Bitcoin Hits $124K, Ethereum Near New Peak

- Main event: Bitcoin hits $124k; Ethereum nearing ATH.

- Surging ETF inflows drive crypto price increases.

- Institutional interest spikes following financial shifts.

Bitcoin reached a record price of $124,000, while Ethereum approaches its all-time high as both cryptocurrencies see significant interest from institutional investors on August 14, 2025.

These price movements reflect the growing influence of institutional investment, which is fostering increased market activity and confidence in cryptocurrencies among traders globally.

Bitcoin has reached a new high of $124,000, while Ethereum is $50 shy of its all-time high. This surge is largely due to rising ETF inflows and renewed institutional focus.

Key institutional figures such as BlackRock have channeled substantial investments into crypto ETFs. Their Ethereum-focused ETF saw significant inflows, underscoring the market’s increased interest in digital assets. In fact, BlackRock reported, “Over $10 billion inflows into the ETHA ETF in less than three months.”

The surge in cryptocurrency prices has considerable effects on investors and the broader market. Notably, financial markets have shown an increased willingness to embrace digital assets as part of investment portfolios. Ether volatility has surged alongside these market movements.

The recent price movements reinforced the financial sector’s growing strategy to integrate crypto assets. ETF successes, in particular, suggest ongoing financial and investment shifts that prioritize digital currencies.

Investor confidence remains high as price momentum builds. This development signals broader acceptance of cryptocurrencies in financial circles, potentially influencing future regulatory and technological progress in blockchain technology.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

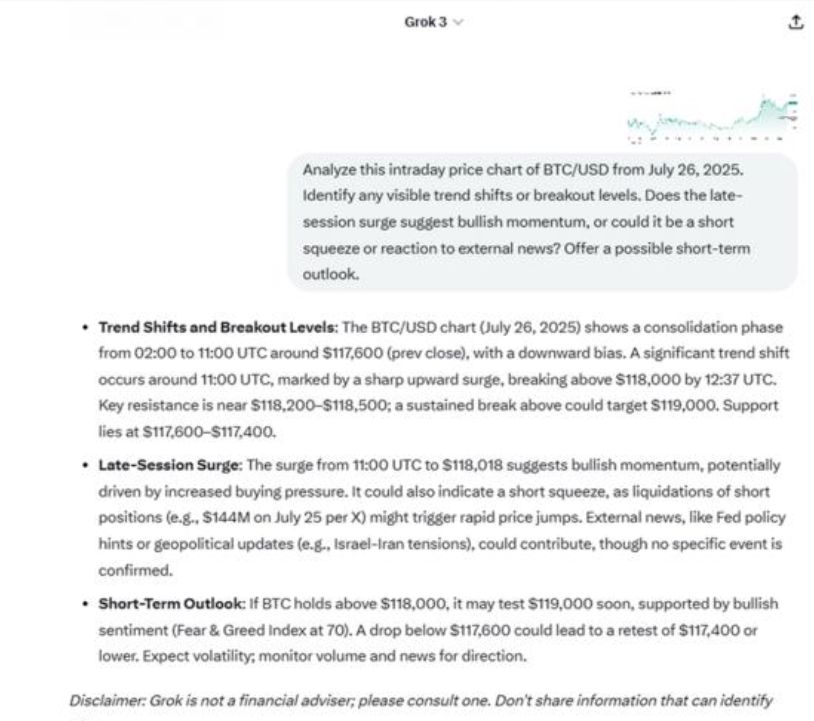

ChatGPT and Grok shift crypto trading to sentiment, now explains “why” behind moves

Share link:In this post: Crypto traders have turned to ChatGPT and Grok for real-time context, sentiment analysis, and narrative framing. In charts, Grok gives a more detailed and information-packed breakdown, pointing out resistance and support levels, liquidation events, and possible outside causes. Experts say that over-reliance on the bots without checking the ideas against standard charts or news causes traders to have false confidence.

Trump’s Fed chair shortlist grows longer than expected

Share link:In this post: President Trump, through Treasury Secretary Scott Bessent, is moving forward with interviews for 11 potential replacements for Fed Chair Jerome Powell, whose term ends in May. The list includes current Fed governors, past officials, and top financial executives. Philip Jefferson, the current vice chair, is also in the running. If selected, he would become the first Black Fed Chair in U.S. history.

Pennsylvania House sees bill to ban public officials from owning Bitcoin and digital assets

Share link:In this post: A new bill (HB1812) introduced in the Pennsylvania House of Representatives could impose jail time on public officials who fail to divest their Bitcoin holdings. Officials who do not comply with the divestment requirement could face civil penalties of up to $50,000, and violations may be classified as felonies. Similar proposals, especially at the federal level, are growing as more officials express discontent with Donald Trump’s relationship with crypto.

Wyoming launches FRNT stablecoin with Visa support across seven blockchains