XRP Price Eyes Rebound as Sell Signs Weaken

XRP’s price may not be done yet. On-chain signs point to weakening sell pressure and growing short-term conviction. Add in a solid chart structure, and the setup hints at a possible recovery — if key levels hold.

XRP is down 5.4% in the last 24 hours, and over 10.3% this past week, moving in sync with the broader market correction. Whale exits and short-term sell pressure have taken a toll. But beneath that surface, something is changing.

With 6,500 US pharmacies now accepting XRP for compliant payments through Wellgistics, utility is getting a real-world boost. And even before that news fully kicks in, key on-chain and chart metrics are flashing one message: XRP’s trend isn’t broken yet.

Percent Supply in Profit Drops; But That’s Historically Bullish

On August 17, XRP’s Percent Supply in Profit stood at 93.53%, the lowest in nearly two weeks. For context, just ten days earlier, on August 7, the same metric had reached its peak at 98.26%.

That’s a clear drop of nearly five percentage points, and it typically signals that fewer holders are sitting on massive unrealized gains.

XRP price and percent supply in profit:

Glassnode

XRP price and percent supply in profit:

Glassnode

This is important because when less of the network is in heavy profit, profit-taking slows. On August 5, a similar drop in this metric (94.75%) triggered a jump from $2.97 to $3.32 for XRP in just two sessions.

It repeated on August 11, when a dip to 94.37% preceded a rally from $3.13 to $3.27. With today’s levels near the fortnightly low, the setup for another short-term bounce is here.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Short-Term Wallets Are Accumulating the Dip

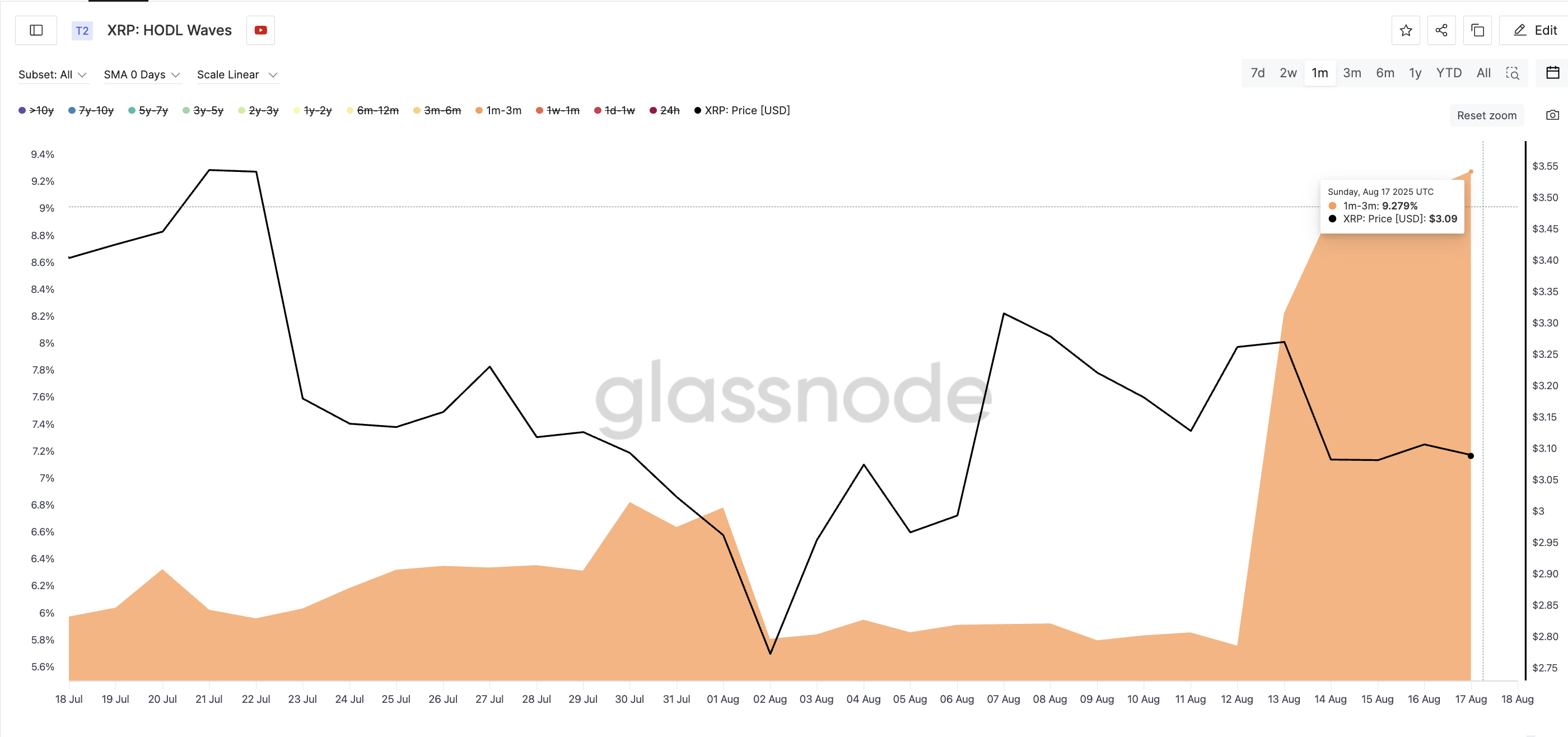

Backing this up is wallet behavior. According to Glassnode’s HODL Waves, the 1-month to 3-month holding cohort has spiked notably after XRP hit its August low of $2.77.

XRP price and HODL Waves:

Glassnode

XRP price and HODL Waves:

Glassnode

On August 1, the 1m–3m cohort made up just 5.81% of the XRP supply. By August 17, this jumped to 9.28%. This shift tells us that recent buyers are holding, not dumping — and they’re doing it despite volatility and the whale selling narrative.

This kind of behavior usually shows growing conviction. These short-term holders are stepping in during corrections, a pattern that tends to front-run trend reversals. The last time this group grew this quickly, XRP’s price saw sustained upward momentum within a week.

XRP Price’s Bullish Structure Still Intact, But Watch These Levels

Zooming out to the daily chart, the XRP price is still holding inside an ascending triangle — a bullish continuation pattern. Price is currently hovering around $2.96–$3.08, just above the triangle’s base.

XRP price analysis:

TradingView

XRP price analysis:

TradingView

Here are the key zones to watch:

- Resistance: $3.15, $3.33, $3.55, and $3.66

- Support: $2.95 (short-term), and $2.72 (final invalidation)

The $3.33 resistance level is easily the strongest, as the XRP price has been rejected at this level quite a few times over the past few days.

If XRP closes below $2.95, the ascending triangle risks a breakdown, but not a full bearish reversal until $2.72 breaks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Amazon’s AI assistant Alexa+ now works with Angi, Expedia, Square, and Yelp

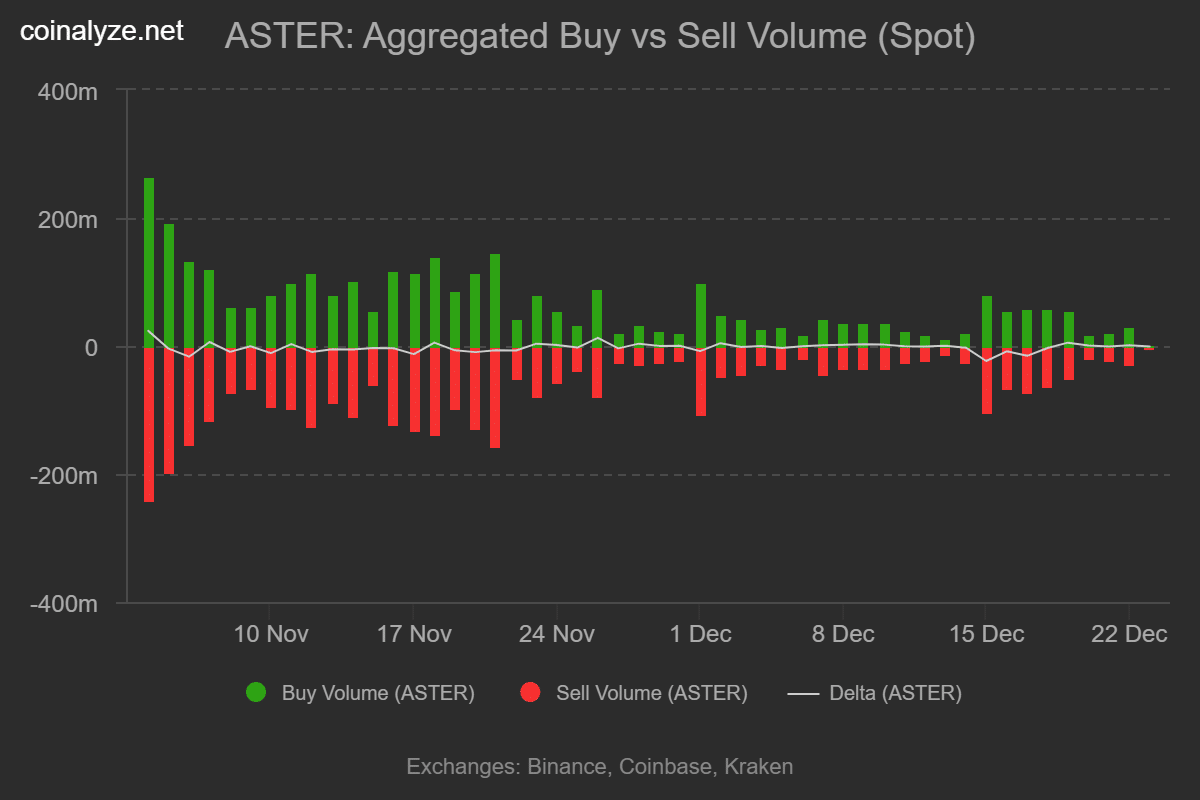

Aster DEX buys back $140M in tokens, yet prices stall – Why?

ETF data shows Bitcoin dominance held firm in 2025 as Ethereum gradually gained share

Top Crypto Gainers December 23 – CRV Leads with 4.46% Surge as Gold Tokens Rise