Ethereum Dip Triggers Million-Dollar Losses for Traders

Ethereum's recent dip has led to widespread liquidations, with millions lost in the process. However, institutional investors are capitalizing on the market downturn, purchasing significant amounts of ETH, suggesting long-term confidence in the asset.

Ethereum (ETH) extended its downward trend today, leading to widespread liquidations and millions in losses for crypto traders.

This comes amid a broader decline in the crypto market. Major cryptocurrencies are continuing to suffer losses, and today is no exception.

Ethereum’s Market Correction Hits Traders Hard

BeInCrypto Markets data showed that ETH has slipped 7.3% since the beginning of the week. This dip follows the second-largest cryptocurrency’s rise to multi-year highs.

Ethereum’s value has decreased 1.54% over the past day alone. At the time of writing, it was trading at $4,166.

Ethereum (ETH) Price Performance. Source:

Ethereum (ETH) Price Performance. Source:

While corrections are typical, they proved costly for those who wagered on the market moving upwards. CoinGlass data revealed total liquidations reached $486.6 million over the past 24 hours.

This figure reflected the liquidation of 136,855 traders. Ethereum bore the brunt of the market drop, with $196.8 million in positions liquidated. Of this, $155.15 million came from long positions.

Lookonchain, a blockchain analytics firm, recently spotlighted a trader who profited millions by going long on Ethereum, only to see nearly all those gains wiped out within two days.

The trader began with a $125,000 deposit into Hyperliquid four months ago. He strategically entered long positions on ETH across two accounts. The trader used his profits to boost his position to 66,749 ETH.

With this strategy, his total equity surged from $125,000 to an impressive $29.6 million. Furthermore, earlier this week, this trader closed all 66,749 ETH long positions, securing a profit of $6.86 million.

However, amid the recent market crash, the trader re-entered the ETH market but was ultimately liquidated, losing $6.22 million in the process.

“Starting with just $125,000, he grew his accounts to $6.99 million (peaking $43 million+). Now only $771,000 remains—4 months of gains nearly wiped out in just 2 days,” Lookonchain noted.

James Wynn, a high-risk leverage trader, also experienced partial liquidation. Lookonchain reported that Wynn opened a 25x leveraged long on ETH after claiming 19,206.72 USDC (USDC) in referral rewards. Nonetheless, as the market went south, his position was partially liquidated.

“James Wynn’s ETH long was partially liquidated, leaving him with a long position of 71.6 $ETH ($300,000),” the post read.

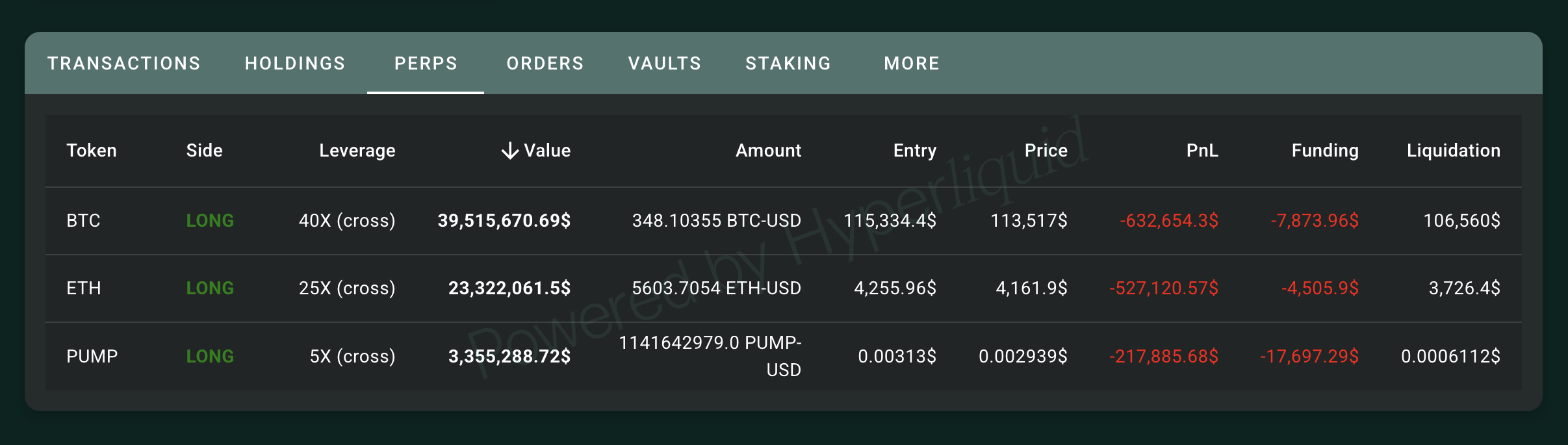

In addition, the blockchain analytics firm noted that a trader made a 1 million USDC deposit into Hyperliquid yesterday. The funds were used to open maximum-leverage long positions on ETH, Bitcoin (BTC), and Pump.fun (PUMP).

Nonetheless, the latest data from HypurrScan showed that the trader now faces unrealized losses exceeding $1 million.

Hyperliquid Trader’s Long Positions in Loss. Source:

Hyperliquid Trader’s Long Positions in Loss. Source:

Institutional Investors Are Buying The Dip

Amid the widespread liquidations, institutional investors are capitalizing on the ETH dip. Bitmine Immersion, the largest publicly traded ETH holder, acquired 52,475 ETH, pushing its total ETH holdings to 1,575,848 ETH worth nearly $6.6 billion.

“SharpLink bought 143,593 ETH($667 million) at $4,648 last week and currently holds 740,760 ETH ($3.19 billion). Together with Bitmine, they bought 516,703 ETH($2.22 billion) last week,” Lookonchain wrote.

Additionally, two institution-linked wallets, 0x50A5 and 0x9bdB, received 9,044 ETH, valued at approximately $38 million, from FalconX. Besides buying, panic-selling was also prevalent.

Whales are panic-selling $ETH as the market plummets!0x1D8d deposited 17,972 $ETH($77.4M) to #Coinbase an hour ago.0x5A8E deposited 13,521 $ETH($57.72M) to #Binance in the past 12 minutes.0x3684 deposited 3,003 $ETH($12.89M) to #Binance 20 minutes ago.…

— Lookonchain (@lookonchain) August 19, 2025

This highlights the diverse strategies investors are employing in response to market conditions. Still, institutional buying does signal strong confidence in Ethereum’s long-term potential.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne