Trump's Cryptocurrency Advisor's "Whale Debut": $680 Million Bitcoin Dip Buy, Now Sitting on Multi-Million Dollar Loss

Bailey's goal is to establish a Bitcoin Treasury Company network in the global capital markets, ultimately holding 1 million BTC, representing nearly 5% of the total Bitcoin supply.

Original Title: "US$680 Million 'Bottom Fishing' of BTC, Holding a Massive Unrealized Loss, Trump Crypto Advisor's 'Whale Debut'"

Source: BitpushNews

In Salt Lake City, Utah, KindlyMD was originally a network of clinics focusing on treating opioid addiction. The founder and CEO, Tim Pickett, has emphasized multiple times, "We are not just treating the illness, but helping patients rebuild their lives." Within the U.S. healthcare system, KindlyMD has gained attention for its "holistic healthcare" model.

However, in August 2025, a piece of news brought this company into the global crypto finance spotlight: KindlyMD completed a merger with Nakamoto Holdings, officially transitioning into a Bitcoin treasury company. After the merger, the stock ticker was changed to NAKA, and it immediately announced the purchase of 5,744 bitcoins, costing approximately US$679 million.

Overnight, this somewhat well-known healthcare company became a new whale in the Bitcoin capital market.

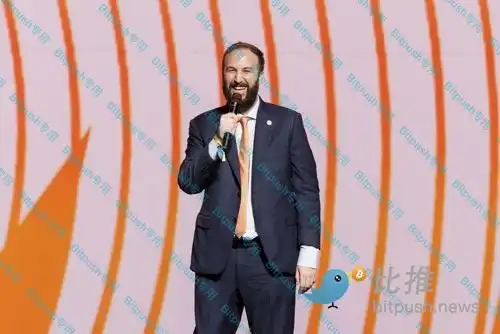

David Bailey: Bitcoin Evangelist and Trump 'Advisor'

Driving this transformation was David Bailey.

He is the CEO of Bitcoin Magazine, long active in Bitcoin industry conferences and industry advancement, regarded as one of the early evangelists of "Bitcoinization".

In 2023, he founded Nakamoto Holdings, a company with no complex products or intricate business, only one goal: to buy as much Bitcoin as possible with available capital.

Bailey states, "This is the Bitcoin Treasury Engineering."

During the 2024 U.S. presidential election, Bailey, in an external advisor/advisor role, provided policy-level advice and engagement on digital assets and Bitcoin-related topics to the Trump campaign team.

He is widely believed to be a key driver in Trump's transition from a crypto skeptic to a Bitcoin supporter. It was his proposal to Trump of using crypto assets as a policy lever and strategic thinking on public asset reserves that influenced his stance and policy direction.

At last year's Bitcoin conference, Trump publicly stated, "Dave, you're doing great" ("So David, congratulations, whatever you do, you did a wonderful job."), expressing his appreciation.

According to CNBC, he visited the White House at least six times. Bailey himself publicly stated, "The President has fulfilled his commitment to the Bitcoin industry, and I am forever grateful for this."

It is worth noting that in the advisory board of Japan's "MicroStrategy" company Metaplanet, Bailey and Eric Trump (Trump's second son) are both members. This subtle connection between KindlyMD/NAKA's strategy and the Trump family's involvement in crypto finance.

PIPE + Convertible Bonds: Capital Magic

In the summer of 2025, Bailey found his "listing vehicle" - KindlyMD.

KindlyMD's transformation was not a simple shell change. Bailey prepared more than enough ammunition for NAKA through a complex capital operation:

· PIPE Financing $540 million, issuance price $1.12 per share;

· Convertible Bonds $200 million, zero interest for the first two years, 6% interest from the third year, conversion price $2.80.

In an interview with CNBC, Bailey said, "I can raise almost $100 million almost every day, sometimes even $200 million."

This financing round received support from over 200 investors, including Actai Ventures, Arrington Capital, BSQ Capital Partners, Kingsway, Van Eck, and Yorkville Advisors.

NAKA's list of investors is almost a "Bitcoin Hall of Fame":

· Adam Back: Hashcash inventor, Blockstream CEO.

· Balaji Srinivasan: Former Coinbase CTO, former a16z partner.

· Jihan Wu: Co-founder of Bitmain.

· Ricardo Salinas: Mexican billionaire, staunch BTC believer.

· Eric Semler: Wall Street veteran, Chairman of Semler Scientific.

· Simon Gerovich: CEO of Metaplanet, driving a Japanese publicly traded company to become the "Asian MicroStrategy."

Notable investors include Actai Ventures, Arrington Capital, BSQ Capital, Kingsway, Off The Chain, ParaFi, RK Capital, Van Eck, Yorkville Advisors (through YA II PN, Ltd.) and individuals such as Adam Back, Balaji Srinivasan, Danny Yang, Eric Semler, Jihan Wu, Ricardo Salinas, Simon Gerovich. Funding sources include a PIPE (~$510M), convertible bonds ($200M), totaling approximately $710M with a rapid raise of $51.5M in June through PIPE within just 72 hours.

These names represent the capital power of the global Bitcoin industry. From Wall Street to Asia, from mining to exchanges, NAKA has assembled a global Bitcoin power map.

Backed by capital, NAKA made its "whale debut" right out of the gate: Buying 5,764.91 BTC at an average price of $118,204 per BTC, instantly becoming one of the top twenty corporate Bitcoin holders worldwide.

Strategy²?

To understand NAKA's strategy, one must consider it in relation to Strategy (formerly MicroStrategy).

· Strategy: Since 2020, founder Michael Saylor has converted the company's cash reserves into Bitcoin, currently holding 629,376 BTC worth over $72 billion. It has transformed into a "Bitcoin proxy stock," with its market value deeply linked to the price of BTC.

· NAKA: Currently holding only 5,765 BTC, a scale equivalent to 0.9% of MicroStrategy's.

But Bailey's goal is more aggressive: to establish a Bitcoin treasury company network in the global capital market, eventually holding 1 million BTC, representing nearly 5% of Bitcoin's total supply.

If MicroStrategy is the "pioneer," then NAKA is the "Strategy²."

However, the market is always brutal.

NAKA bought the dip at an average price of $118,204, and as of the Japanese article's publication on August 19, the Bitcoin price dropped to around $112,757, resulting in NAKA holding an unrealized loss of about $31.39 million, which is not significant, accounting for only 4% of the total investment. But it revealed the risk nature of the Bitcoin treasury model: stock price and enterprise value are almost entirely tied to the Bitcoin price.

Nevertheless, this is a long-term strategic game aiming for a million-level BTC reserve, and short-term volatility actually provides a better entry opportunity.

According to data from bitcointreasuries.net, currently, 168 publicly traded companies hold Bitcoin, totaling over 983,000 BTC, close to 5% of Bitcoin's total supply.

In addition to MicroStrategy and NAKA, a new player is also attracting market attention—Twenty One. It was jointly founded by Tether, Bitfinex, Cantor Fitzgerald, and SoftBank, initially holding 43,500 BTC, nearing $5 billion at current market prices. Although not yet officially traded, its consortium background implies that the Bitcoin treasury model is transitioning from a "single-company bet" to a stage driven by a cross-industry consortium.

As the financial giants begin to see Bitcoin as a core asset on their balance sheets, the market's pricing power is quietly shifting away from scattered retail investors to an institutional alliance that controls financing, investment banking tools, and multinational resources.

Is this the beginning of a new chapter in financial history or a reenactment of an old narrative?

Regardless of the answer, history will remember this scene: a healthcare company, transforming into a Bitcoin whale. And behind it, what truly influences the future price trajectory of Bitcoin is no longer retail sentiment but the patience and ambition of institutional capital.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.

Stunning $204 Million USDT Transfer Ignites Market Speculation