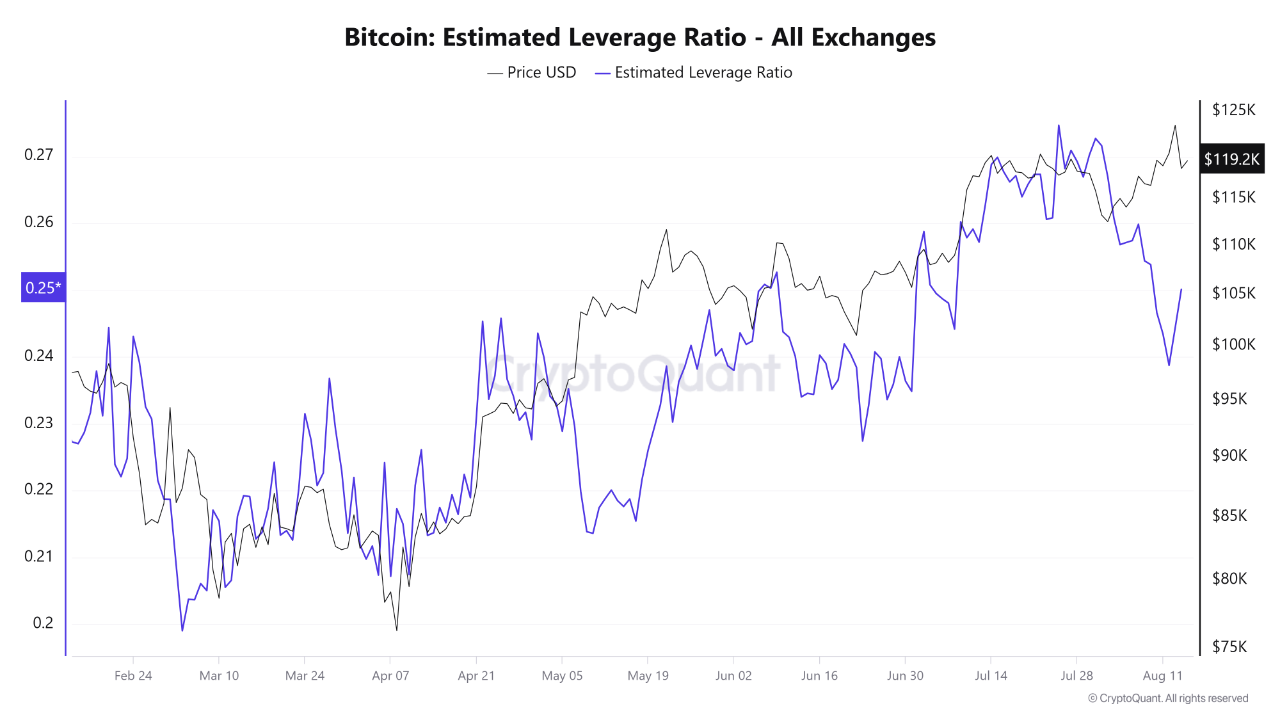

Bitcoin Leverage Ratio Drops, Easing Correction Risks as Price Holds Near $119K

Bitcoin’s estimated leverage ratio (ELR) has dropped from its late July and early August highs, reducing the likelihood of sharp market corrections and helping to sustain price stability at elevated levels.

Bitcoin’s estimated leverage ratio (ELR) has dropped from its late July and early August highs, reducing the likelihood of sharp market corrections and helping to sustain price stability at elevated levels.

Data from CryptoQuant shows the ELR peaked above 0.27 before falling sharply in early August to around 0.25, where it has since stabilized with minor fluctuations. From May to late July, both Bitcoin’s price and leverage ratio rose in parallel, reflecting a surge in traders entering the market with larger positions.

Source

:

CryptoQuant

.

Source

:

CryptoQuant

.

The recent decline in leverage, despite Bitcoin holding near $119,000, points to position closures or liquidations without a matching price drop. Analysts say the lower ELR indicates that current market momentum is being fuelled more by spot buying and genuine liquidity than by speculative leverage.

If the ELR remains between 0.24 and 0.25, coupled with a steady move above the $120,000 threshold, it could pave the way for a renewed rally towards the July highs, supported by moderate funding rates and gradually rising open interest.

However, a sharp rise in leverage above 0.27 before or during a test of the $120,000–$124,000 range could heighten the risk of liquidations and trigger a downside “shakeout”, driven by the combination of high leverage, elevated funding rates, and weak price divergence.

Market conditions are currently calmer than at the July peak, with excess leverage already flushed out. This reduction in speculative pressure could provide a stronger base for the next price move, though the balance between leverage levels and price momentum remains key to Bitcoin’s short-term outlook.

Meanwhile, Bitcoin’s futures market momentum has cooled. The Bitcoin Futures Power Index has fallen to zero in August after a series of positive readings that coincided with price gains, a shift signalling weaker futures market strength based on open interest, funding rates, and taker order imbalances, according to CryptoQuant.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Decoding VitaDAO: A Paradigm Revolution in Decentralized Science

Mars Morning News | ETH returns to $3,000, extreme fear sentiment has passed

The Federal Reserve's Beige Book shows little change in U.S. economic activity, with increasing divergence in the consumer market. JPMorgan predicts a Fed rate cut in December. Nasdaq has applied to increase the position limit for BlackRock's Bitcoin ETF options. ETH has returned to $3,000, signaling a recovery in market sentiment. Hyperliquid has sparked controversy due to a token symbol change. Binance faces a $1 billion terrorism-related lawsuit. Securitize has received EU approval to operate a tokenization trading system. The Tether CEO responded to S&P's credit rating downgrade. Large Bitcoin holders are increasing deposits to exchanges. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

The central bank sets a major tone on stablecoins for the first time—where will the market go next?

The People's Bank of China held a meeting to crack down on virtual currency trading and speculation, clearly defining stablecoins as a form of virtual currency with risks of illegal financial activities, and emphasized the continued prohibition of all virtual currency-related businesses.