LIBRA Meme Coin Rallies After US Federal Judge’s Decision

LIBRA promoters Hayden Davis and Ben Chow had $57.5 million unfrozen by a US judge, causing a brief spike in the coin, while the lawsuit may ultimately fail.

A US Federal Judge unfroze $57.5 million from LIBRA promoters Hayden Davis and Ben Chow, prompting the meme coin to briefly spike. Judge Rochon warned that the lawsuit against these men may fail altogether.

Although all the details have yet to surface, the crypto community reacted with incredulity. Since President Milei dissolved the Task Force investigating him, none of the meme coin’s promoters may face lasting consequences.

Huge Upset in LIBRA Lawsuit

A few months ago, the LIBRA meme coin turned into a tremendous scandal in Argentina, as rug pull accusations implicated President Milei and several cabinet members.

Compared to this, Burwick Law’s suit against two promoters, Hayden Davis and Ben Chow, was a sideshow, but there’s been an unexpected twist.

According to court reporting, a US federal judge lifted an asset freeze on the meme coin promoters’ assets, throwing the LIBRA case into disarray.

In May, Burwick Law’s class-action suit became a federal case, and the courts froze $57.5 million in USDC. Davis and Chow will now regain access to these funds.

To say this is unexpected is an understatement. Ben Chow had to resign from Meteora over the scandal, and global arrest warrants targeted Hayden Davis. However, presiding Judge Jennifer L. Rochon warned that Burwick’s lawsuit may fail altogether.

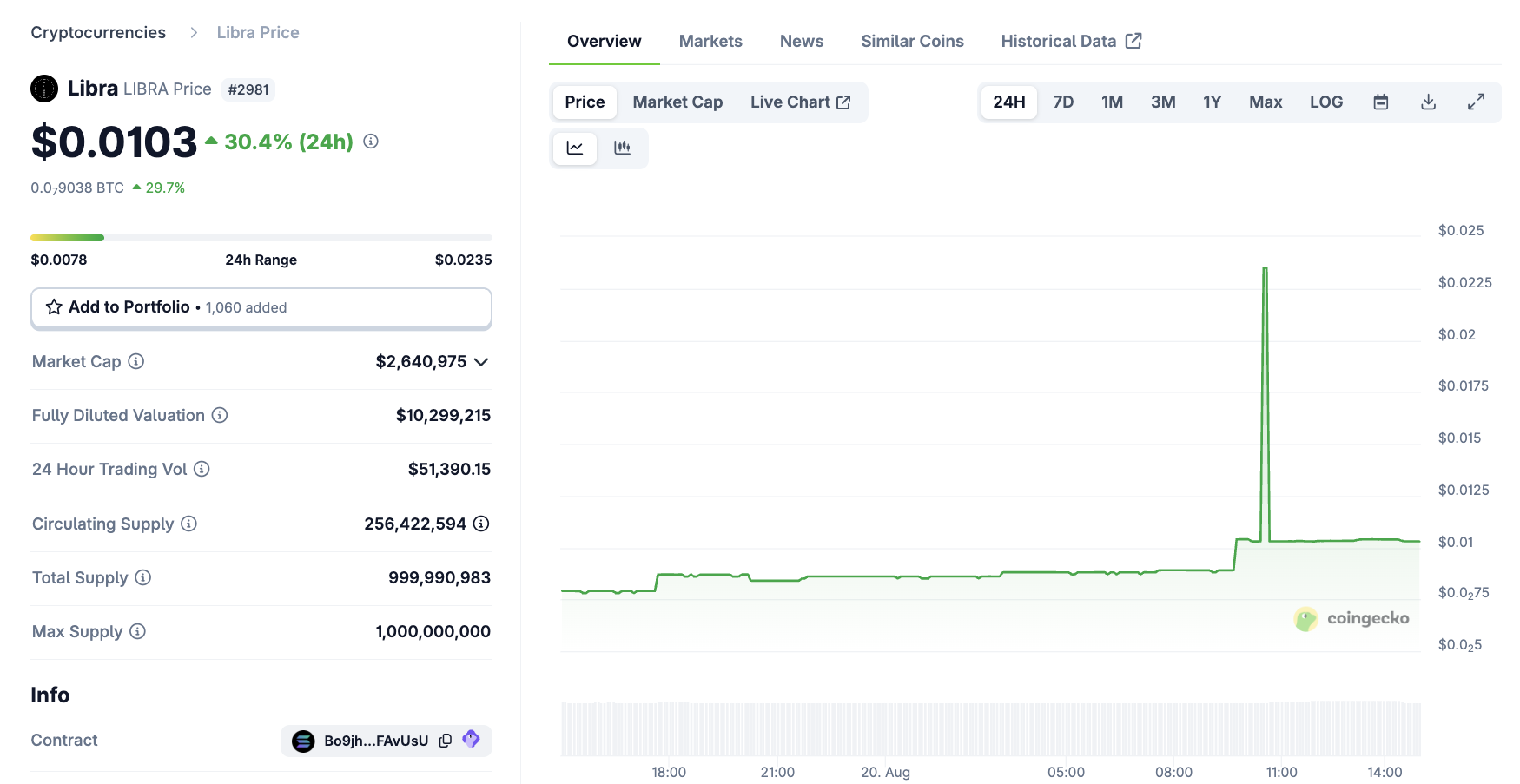

This caused LIBRA to briefly spike, but it soon crashed again:

LIBRA Price Performance. Source:

LIBRA Price Performance. Source:

“Crime is Legal Now” and Crypto Cynicism

This case is still ongoing, but a few things might explain this setback. The LIBRA scandal sent shockwaves through Argentina’s crypto community, creating huge institutional pressure, but President Milei apparently evaded consequences.

Compared to this effort, Burwick’s class-action civil suit was comparably tiny. Why should it succeed when the Argentinian judicial system seemingly failed?

Still, the crypto community has been displeased, especially in light of a guilty verdict for Roman Storm. The phrase “crime is legal now” has been reiterated as observers watched in disbelief:

Two weeks after Roman Storm was found guilty for simply building Tornado Cash, Hayden Davis and Ben Chow are one step closer to walking away as free menAbsolutely disgusting behavior from the judicial system

— Squiffs (@Squiffs_) August 20, 2025

In other words, the LIBRA scandal could end with no real consequences for any of the perpetrators. The battle hasn’t been resolved, and more relevant details may come to light.

Still, incidents like this can contribute to a culture of cynicism in the crypto community. Such a pessimistic attitude could negatively impact future investments, especially regarding meme coins.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.