Ethereum Treasury Companies Are a Better Buy Than US Spot Ether ETFs, Standard Chartered Says

Why Ethereum Treasury Holdings Beat Spot ETFs, According to Standard Chartered

Geoffrey Kendrick, head of digital assets research at London-based Standard Chartered Bank, delivered a nugget of alpha that many may have missed last week, ether treasury companies are probably a better buy than spot ether ETFs. The reason, which may be obvious to some, is that spot ETH funds don’t currently offer staking rewards, but treasury companies do.

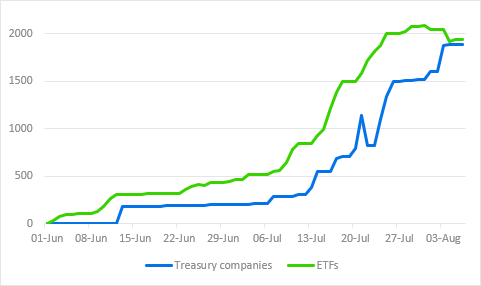

Kendrick and his team published a research note last Tuesday, showing how ether treasury companies such as Sharplink , have purchased the cryptocurrency at double the rate of spot ETFs. In a follow-up note yesterday, Kendrick said that since June, both treasury firms and ETFs each bought roughly 1.6% of all ether in circulation.

( ETH holding companies and ETFs are neck-and-neck when it comes to amount of ETHbought since June / Standard Chartered Research)

And now, given the already rapid pace of acquisition shown by treasury entities, the additional benefit of compounded staking rewards, and the fact that holding companies face fewer regulatory hurdles than ether ETFs, Kendrick and team see ETH treasury firms as having more growth potential than their fund counterparts or even their bitcoin treasury cousins.

“We think ETH treasury companies have even more growth potential than BTC ones from a regulatory arbitrage perspective,” Kendrick and team explain. “We think they may eventually end up owning 10% of all ETH , a 10x increase from current holdings.”

The team also expects ether treasury companies to help buoy the cryptocurrency past the $4,000 threshold. Ether, which floundered in the first quarter of 2025, reached its all-time high of $4,891.70 nearly four years ago in November 2021. The digital asset was trading at $3,816.40 at the time of reporting, up 3.81% over 24 hours, according to Coinmarketcap.

“If the flows can continue, ETH may be able to break above the key USD 4,000 level (our current end-2025 forecast),” Kendrick and team said.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Weekly Crypto Market Watch (11.10-11.17): Extreme Market Panic, Privacy Sector Stands Out

Last week, both the open interest and trading volume of altcoin contracts on exchanges declined, reflecting a continued lack of liquidity following the sharp drop on October 11.

Multiple grand rewards are coming, TRON ecosystem Thanksgiving feast begins

Five major projects within the TRON ecosystem will jointly launch a Thanksgiving event, offering a feast of both rewards and experiences to the community through trading competitions, community support activities, and staking rewards.

Yala Faces Turmoil as Stability Falters Dramatically

In Brief Yala experienced a dramatic 52.9% decline, challenging its stability. Liquidity management emerged as a critical vulnerability in stablecoins. Investor skepticism deepened despite major fund support.