Date: Sat, Aug 16, 2025 | 06:40 PM GMT

The cryptocurrency market is going through another round of cooling as Ethereum (ETH) retreats to $4,400 from its recent peak of $4,780. This pullback has placed pressure on many altcoins , though some are showing resilience.

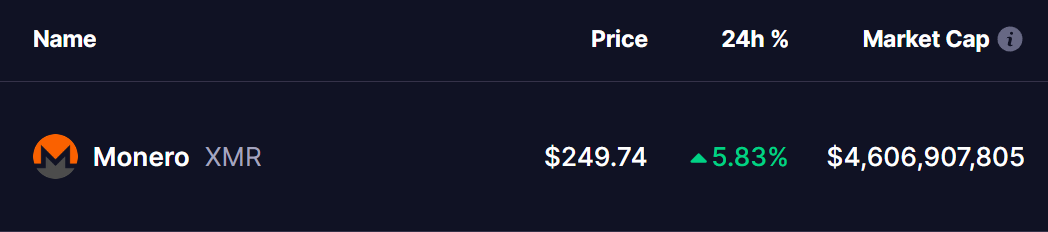

One standout is Monero (XMR), which has managed to stay in positive territory with a 5% gain. Even more interesting, XMR’s chart is now flashing a potentially bullish signal through the appearance of a well-known harmonic structure.

Source: Coinmarketcap

Source: Coinmarketcap

Harmonic Pattern Hints at Potential Upside

On the daily timeframe, Monero is shaping what looks to be a textbook Bullish Bat harmonic pattern. This advanced formation is closely watched by technical traders because it often signals a strong reversal point and sets the stage for the next major move higher.

Monero (XMR) Daily Chart/Coinsprobe (Source: Tradingview)

Monero (XMR) Daily Chart/Coinsprobe (Source: Tradingview)

The pattern began with an initial leg from point X around $184.98, a sharp rally to point A, a retracement down to B, followed by a bounce to C, and finally, a pullback to the D point near $232.

Following this, XMR has started to recover and is now trading around $249. Notably, the price is edging closer to the 200-day moving average, currently hovering near $273. This level is likely to serve as a short-term resistance and also a crucial confirmation point for the bullish scenario.

What’s Next for XMR?

If Monero can decisively break above the 200-day MA with solid buying volume, the Bullish Bat pattern projects significant upside targets. The Potential Reversal Zone (PRZ) stretches between $331 (0.618 Fibonacci extension of the CD leg) and $422 (1.0 extension). Historically, these levels are where the Bat formation tends to complete before facing any possible reversal or consolidation.

Still, the bullish outlook hinges on Monero holding firm at the D point support near $232. A breakdown below this level would invalidate the pattern and likely delay any breakout attempt.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always perform your own research before investing in cryptocurrencies.