Bitcoin Price Falls As The Two Most Important BTC Holders Sell – Weekly Whale Watch

Bitcoin price drops after whales sell off 30,000 BTC, causing pressure on the market; BTC may test $112,526 or bounce toward $117,261.

Bitcoin experienced a sharp correction this week, with its price falling significantly from recent highs. While macroeconomic factors contributed to the decline, the selling behavior of Bitcoin’s largest holders played a crucial role.

The actions of these two major holders, in particular, have had a direct impact on the price.

Bitcoin Holders Pull Back

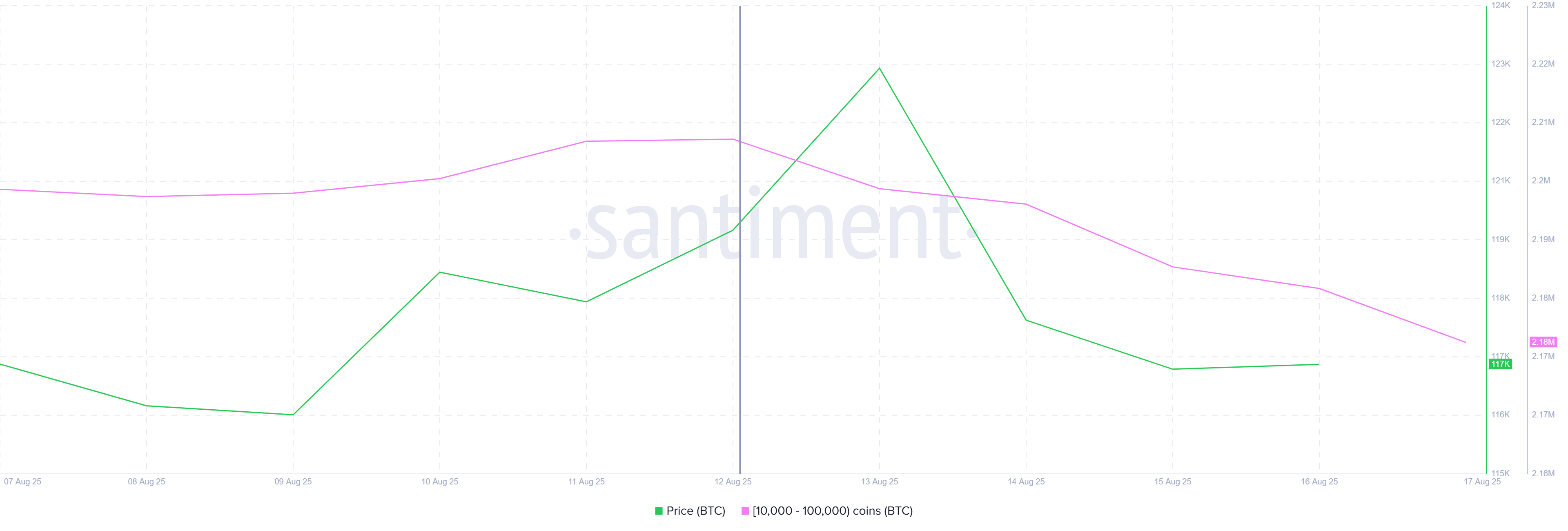

Over the past six days, Bitcoin whales—addresses holding between 10,000 and 100,000 BTC—have sold off over 30,000 BTC, worth more than $3.45 billion. This large-scale selling likely stems from the desire to secure gains as Bitcoin reached its peak. According to CryptoQuant analyst JA Maartunn, the selling pattern aligns with past whale behavior during price rallies.

“Bitcoin has increased to $120,000, but whales are capitalizing on the rally with a third wave of selling.”

Given the significant influence these whales hold over Bitcoin’s price, their actions have led to a sharp decline. The sudden influx of BTC onto exchanges created selling pressure, causing a dip in price.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Whale Holding. Source:

Santiment

Bitcoin Whale Holding. Source:

Santiment

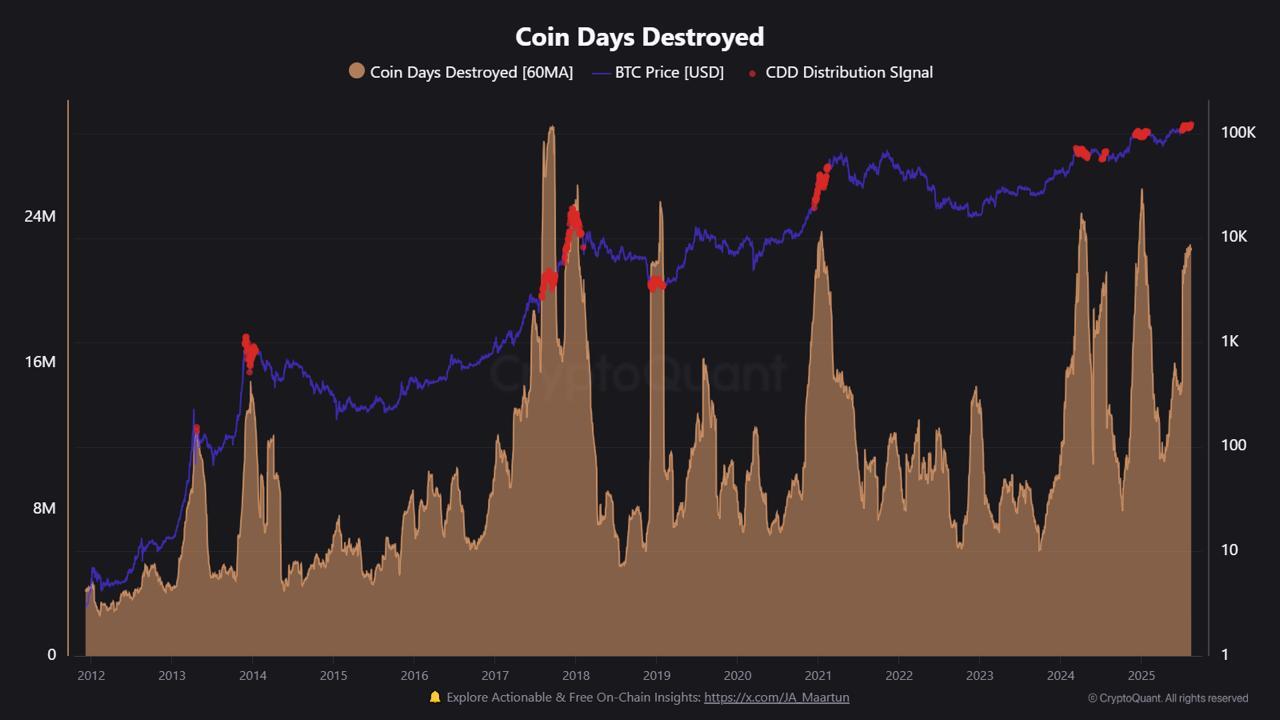

The overall macro momentum of Bitcoin is also showing signs of weakness. One notable indicator is the recent spike in “Coin Days Destroyed,” a metric used to track the movement of long-term holders (LTHs). According to CryptoQuant data, this is the second major spike in the metric this year, signaling increased selling activity among LTHs.

Like whales, LTHs have significant influence over Bitcoin’s price. A larger spike in Coin Days Destroyed typically indicates that long-term holders are cashing out their holdings. This selling behavior from both whales and LTHs has put downward pressure on the price, compounding the challenges facing Bitcoin in the short term.

Bitcoin Coin Days Destroyed. Source:

CryptoQuant

Bitcoin Coin Days Destroyed. Source:

CryptoQuant

BTC Price Could Witness Further Losses

Bitcoin’s price is currently hovering around $115,130, barely holding above the $115,000 support. The 6% decline over the past few days, driven by whale selling and LTH movements, suggests that BTC could continue to slide lower in the short term.

If selling pressure persists, Bitcoin could drop to the $112,526 support level. A further decline could see BTC testing the $110,000 mark, representing a near 6-week low for the cryptocurrency. This scenario would reflect a continuation of the current bearish momentum and raise concerns about further market weakness.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, if Bitcoin manages to bounce off the $115,000 support level, either due to a shift in investor sentiment or more favorable broader market conditions, it could recover to $117,261. A successful push past this level would open the door to a potential rise toward $120,000, invalidating the current bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

By winning the championship with Faker, he earned nearly $3 million.

Faker's sixth championship also marks fengdubiying's legendary journey on Polymarket.

Warren Buffett's "Last Letter" in Full: "I Was Just Lucky," But "Father Time" Has Caught Up

Buffett concluded his legendary 60-year investment career with the British expression "I'm 'going quiet'" in his letter.

Zero flow to Bitcoin ETFs: The market sulks despite a favorable context

Bitcoin Eyes Year-End ‘Santa Claus Rally’ After October Setbacks