Chainlink Price Jumps as Whales Accumulate and Supply Falls

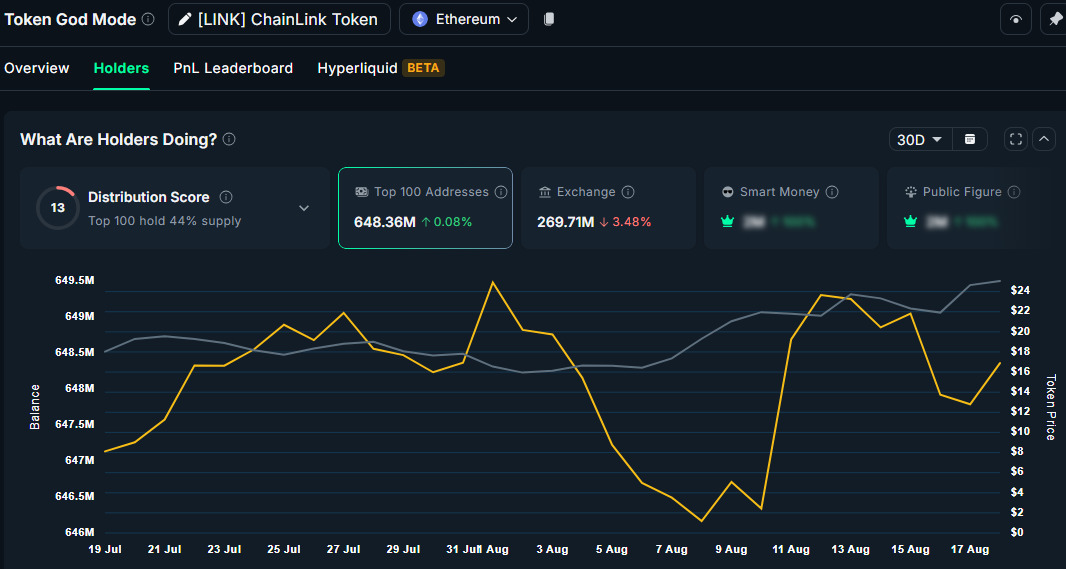

- Whales now hold 648.36 million LINK, which equals 44 percent of the total supply.

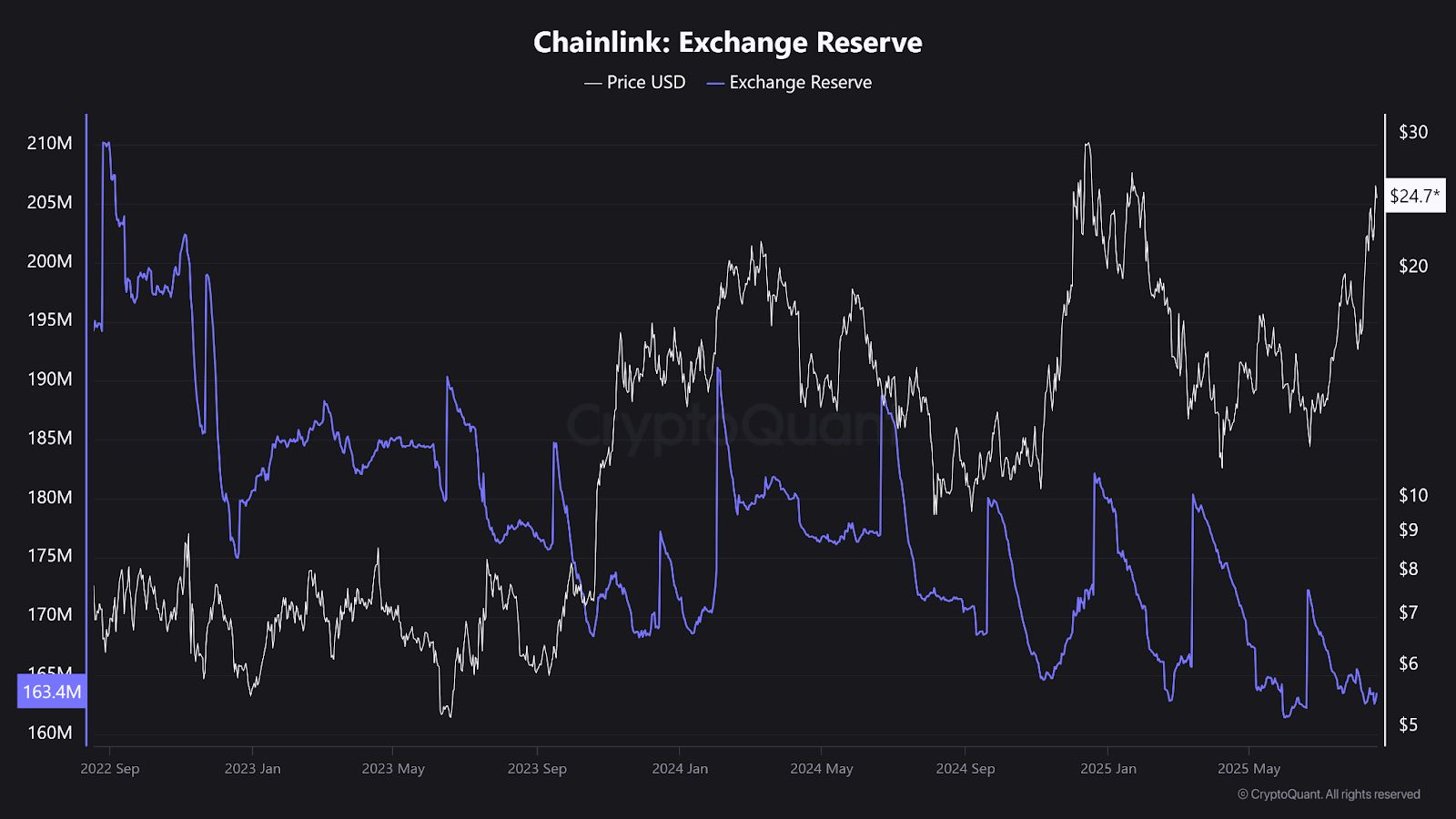

- Exchange reserves fell to 163.4 M LINK, marking a drop from over 210M in late 2022.

- Support levels stand at $23.87 and $20.95 as bulls try to defend previous gains.

Chainlink has outperformed the broader market slump, gaining more than 5% in the past 24 hours and more than 140% in a year. While many altcoins are struggling to hold their recent gains, LINK has continued climbing, supported by whale accumulation and a shrinking supply on exchanges. This latest rally has made investors question whether the surge was a shift driven by fundamentals or was it simply speculative fuel driving a temporary spike.

Whale Activity and Exchange Balances

On-chain data from Nansen illustrates that whales and exchanges are moving in opposite directions. The top 100 addresses hold 648.36 million LINK, showing a 0.08% increase in the past 30 days. Added together, these addresses now are in control of 44% the supply.

Source:

Nansen

Source:

Nansen

Meanwhile, exchange balances dropped 3.48% to 269.71 million LINK, reducing liquidity available for trading. A distribution score of 13 reflects the strong concentration of LINK in the hands of large holders. From July 19 through late July, whale balances climbed above 648.5 million tokens before sliding to around 646M LINK in early August.

Exchange Reserves and Supply Pressure

Data from CryptoQuant clearly shows a supply squeeze. Exchange reserves have dropped sharply to 163.4 million LINK, down from more than 210 million in late 2022.

Source:

Cryptoquant

Source:

Cryptoquant

Each reserve decline since 2023 has gone hand-in-hand with upward reactions, often pushing LINK above $20. Just recently, the token rose to $24.7, its highest level in nearly two years, as reserves hit multi-year lows.

This consistent pattern shows that reduced reserves often accelerate demand-driven price gains. With fewer tokens available for sale, liquidity risks increase, which in turn strengthens upward volatility during accumulation periods.

Related: Chainlink Targets $30 as Whale Activity and OI Hit Records

Technical Breakout and Market Signals

Data from TradingView shows a definite breakout to the upside. On August 18, an intraday dip of 2.96% occurred with the coin trading at $24.88 at press time. It was marked by a climb to $26.50 and a pullback to an intraday low of $24.29.

Source:

TradingView

Source:

TradingView

The price remains inside a steep ascending channel that holds a test on the upper boundary around $26.48, which incidentally also coincides with the 0% Fibonacci extension. Immediate support is seen at $23.87, equating with the 0.236 retracement and Fair Value Gap (FVG).

Further support remains at $20.95 on the 0.5 retracement and $17.79 on the 0.786. A full retracement would return to $15.43, while an extreme downside target could lie at the 1.414 Fibonacci extension of $10.86.The MACD still stays positive, with its line at 1.95 above the signal line at 1.52 and a histogram reading of 0.43. Although bullish performance continues, the histogram indicates a potential decline, suggesting a pause after the recent rally from below $16 in late July.

With whales accumulating and exchange reserves at multi-year lows, the market is likely to remain volatile. Reduced supply gives LINK long-term strength, with speculative trading driving sharp price swings, meaning the rally is fuelled by both fundamentals and speculation

The post Chainlink Price Jumps as Whales Accumulate and Supply Falls appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

By winning the championship with Faker, he earned nearly $3 million.

Faker's sixth championship also marks fengdubiying's legendary journey on Polymarket.

Warren Buffett's "Last Letter" in Full: "I Was Just Lucky," But "Father Time" Has Caught Up

Buffett concluded his legendary 60-year investment career with the British expression "I'm 'going quiet'" in his letter.

Zero flow to Bitcoin ETFs: The market sulks despite a favorable context

Bitcoin Eyes Year-End ‘Santa Claus Rally’ After October Setbacks