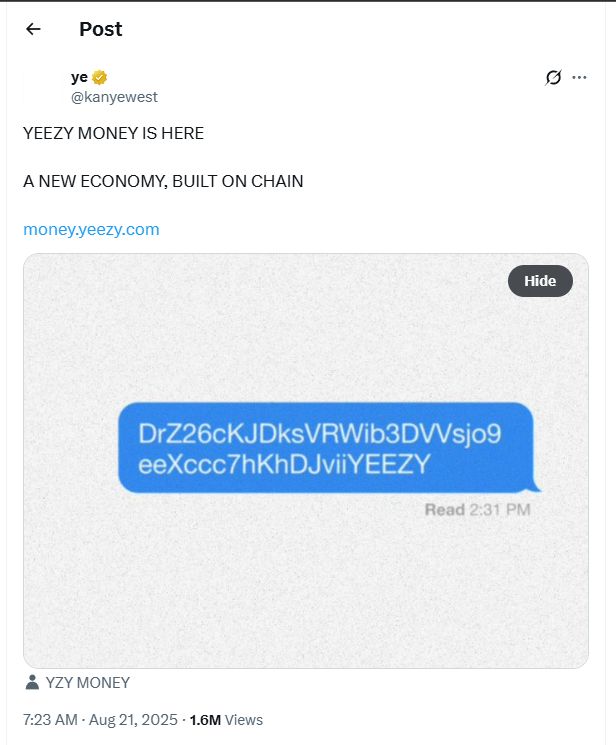

In a Thursday X post , West, who officially goes by Ye, shared the contract address along with the website for Yeezy Money, which he describes as “A NEW ECONOMY, BUILT ON CHAIN.”

The website describes YZY as a currency to power transactions within “YZY MONEY,” a ”financial system built on crypto rails.”

In a later post , West was seen saying, “the official YZY token just dropped.”

Source: Kanye West

Source: Kanye West

Within 40 minutes, the YZY token hit a market capitalization of $3 billion , but it fell to about $1.05 billion at the time of writing, according to data analytics platform Nansen.

In the website’s fine print, it is mentioned that the token is not available to entities in restricted jurisdictions. It also warns users about the risks associated with digital assets, including a “potential for complete loss.”

One user shared a screenshot where West had warned users in February that he was asked to promote a fake currency for $2 million, which would have involved him faking his account being hacked after promoting the token.

At the time of writing, West’s net worth was estimated at $400 million, according to Forbes.

Observers point to alleged insider trading

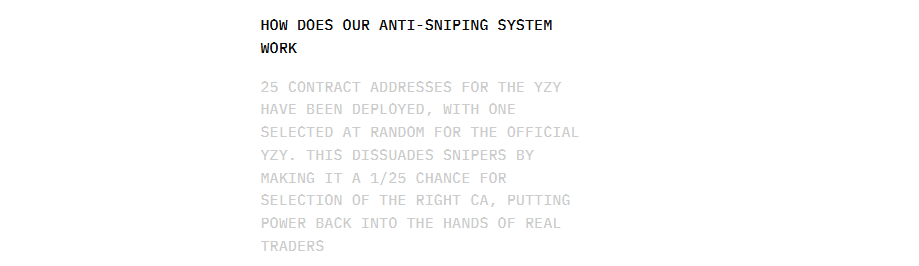

The Yeezy Money website said that it deployed 25 contract addresses for the YZY token, with one selected at random to be the official token in order to discourage token snipers.

Source: Yeezy Money

Source: Yeezy Money

Still, the YZY token launch has raised suspicions over insider trading, similar to other celebrity memecoins.

Onchain analytics platform Lookonchain said that only YZY tokens were added to the liquidity pool, which meant that the developers could sell the tokens at any time they liked by modifying the liquidity of the pool.

Conor Grogan, a director at Coinbase, pointed out that at least 94% of the token supply was held by insiders, with one single multisig wallet holding 87% of the supply before it was distributed to multiple wallets.

One user who allegedly had insider knowledge mistakenly bought the wrong token, which caused them to lose $710,000 ; however, they recovered their losses by later purchasing the correct token, Lookonchain said.

Another user profited $3.4 million , paying $24,000 in priority fees to the Solana network to ensure the transaction was processed as fast as possible.

Onchain Lens noted that an entity that bought the token early on sat at a profit of $6 million when the token peaked.

Crypto whales, traders are still buying

Despite the concerns, several well-known crypto traders said they bought the token.

Leverage trader James Wynn said that whales would likely be attracted to the token due to its liquidity and volume.

Wynn said that it is a short-term play, and that he is looking to double or quadruple the amount he has poured into the token. The trader cited President Donald Trump’s eponymous memecoin that quadrupled in 28 hours as his reason behind the investment.

“Aped $YZY on a 60% pull back. $TRUMP ran from $4bn to $15bn in 28 hours. 4x” Wynn mentioned.

BitMEX co-founder Arthur Hayes also appears to have bought the token.

Source: Arthur Hayes

Source: Arthur Hayes

Celebrity tokens have had a mixed track record

Celebrity mememcoins got a lot of attention this year, with Argentina’s President Javier Milei’s support of the LIBRA token seen as one of the more controversial.

In February, the Argentine president shared the LIBRA token on X , which caused the token to soar to a market capitalization of $4 billion; however, he deleted the post hours after facing backlash from the community, which brought the token price crashing down.

The incident caused outrage, with many calling for strict restrictions to be placed on memecoins promoted by politicians .

Earlier this year, US President Donald Trump launched the TRUMP memecoin ahead of his presidential inauguration .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

XRP price slips despite Ripple’s bullish Swell announcements: Is $2 next?

Four reasons Ether did not fall below $3K, and probably won’t

Bitcoin crisscrosses $100K as BTC price ‘bottoming phase’ begins

Price predictions 11/7: BTC, ETH, BNB, XRP, SOL, DOGE, ADA, HYPE, LINK, ZEC