- Ethereum captured $2.9 billion in ETF inflows, outpacing Bitcoin’s $552 million despite BTC’s new highs.

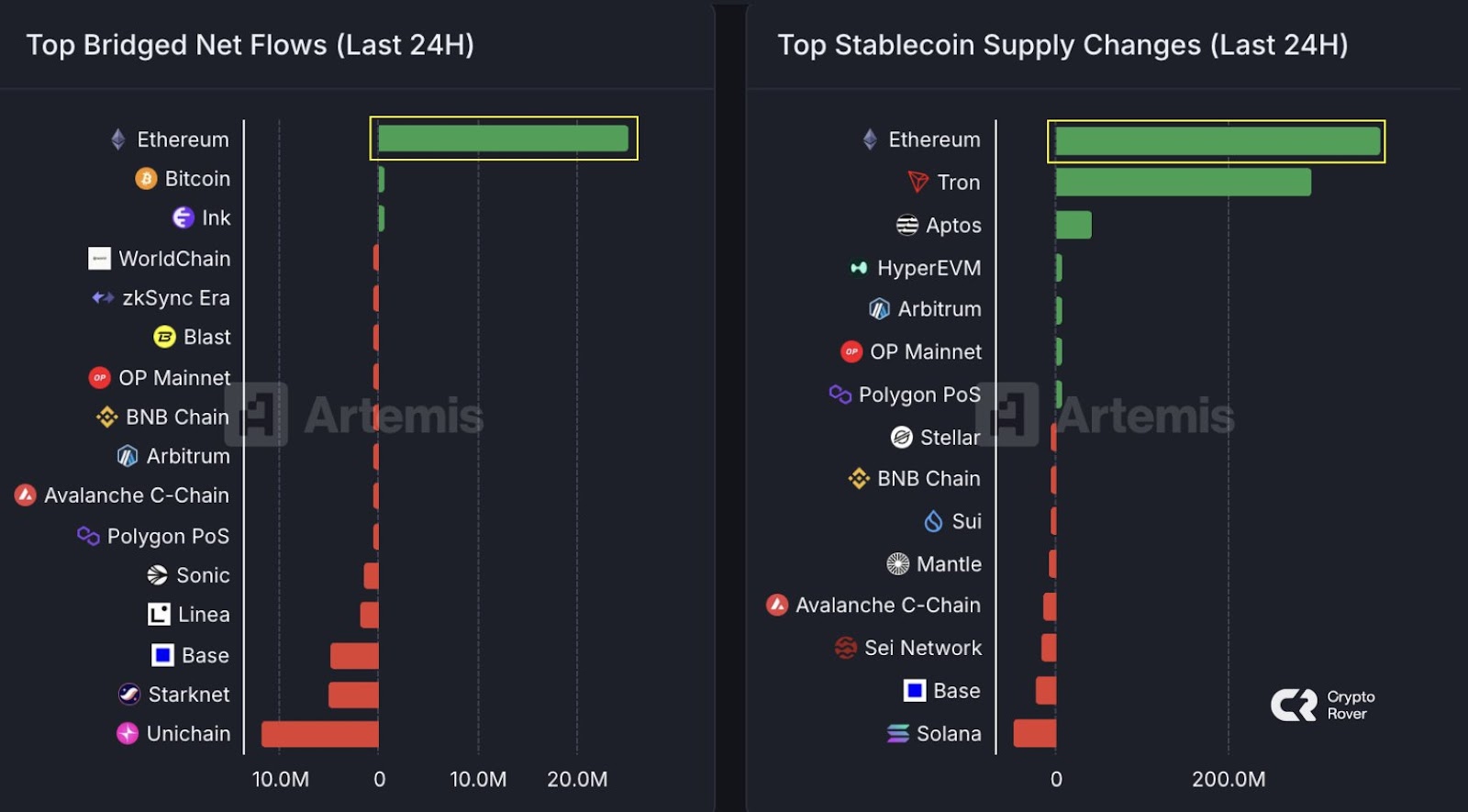

- On-chain data showed $20M in Ethereum bridge inflows and nearly $200M in new stablecoin supply.

- Ether ETFs set a $17B weekly trading volume record, highlighting rising institutional demand despite volatile streaks.

During the latest market correction, Ethereum absorbed the bulk of new inflows, reinforcing its growing dominance. Crypto Rover highlighted this trend on X, stating,

“During this correction, money keeps flooding into $ETH. That tells you everything you need to know.”

Data from the analytics platform Artemis confirms his point. In the past 24 hours, Ethereum has dominated both net bridge inflows (+$20 million) and stablecoin supply increases (+$200 million), while rival networks like Starknet and Base saw significant outflows.

Similarly, Ethereum dominated stablecoin supply increases, with nearly $200 million added, far ahead of Tron and Aptos.

Ethereum Inflows and Stablecoin Supply Surge. Source: Crypto Rover / Artemis

Ethereum Inflows and Stablecoin Supply Surge. Source: Crypto Rover / Artemis

Institutional Money Is Also Choosing Ethereum

This on-chain “flight to quality” is being mirrored in the institutional world. CoinShares reported $3.75 billion in total crypto ETP inflows last week, with $2.9 billion directed to Ether products. In contrast, Bitcoin ETPs captured just $552 million, about 15 percent of the total, despite BTC surpassing $124,000.

According to Bloomberg ETF analyst Eric Balchunas, spot Bitcoin and Ether ETFs reached $40 billion in trading volume in only four days. He noted that Ether ETFs alone contributed $17 billion, breaking previous weekly records. NovaDius president Nate Geraci echoed this, observing that Ether ETFs “absolutely obliterated” prior volume highs.

But the Money Isn’t as “Sticky” as It Used to Be

While the inflow numbers are huge, there is one note of caution. SoSoValue data showed that the daily inflow streaks are getting shorter.

Spot Ether ETFs attracted $3.7 billion over an eight-day run since August 5, down from a 20-day streak in July. Bitcoin ETFs managed $1.3 billion across a seven-day run, well below their June performance.

This pattern highlights both rising demand and fast-changing sentiment. Ethereum continues to capture liquidity during downturns, but investors remain cautious about sustaining inflows over extended periods. The shorter streaks underscore volatile conditions, even as overall institutional engagement grows.

So how risky is it? This level of institutional interest at all-time highs is a hot topic. Here’s our report on the risks of holding Ethereum at these levels .

How Are Other Altcoins Faring?

Other networks displayed smaller movements. Solana recorded $176.5 million in inflows, while XRP saw $125.9 million. Meanwhile, Litecoin lost $0.4 million and Toncoin dropped $1 million. On-chain data reflected the same imbalance, with Ethereum’s inflows sharply outpacing rivals.

Together, ETF records and on-chain flows confirmed that capital consistently seeks Ethereum first. Both institutional and on-chain indicators show that even during corrections, Ethereum remains the leading destination for liquidity.

What’s next for the price? All this on-chain activity is building pressure. Here’s our detailed price prediction for Ethereum for tomorrow .