XRP Price Drops 11% as Holders Appear Stuck Between Hope and Reality

XRP drops 10% over the past week, with investors stuck in the belief–denial zone. While futures market participants remain bullish, rising volatility and sell-offs could push XRP toward $2.63 or a rebound to $3.22.

Ripple’s XRP has shed roughly 10% of its value in the past week as sell-offs intensify across the broader crypto market.

While the token’s rally to an all-time high of $3.66 during July’s market boom left many holders in profit, rising volatility is beginning to test investor sentiment. What does this mean for token holders?

XRP Traders Cling to Gains Despite Losses

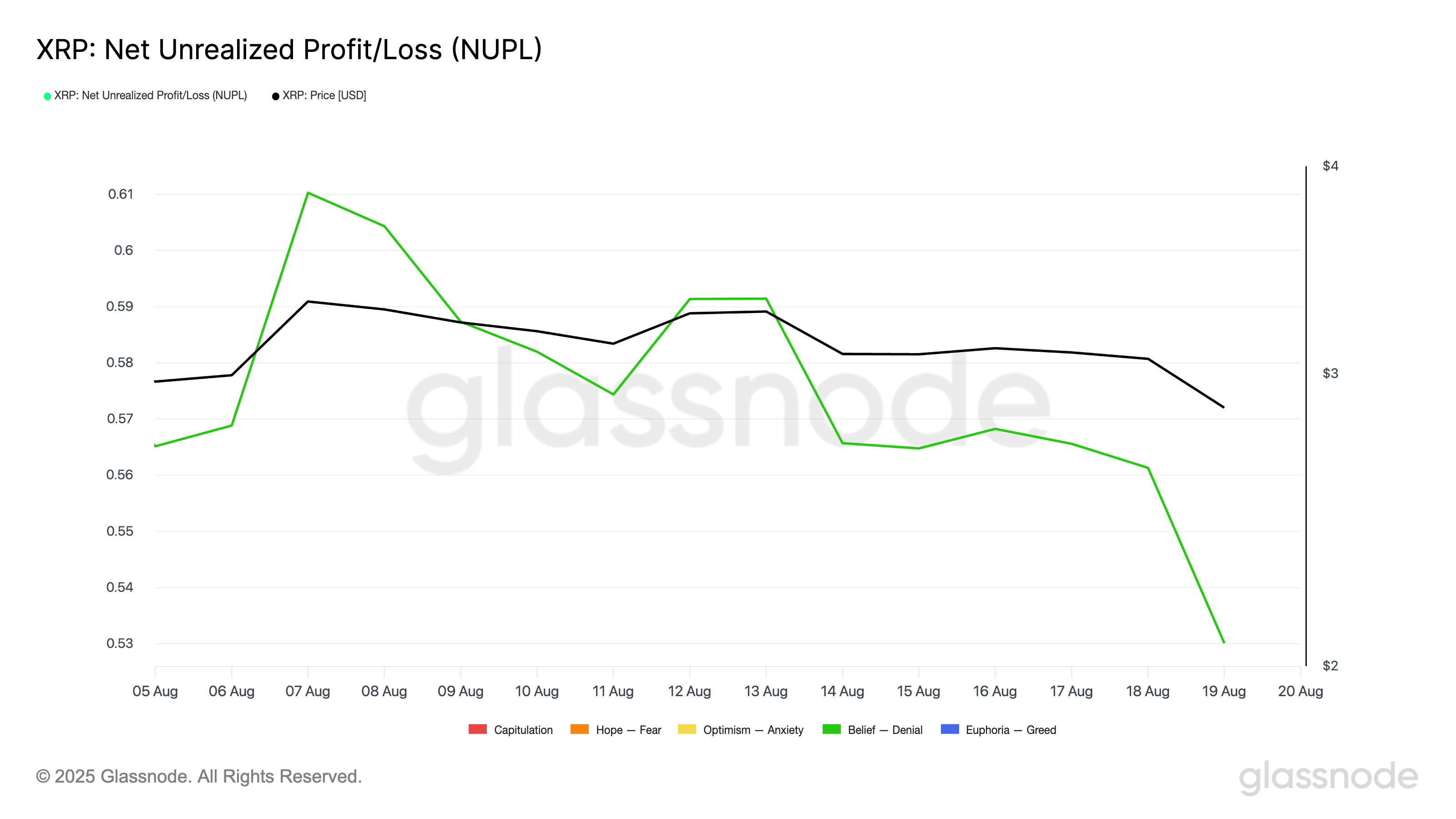

According to Glassnode, readings from XRP’s Net Unrealized Profit/Loss (NUPL) metric show that the market is currently in the belief–denial zone, where investors hold on to gains despite mounting losses.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

XRP Net Unrealized Profit/Loss. Source:

Glassnode

XRP Net Unrealized Profit/Loss. Source:

Glassnode

The NUPL metric measures the difference between unrealized profits (when holders are still in the green) and unrealized losses (when positions are underwater).

Per the on-chain data provider, the belief–denial zone reflects a transitional phase in market sentiment. In the belief stage, investors are confident, most positions are profitable, and optimism dominates. In the denial stage, prices begin to slip, but holders refuse to acknowledge the downturn, hoping for a rebound.

With XRP’s NUPL in this zone and the token having dropped 11% over the past week, holders’ confidence is starting to waver. Nevertheless, many continue to cling to hope, denying the possibility of a deeper downturn.

XRP Futures Reveal Bullish Bias Despite Price Pressure

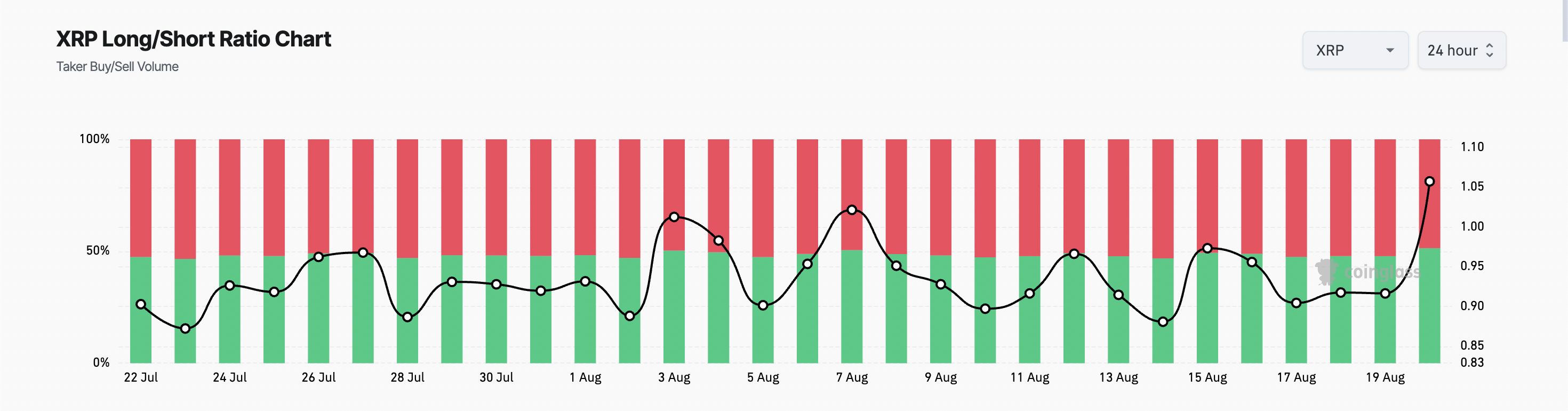

XRP’s rising long/short ratio highlights the optimism among futures market participants, who continue to bet on a price rebound despite recent losses.

According to CoinGlass, the ratio currently sits at a 30-day high of 1.05, showing that more traders take long positions than short ones.

XRP Long/Short Ratio. Source:

Coinglass

XRP Long/Short Ratio. Source:

Coinglass

The long/short ratio tracks the balance between traders betting on price increases (longs) versus those betting on declines (shorts). When the ratio is above 1, it indicates that long positions dominate, signaling bullish sentiment; conversely, a ratio below 1 suggests that short positions are heavier, pointing to bearish expectations.

XRP’s elevated ratio shows that traders remain hopeful for a rebound, even as market volatility and selling pressure continue to rise.

XRP at a Tipping Point

At press time, XRP trades at $2.887. If bullish bets climb and market sentiment gradually flips positive, the token could reach $3.222.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

On the other hand, if selloffs persist and bearish pressure increases, XRP could continue its decline and fall toward $2.637.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

TOTAL3 Holds Strong: October Confirms Bullish Setup for these 5 Cryptocoins

Multi-Year Breakout Structure Returns: Altcoin Market Eyes 50x Potential — Top 5 Alts to Risk Trading In as October Ends

XRP Holds Strong Above 2021 Highs as 7-Year Breakout Confirms Major Bullish Shift

Bitcoin Sees First Red October Since 2018

Bitcoin closed October 2025 in the red for the first time since 2018 — but is it a reason to worry?Bitcoin’s First Red October in 7 Years: A Warning or a Blip?What’s Behind October’s Decline?Zooming Out: No Need to Panic