Meta to Downsize AI Division, Prompting Token Declines

Meta’s decision to cut back on AI investment and restructure its division is causing turbulence in the AI token market, with price drops seen across major assets.

A new report claims that Meta is preparing to downsize its AI division, dismissing high-level executives and introducing third-party software in its product offerings.

This has caused a lot of chaos for the AI-related token sector, which saw price drops across nearly all its leading assets. This may not precipitate a true crash, but it’s certainly a concerning sign.

Will Meta Pull Back From AI?

Meta, the parent company of Facebook and Instagram, has invested in several Web3 initiatives over the years, but it’s going all in on AI. The firm has worked on AI construction for several years, investing over $14 billion in the technology.

According to a report from The New York Times, however, Meta might be pulling back its commitments. This has understandably made some industry commentators nervous.

I think Mark Zuckerberg could single-handedly engineer a recession if and when he ever decides to scale back Meta’s AI investments.

— Conor Sen (@conorsen) August 19, 2025

Specifically, the report claims that Meta is restructuring and downsizing its AI division. This includes several high-level executives planning to leave the company, allowing third-party contractors to power its AI-centric products, and other such measures.

Token Market Tremors

So, how could this impact crypto’s AI sector? The two markets are thoroughly intertwined; AI tokens are a large market, and crypto miners are pivoting to data center construction.

Last week, OpenAI CEO Sam Altman claimed that the AI market is currently in a bubble, prompting anxiety about the related token market.

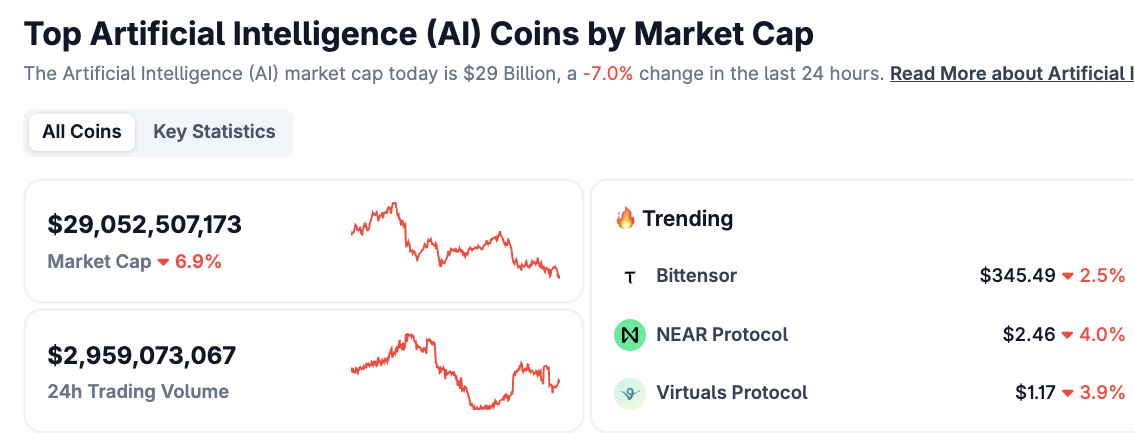

If Meta starts pulling back from AI, it might cause this bubble to pop. In the last hour, all but two of the top 30 best-performing AI tokens have depreciated in value, highlighting the concern.

AI Tokens React to Meta Downsizing. Source:

CoinGecko

AI Tokens React to Meta Downsizing. Source:

CoinGecko

Meta recently suffered a scandal involving its AI department, where Reuters obtained documents showing the company’s internal guidelines, showing a disturbing tolerance for generating romantic or sensual content for underage users.

In other words, this scandal may also have a prominent role in Meta’s corporate restructuring plans. It’s unclear what exactly is responsible for any of these changes, assuming that they’ll happen as the NYT described.

In any event, it’s difficult to extrapolate what the long-term impact of these changes will be. Still, AI cryptoassets are largely orbiting around big builders like Meta, and an unexpected downsizing could introduce a lot of chaos.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

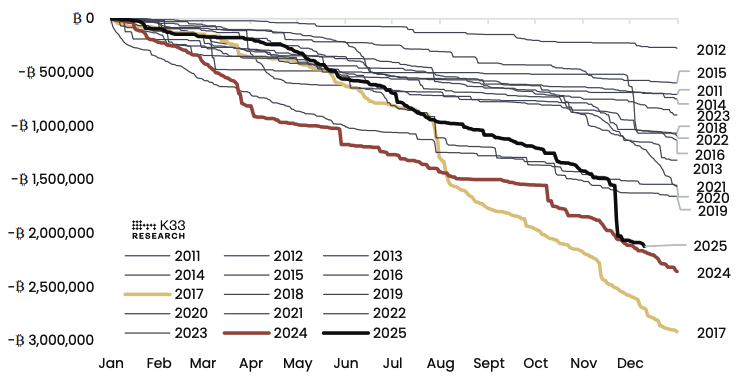

Sell-side pressure from long-term Bitcoin holders nears saturation: K33

Unveiled: Infrared’s Token Generation Event Kicks Off on Berachain

IoTeX Publishes MiCA-Compliant Whitepaper to Expand EU Market Access for IOTX

BlackRock moves 47K Ethereum in a day: But the real story isn’t a sell-off