Tom Lee’s Ethereum treasury BitMine tops 1 million ETH worth nearly $5 billion

Key Takeaways

- BitMine Immersion Technologies holds over 1 million ETH, making it the largest ETH treasury in the world.

- BitMine rapidly grew its ETH holdings by $2 billion in one week and aims to acquire 5% of all ETH.

Share this article

BitMine Immersion Technologies, the largest corporate holder of Ethereum, said Monday it now holds over 1 million ETH valued at nearly $5 billion. That’s an increase of 317,126 tokens, worth around $2 billion, from over 833,000 ETH it disclosed last Monday.

With this boost, BitMine strengthens its lead as the top Ethereum treasury by holdings. The firm has been on an aggressive buying spree since late June, aiming to capture 5% of all Ethereum in existence.

“We are leading crypto treasury peers by both the velocity of raising crypto NAV per share and by the high trading liquidity of our stock,” said Thomas “Tom” Lee of Fundstrat, Chairman of BitMine’s Board of Directors.

BitMine has climbed into the top tier of US stock trading activity, with a five-day average daily volume of 2.2 billion dollars as of August 8. This puts it at number 25 on the US list, between Costco Wholesale Corp and Micron Technology.

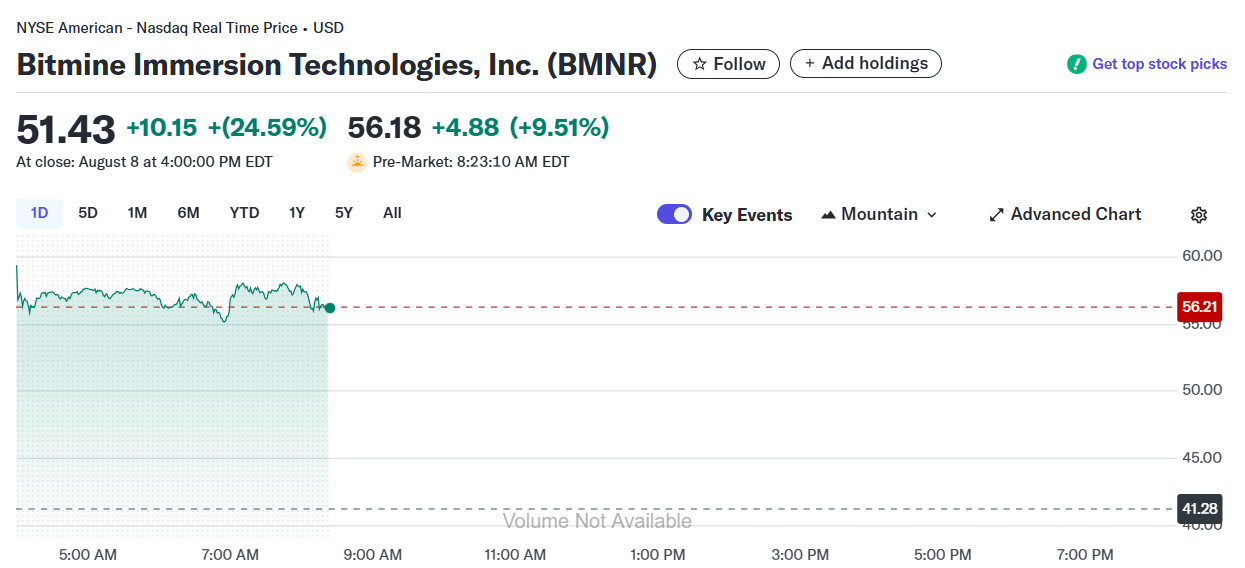

According to Yahoo Finance, BitMine (BMNR) shares ended Friday with a 24.5% rise. The stock climbed another 9.5% in pre-market trading on Monday.

Share this article

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Price predictions 12/10: BTC, ETH, XRP, BNB, SOL, DOGE, ADA, BCH, LINK, HYPE

Ether vs. Bitcoin: ETH price poised for 80% rally in 2026

Prediction markets bet Bitcoin won’t reach $100K before year’s end

Bitcoin rallies fail at $94K despite Fed policy shift: Here’s why