Bitcoin (BTC) Price Prediction for August 16

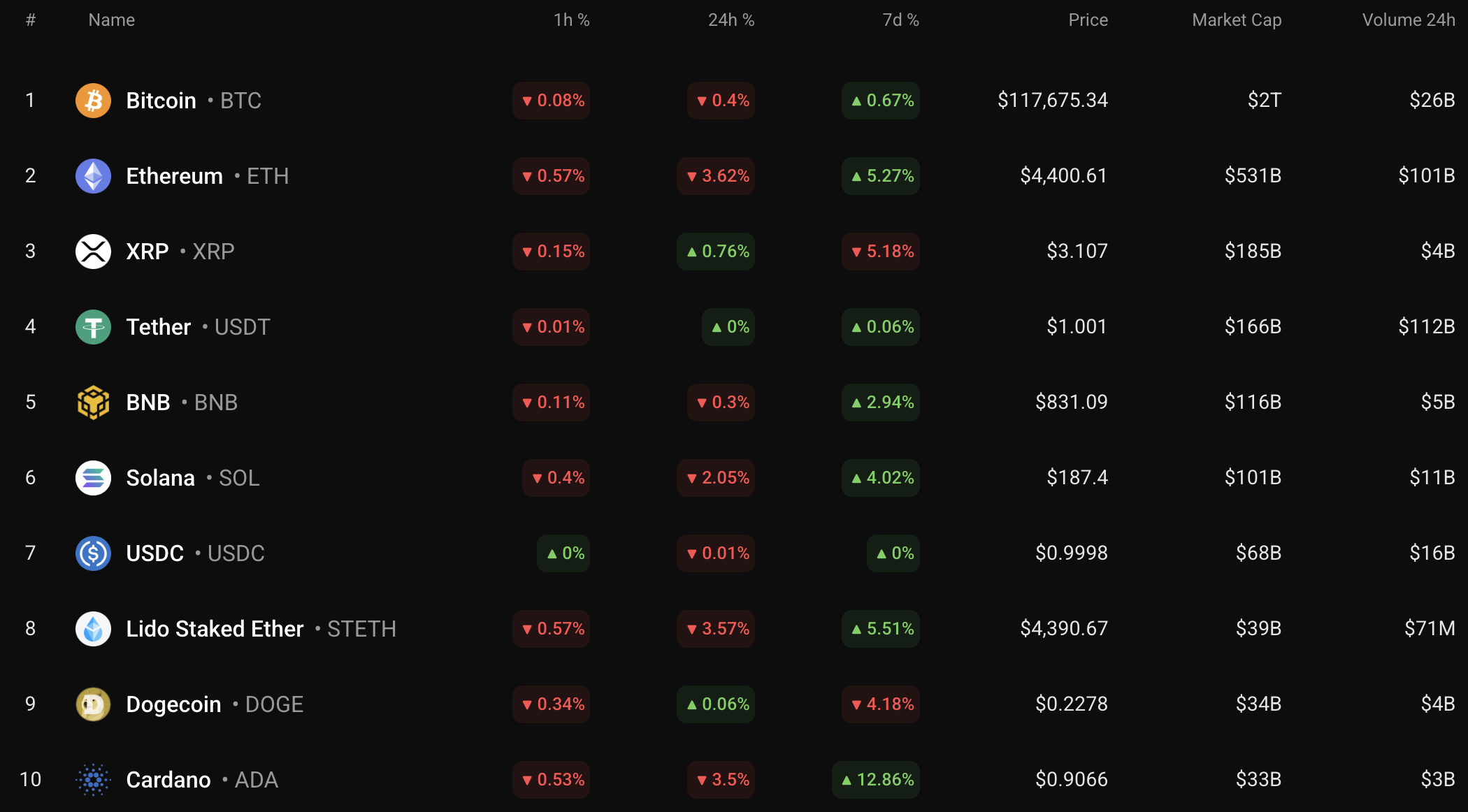

Saturday has started with the correction of some coins, according to CoinStats.

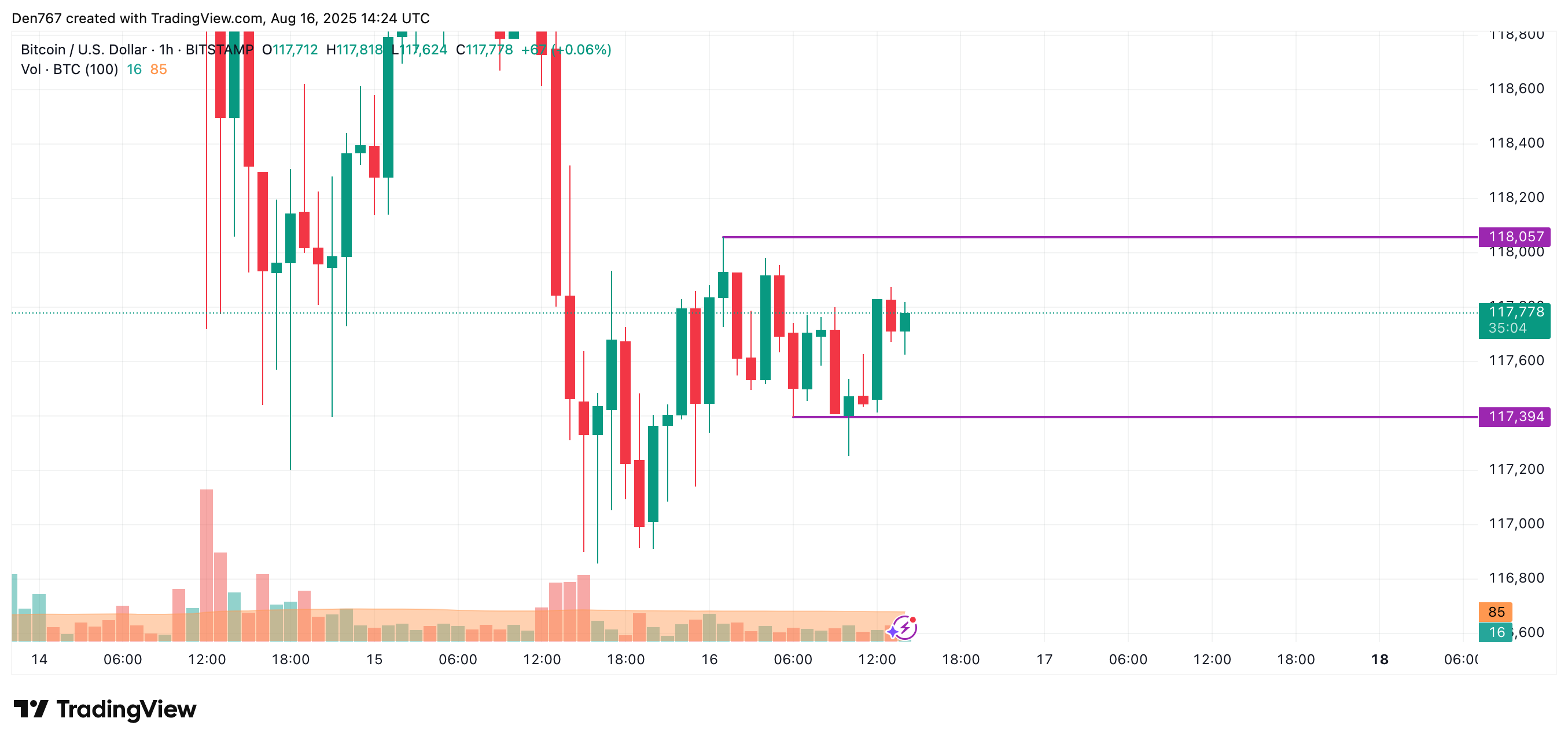

BTC/USD

The rate of Bitcoin (BTC) has fallen by 0.4% since yesterday.

On the hourly chart, the price of BTC is rising after a false breakout of the local support of $117,394. If the growth continues, one can expect a test of the resistance by tomorrow.

On the bigger time frame, the picture is less bullish. The rate of the main crypto is closer to the support level, which is a bearish signal.

If a breakout of the $117,201 mark happens, the accumulated energy might be enough for a drop to the $115,000-$116,000 range.

From the midterm point of view, the price of BTC has made a false breakout of the $123,236 level. If the weekly bar closes far from that mark, bears may seize the initiative, which may lead to an ongoing correction to the $112,000 area.

Bitcoin is trading at $117,837 at press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget donates HK$12 million to support fire rescue and reconstruction efforts in Tai Po, Hong Kong

Bitget Spot Margin Announcement on Suspension of ELX/USDT Margin Trading Services

Enjoy perks for new grid traders and receive dual rewards totaling 150 USDT

Bitget Spot Margin Announcement on Suspension of BEAM/USDT, ZEREBRO/USDT, AVAIL/USDT, HIPPO/USDT, ORBS/USDT Margin Trading Services