Date: Mon, Aug 18, 2025 | 07:54 AM GMT

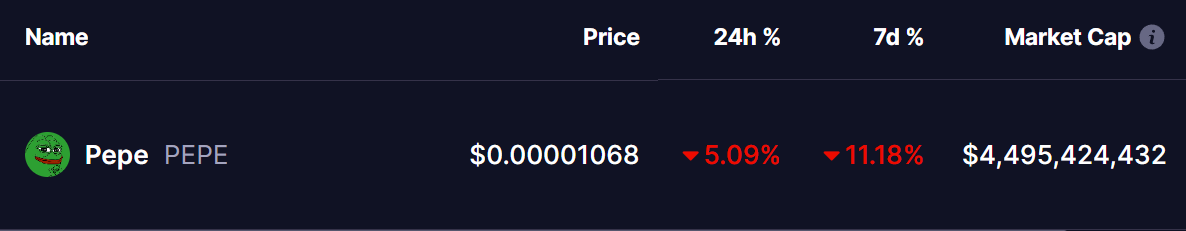

The cryptocurrency market is under slight selling pressure as Ethereum (ETH) drops 4% on the day, sliding to $4,250 from its recent high of $4,780. This decline has spilled over into memecoins , with Pepe (PEPE) among the notable decliners.

PEPE fell more than 5% today and is down 10% on the week, bringing the token to a critical support zone that could shape its next move.

Source: Coinmarketcap

Source: Coinmarketcap

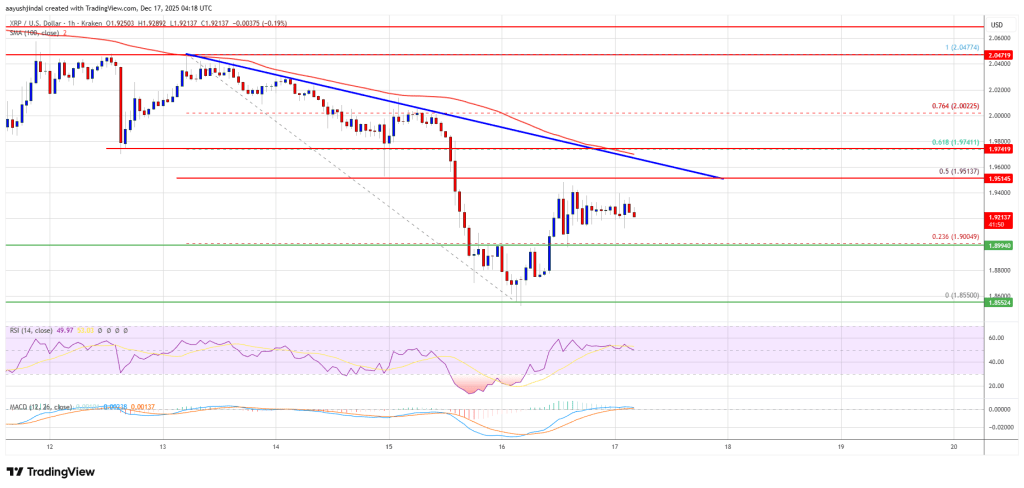

Testing Key Support

On the daily chart, PEPE appears to be consolidating within a symmetrical triangle pattern — typically a precursor to a strong breakout in either direction. The latest pullback has driven price toward the triangle’s lower boundary, near $0.00001060, where buyers are now being tested.

PEPE Daily Chart/Coinsprobe (Source: Tradingview)

PEPE Daily Chart/Coinsprobe (Source: Tradingview)

At the same time, a bearish Bat harmonic pattern is also visible. The C point of this setup seems to be forming right at the lower trendline support, adding further significance to this zone.

What’s Next for PEPE?

If buyers manage to hold the $0.00001060 level, a rebound toward the 50-day moving average at $0.00001157 could provide early confirmation of the Bat pattern’s validity. A breakout above that level would open the door for a retest of the upper resistance trendline, potentially aligning with the D point ($0.00001371) of the harmonic structure.