Spain's Uneven Crypto Taxation Laws Lead Trader to Mayhem: A €9M Surprise Charge

The unclear state of Spain’s cryptocurrency taxation led to a trader being taxed millions for an operation that should not constitute a taxable event. Analysts agree that this uneven situation will continue, as there are no clear determinations on which operations can be taxed.

A 5M Euro Transaction: How Spain’s Unclear Taxation Affects Crypto Traders

Taxation has become a relevant part of the everyday lives of Spain’s traders now that the crypto asset class has become mainstream. Spain’s local press has reported the case of a cryptocurrency trader who, even after following law-established procedures and paying over 5 million euros in taxes, faces additional charges for his operations.

According to documents reviewed, Periodista Digital tells the story of an unnamed trader who was charged 9 million euros for an operation involving a decentralized crypto protocol. The transaction allegedly involved the deposit of funds as collateral for a loan, a common operation in this kind of platform.

While the transaction does not involve either any sale or the generation of any income derived from the movement, the Spanish tax agency (AEAT) considered that the operation was enough to trigger the capital gains tax three years after it occurred.

“It was a technical movement of assets within a DeFi protocol: no gain, no change of ownership, no profit obtained. The AEAT equated it to a capital realization, an interpretation that has no legal basis in current Spanish or European legislation,” said the investor’s legal advisor.

This seemingly contradicts the Spanish tax laws, which define tax gains movements as those that involve an actual economic benefit and a change in net worth.

For the local press, this event unveils how seemingly legal transactions might generate serious tax risks. Experts state that this situation is unlikely to change shortly, as there are no clear laws regarding the classification of these transactions.

Lullius Partners, a tax law firm, highlighted the challenges of crypto taxation in Spain, explaining that “Spanish tax legislation lacks specific guidelines on taxing cryptocurrency or token ownership, income, and gains.”

Read more: Spain Introduces Law to Acquire Crypto Exchanges’ Data, Seize Digital Assets

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

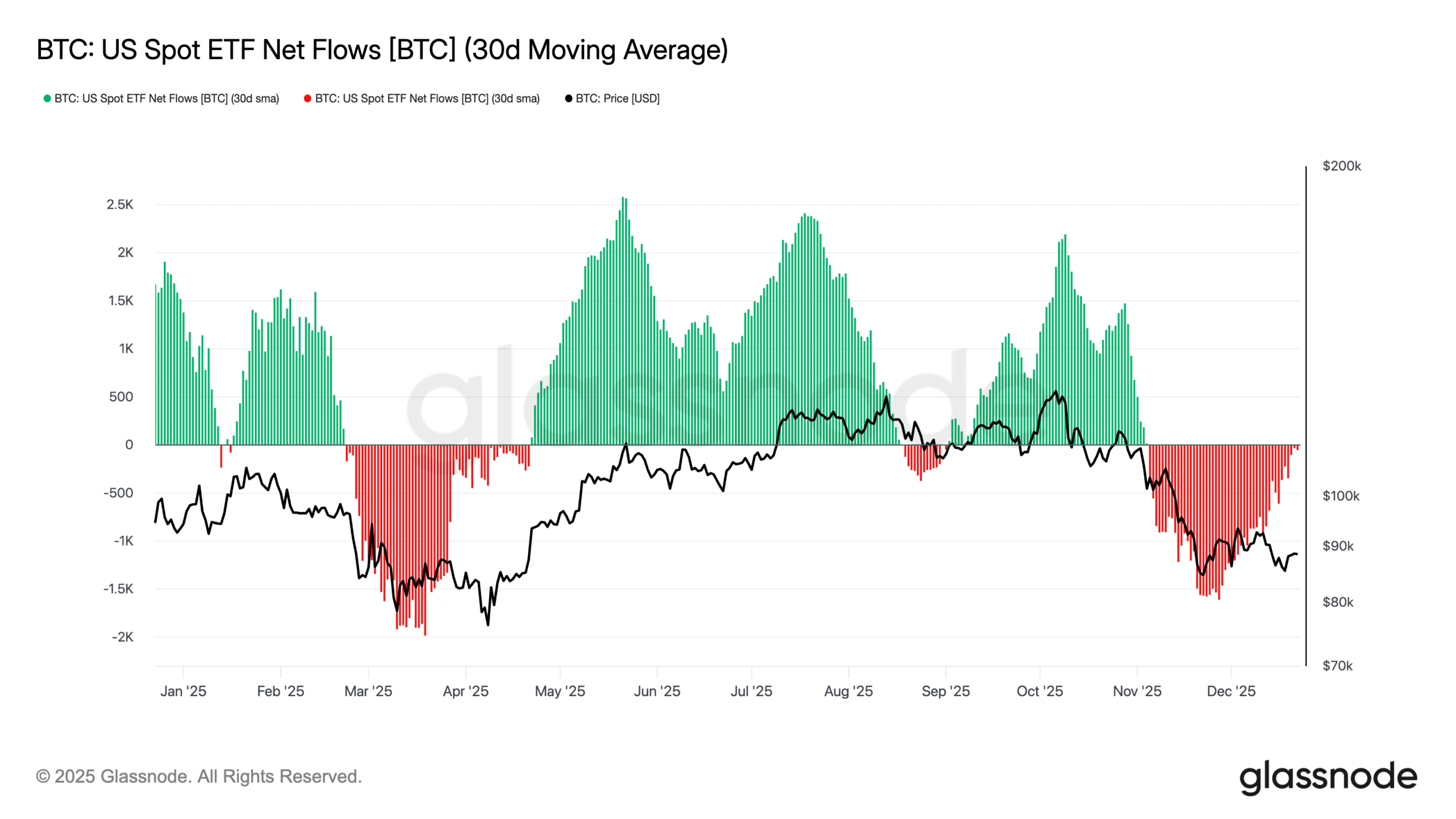

Bitcoin and Ethereum ETFs see persistent outflows as institutional appetite weakens

Zoox issues software recall over lane crossings

The Biggest Bitcoin and Crypto Treasury Plays of 2025

Why Can’t Bitcoin Experience Massive Rallies Anymore? Anthony Pompliano Says the “Wild Era” Is Over and Explains Why