DOGE Price Prediction for August 19

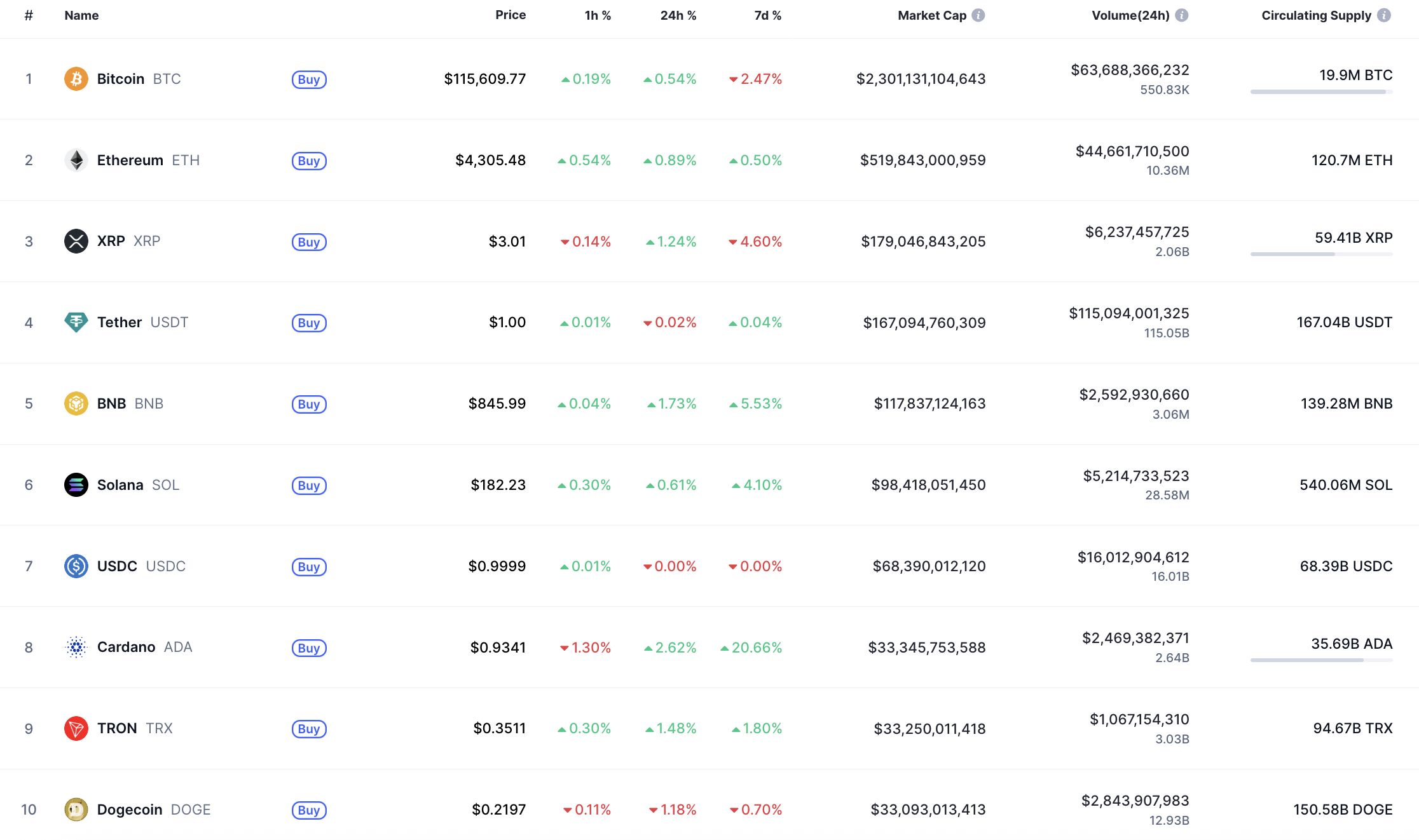

The market is returning to the green zone, according to CoinMarketCap.

DOGE/USD

DOGE is an exception to the rule, falling by 1.18% over the last 24 hours.

On the hourly chart, the rate of DOGE has made a false breakout of the local support of $0.2156. If bulls' pressure continues, the upward move is likely to continue to the nearest resistance by tomorrow.

On the longer time frame, the price of the meme coin has made a false breakout of the support of $0.2157.

If the daily bar closes far from that mark, one can expect a bounce back to the $0.2250-$0.23 area soon.

From the midterm point of view, none of the sides is dominating as the rate of DOGE is far from key levels. If the situation does not change by the end of the week, sideways trading in the zone of $0.21-$0.25 is the most likely scenario.

DOGE is trading at $0.2203 at press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List Datagram (DGRAM) in the Innovation and DePIN Zone

Bitget Spot Margin Announcement on Suspension of L3/USDT, ULTI/USDT Margin Trading Services

Bitget PoolX is listing Planck (PLANCK): Lock BTC to get PLANCK airdrop

Bitget x PLANCK Carnival: Grab a share of 1,880,000 PLANCK!