AMTD Group Launches Crypto Equity Swap Program, Boosting Investor Access to Digital Assets

Hong Kong-listed financial services group AMTD is inviting investors to participate in its innovative equity swap program by exchanging their cryptocurrency holdings.

Hong Kong-listed financial services group AMTD is inviting investors to participate in its innovative equity swap program by exchanging their cryptocurrency holdings.

This program aims to bridge traditional equity markets and the growing digital asset space, allowing crypto investors to convert assets like Bitcoin and Ethereum into equity stakes in AMTD.

source:

Google

source:

Google

The offering, launched by AMTD’s flagship listed entity AMTD Idea Group, allows investors to provide supported cryptocurrencies in exchange for company shares at a fixed ratio. The firm promotes this program as a means to tap into liquidity opportunities by harnessing crypto assets, potentially attracting a broader investor base.

AMTD’s initiative arrives amid increasing mainstream adoption of cryptocurrencies in corporate finance and investment ventures. By integrating crypto assets into equity transactions, the program targets expanding access and diversifying investment avenues amid volatile digital markets.

The swap program highlights AMTD’s strategy to embrace blockchain-driven financial innovation while maintaining regulatory compliance. Participants must meet eligibility criteria and comply with the company’s terms to engage in the swap, ensuring thorough oversight.

This step exemplifies the trend of publicly-listed firms incorporating crypto as a legitimate financial instrument to attract and retain investors amid evolving market dynamics. With AMTD’s sizable presence in Asian markets and established financial credentials, the program may encourage similar hybrid investment models in the region.

Industry watchers view AMTD’s equity swap program as an important move toward mainstreaming cryptocurrency within established financial frameworks. It reflects a growing shift where traditional firms recognize digital assets as complementary investment vehicles rather than alternatives or risks.

As investor interest in decentralized finance and digital asset economies grows, corporate mechanisms like AMTD’s crypto equity swap could become vital in bridging the divide between conventional and crypto markets, ensuring smoother participation and increased liquidity.

In another development, Dutch cryptocurrency service provider Amdax is set to establish a Bitcoin-focused treasury company, AMBTS B.V., with plans to list on Amsterdam’s Euronext stock exchange. The move signals a growing trend among European firms following in the footsteps of U.S. companies by incorporating Bitcoin into corporate treasury strategies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

BTC price bull market lost? 5 things to know in Bitcoin this week

1inch launches Aqua: the first shared liquidity protocol, now open to developers

The developer version of Aqua is now online, offering the Aqua SDK, libraries, and documentation, allowing developers to integrate the new strategy models ahead of time.

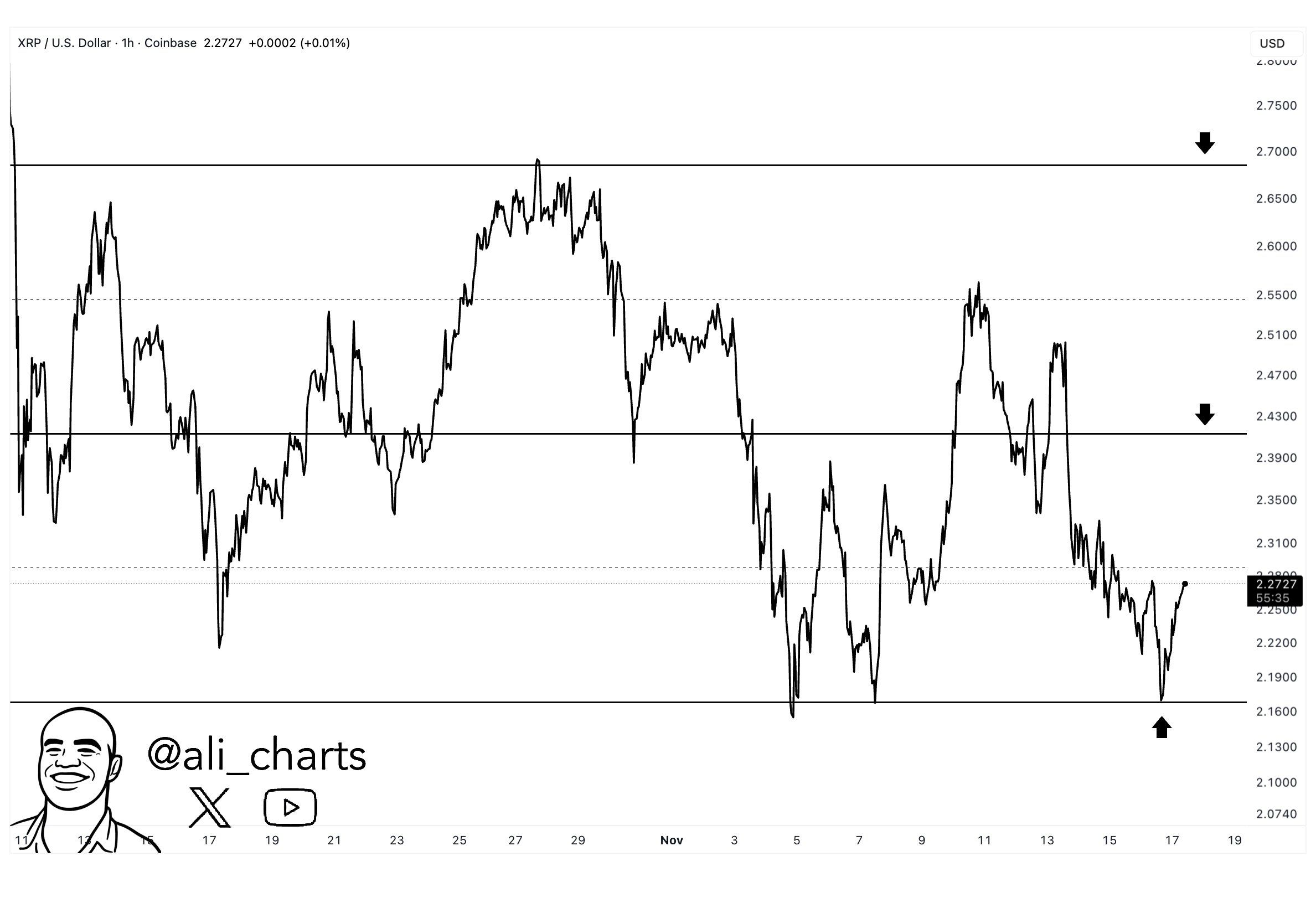

Franklin XRP ETF Debut Meets XRP’s $2.15 Line in the Sand