Ether ETFs hit record high with $3,75 billion in weekly inflows

- Ether ETFs concentrate the largest weekly volume in cryptocurrencies

- ETF trading hits historic high in the market

- Bitcoin and altcoins see more restrained flows

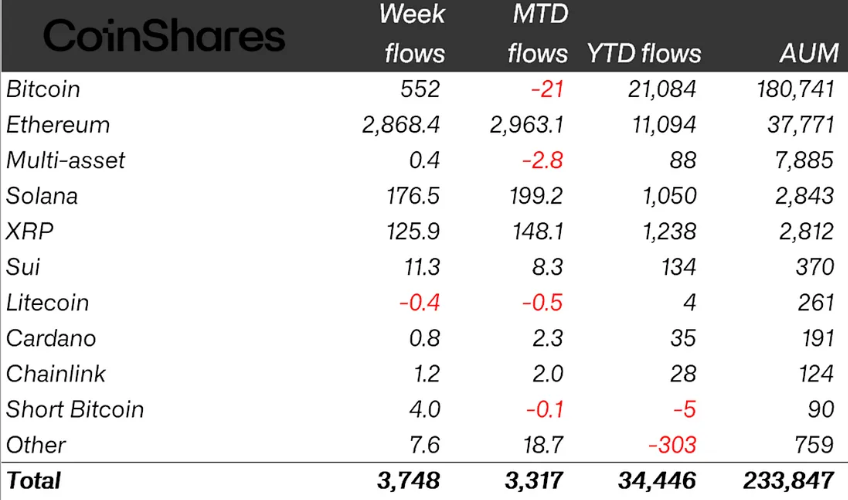

Cryptocurrency investment funds had a week marked by strong fundraising, led by products linked to Ether. Reports Recent data indicate that ETFs and ETPs totaled approximately US$3,75 billion in inflows in the week ending Friday, reflecting the enthusiasm surrounding the asset, which was traded at close to US$4.700.

Ether (ETH) is currently trading at $4.347,29, down 3,8% in the last 24 hours, a movement that reflects volatility even during a period of strong capital inflows into funds related to the token.

Despite the significant increase throughout the week, the movement was not linear. After four consecutive days of inflows, some investors reduced their positions on Friday, generating outflows in both Ether and Bitcoin funds, according to data from SoSoValue. Still, the final balance was largely positive for Ether ETFs.

Bitcoin surpassed $124.000 on Wednesday, but its ETFs failed to attract the same level of interest. Inflows totaled $552 million, representing around 15% of the weekly volume. Ether-linked products accounted for approximately $2,9 billion, reinforcing the growing demand for exposure to this altcoin.

Other assets also saw significant movements. Solana received approximately $176,5 million in new inflows, while XRP attracted $125,9 million. Conversely, Litecoin and Toncoin saw small outflows, amounting to $0,4 million and $1 million, respectively.

According to Bloomberg analyst Eric Balchunas, the period represented a milestone for publicly traded cryptocurrency funds. He noted that, in just four trading days, spot Bitcoin and Ether ETFs moved $40 billion. "ETHSANITY: Weekly Ether ETF volume was about $17 billion, breaking a record. Man, they woke up in July," he commented.

The data also suggests a shift in the flow pattern. Inflow streaks have been shorter compared to previous months. Since August 5, Ether ETFs have raised $3,7 billion in just eight days, while Bitcoin ETFs have raised $1,3 billion in seven days. This shows that interest in Ether ETFs remains strong, albeit with shorter inflow intervals.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

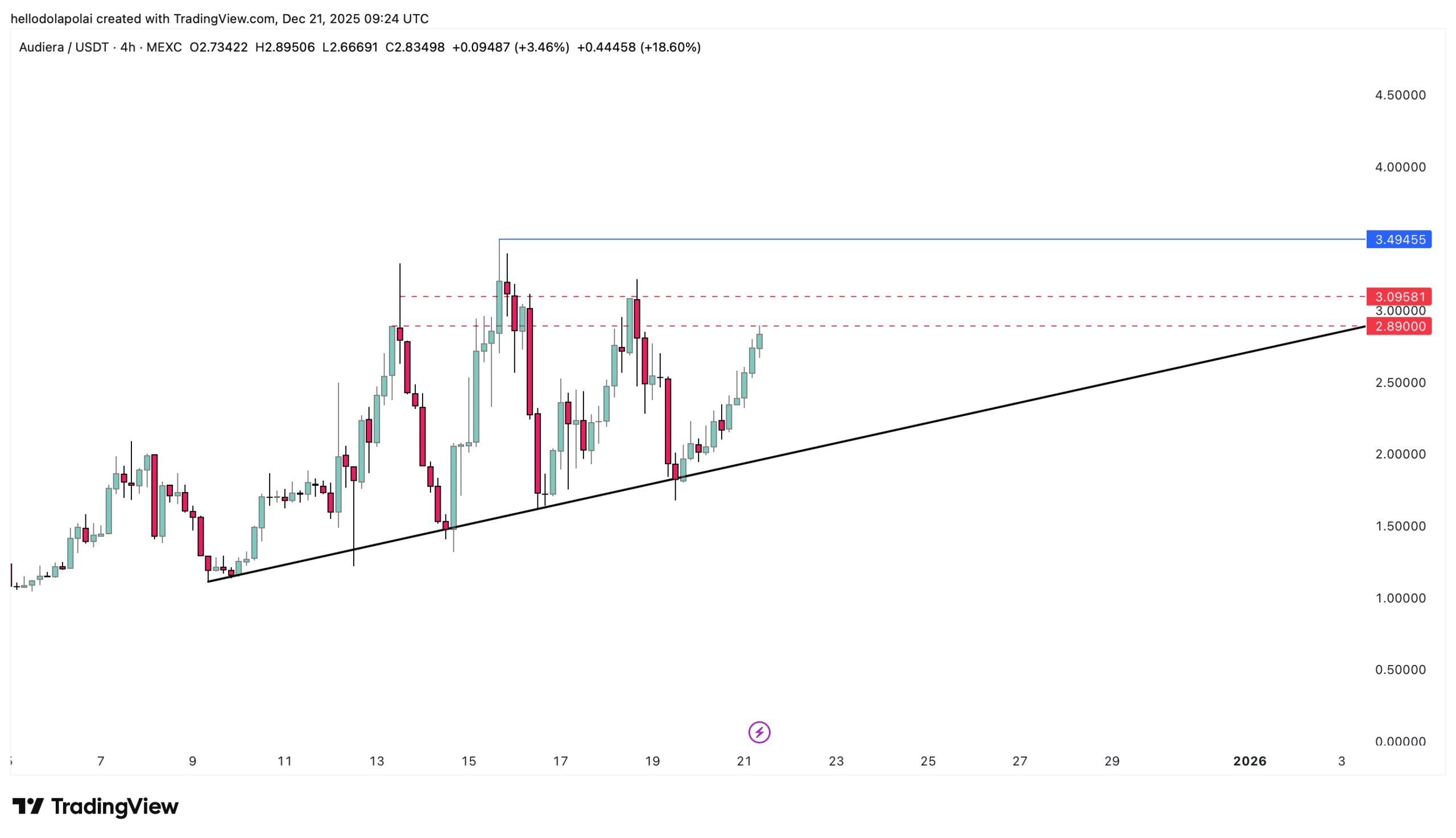

BEAT heats up, rallies 30%! A key level stands before Audiera’s ATH

Trending news

MoreBitget Daily Digest (Dec.22)|The U.S. House of Representatives Is Considering a Tax Safe Harbor for Stablecoins and Crypto Staking; Large Token Unlocks for H, XPL, SOON, and Others This Week; BTC RSI Near a 3-Year Low

Bitget US Stock Morning Brief | Fed Internal Divisions Widen; Trump Accelerates Space Militarization; Pharma Giants Accept Price Cuts for Tariff Relief (December 20, 2025)