Altcoin Season Countdown Begins – 7 Best Altcoins to Buy Before the Next Breakout Phase

The cryptocurrency market is heating up as investors begin to ask the familiar question: is Bitcoin over the past month, a signal that the next breakout phase could already be underway.

Analysts are calling this the start of a major rotation into altcoins, where smaller and mid-cap projects often deliver outsized returns compared to Bitcoin. For investors looking to position ahead of the wave, several key altcoins stand out. Among them, MAGACOIN FINANCE has emerged as one of the most talked-about new entries, with growing community interest and forecasts of explosive returns.

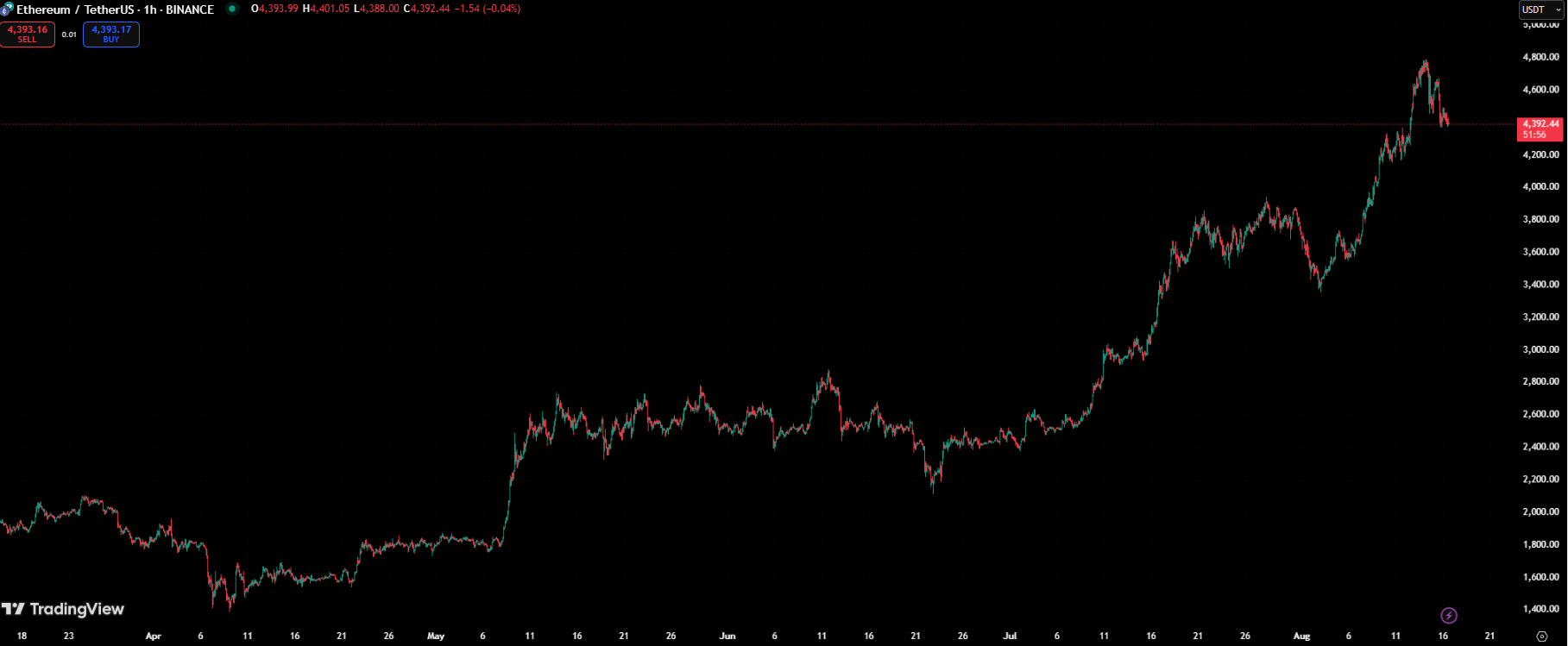

Ethereum (ETH)

Ethereum remains the leading altcoin by market cap and often serves as the benchmark for the broader market. Following record inflows into U.S.-approved spot ETH ETFs, institutional interest is soaring. If Ethereum can break past its previous all-time high near $4,878, analysts see upside toward $5,500–$6,000 in the near term, with long-term projections reaching $20,000 by 2026.

XRP

After years of legal uncertainty, XRP has regained its momentum. The asset surged more than 470% in the past year and trades below its ATH. XRP’s role in cross-border payments continues to expand, with some analysts expecting XRP to test levels between $7 and $13 this cycle.

SUI

SUI has quietly gained traction in 2025, with its DeFi ecosystem seeing a 42% surge in Total Value Locked (TVL) since January. Currently trading around $3.82, forecasts call for $4.75–$5.00 by late August, with long-term targets between $12 and $14 by October 2025.

MAGACOIN FINANCE

Among emerging projects, MAGACOIN FINANCE has captured analyst attention for its explosive potential, receiving $12.5 million in fresh capital. The limited early supply and strong community engagement are fueling comparisons to the early days of Dogecoin, making it an opportunity for investors seeking greater gains before the next wave of capital floods in.

Cardano (ADA)

Known for its careful, research-driven development, Cardano is rolling out its Voltaire governance era, a milestone that brings on-chain community-led decision-making. Trading near $0.936, ADA could retest its all-time high above $3 if positive momentum continues into the year-end.

Chainlink (LINK)

Chainlink is a cornerstone of Web3, delivering secure data to smart contracts across DeFi and institutional finance. LINK, priced at $21.54, shows bullish chart patterns, with forecasts ranging from $25–$30 in the conservative case to as high as $100 in aggressive scenarios. Its Cross-Chain Interoperability Protocol (CCIP) remains a key growth driver.

Solana (SOL)

Solana has bounced back impressively in 2025, trading around $185. Its Total Value Locked (TVL) has doubled this year, and the anticipated Firedancer validator could elevate throughput beyond one million transactions per second. Analysts suggest a potential rally to $300–$400, especially with growing speculation of a spot SOL ETF.

Conclusion

As the countdown to altcoin season accelerates, investors are turning their attention to assets beyond Bitcoin. Ethereum, XRP, SUI, Cardano, Chainlink, and Solana all present strong fundamentals and upcoming catalysts. But it’s MAGACOIN FINANCE, with its strong performance and scarcity-driven setup, that stands out as one of the boldest opportunities of this cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services